- UK QuickBooks Community

- :

- QuickBooks Q & A

- :

- Transactions

- :

- We use iZettle to take payments. In QB a number of these transactions have appeared as debtor items (total around £6500) even though they are income for sales. Why?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

We use iZettle to take payments. In QB a number of these transactions have appeared as debtor items (total around £6500) even though they are income for sales. Why?

Solved! Go to Solution.

Labels:

0 Cheers

Best answer April 30, 2020

Solved

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

We use iZettle to take payments. In QB a number of these transactions have appeared as debtor items (total around £6500) even though they are income for sales. Why?

I appreciate you getting back to us and providing detailed information about your concern, @robwillwood.

You can create a journal entry to offset the difference. However, due to the nature of this matter, I recommend you to contact an accounting professional for guidance on what's the best thing to do in this situation. This is to ensure your books won't be messed up.

Moreover, I don’t want to leave you empty-handed, you'll want to visit our Community Help Articles hub in case you need some related articles in managing your account.

Know that you're always welcome to stop by the Community if you need anything else. I'm here to help. Have a fantastic day!

0 Cheers

4 REPLIES 4

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

We use iZettle to take payments. In QB a number of these transactions have appeared as debtor items (total around £6500) even though they are income for sales. Why?

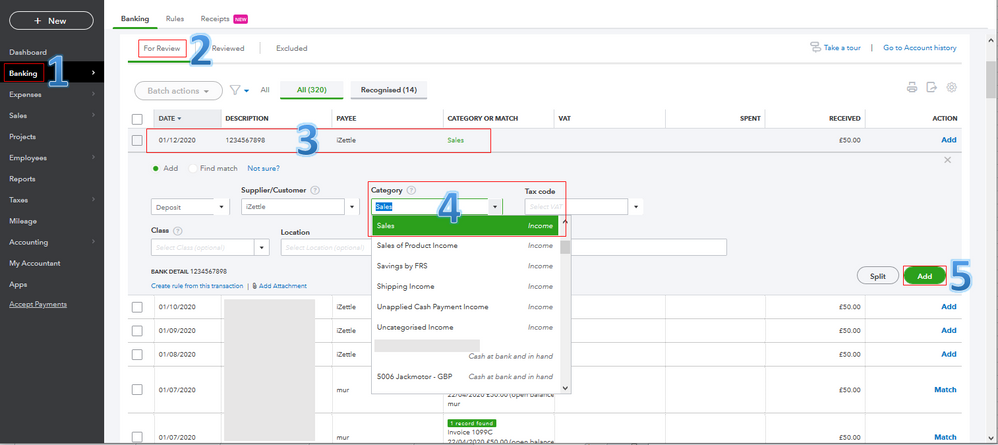

I've got the steps you can perform to categorise your iZettle transactions in QuickBooks Online (QBO), @robwillwood.

Based on your scenario, it looks like the transactions have appeared in the Banking page. We receive the data on how iZettle communicates with our system. With this, I'd first suggest contacting their support team. They can help you confirm why the transactions have appeared as debtor items, not income for sales.

Once verified, let's go to the For Review tab so you can change the category of the transactions worth £6500. Please make sure to choose the account where you collect the iZettle sales data. This way, your financial records are accurate in the program. I'll guide you how.

- Go to Banking from the left menu.

- Select the For Review tab.

- Locate and select the iZettle transaction.

- Choose the correct account in the Category drop-down.

- When you're ready, click Add.

- Repeat the process for the other transactions.

The screenshot below shows you the first five steps. For the detailed instructions, check out this article: Categorising Bank Transactions.

Moreover, it's a best practice to reconcile your account monthly to ensure it matches your iZettle statement. Also, you'll know your business' net worth in real-time. To learn more about this process, visit this article: Reconciling An Account.

I'm always here to lend you a helping hand if you need anything else. Enjoy the rest of your day, @robwillwood.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

We use iZettle to take payments. In QB a number of these transactions have appeared as debtor items (total around £6500) even though they are income for sales. Why?

Thanks for your reply but I think you have misunderstood the question.

We have reconciled all iZettle income to 'product' sales and this has successfully hit the P&L account.

However we still seem to have £6675 sitting in debtors for iZettle income. This may have resulted from a short period where we linked QB to iZettle which was disastrous.

I really just need to know how to delete the £6675 from debtors as it is double counting income

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

We use iZettle to take payments. In QB a number of these transactions have appeared as debtor items (total around £6500) even though they are income for sales. Why?

I appreciate you getting back to us and providing detailed information about your concern, @robwillwood.

You can create a journal entry to offset the difference. However, due to the nature of this matter, I recommend you to contact an accounting professional for guidance on what's the best thing to do in this situation. This is to ensure your books won't be messed up.

Moreover, I don’t want to leave you empty-handed, you'll want to visit our Community Help Articles hub in case you need some related articles in managing your account.

Know that you're always welcome to stop by the Community if you need anything else. I'm here to help. Have a fantastic day!

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

We use iZettle to take payments. In QB a number of these transactions have appeared as debtor items (total around £6500) even though they are income for sales. Why?

I am an accounting professional! The problem was caused because the automatic downloads from iZettle do not work well.

I will nonetheless create a journal entry to balance it

0 Cheers

Recommendations

Featured

Ready to get started with QuickBooks Online? This walkthrough guides you

th...