Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello Community Users! Just wanted to add an update. You can now unfile the CIS return directly in Quickbooks Online, instructions on how to do that are available here. Any questions feel free to reply to this thread.

Hello R0lph,

Welcome to the Community page,

If you could please either send us a PM on Facebook or a DM on twitter with your email address linked to your account, a screenshot of the CIS return you want unfiled and we can get it raised up for you.

I have spent 3 weeks trying to get my cis return unfiled as I sent this to Hmrc manually and just wanted to put the tick in the box next to the monthly return on QB's to make it look tidy. But still shows as being rejected and needs to be prepared.

No one at quick books knows how to do it! I will from now on send all my returns manually to Hmrc. Its quicker and I know they get the correct information plus, I dont have to keep calling QB's and sending screenshots to get something corrected that QB's do not know how to correct. Keep it simple!

I appreciate you making us aware of your experience, @283.

If there are corrections to be made on the return and you need to unfile it from QuickBooks, I'd recommend contacting our Customer Care Support team again. They are the ones who can check your account with us and help you make amendments to an erroneous filing.

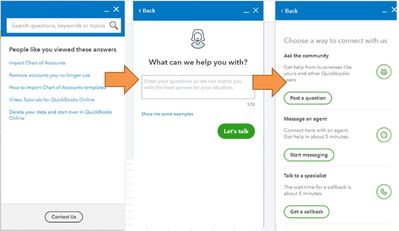

Here's how to contact our Live Support:

Here are some helpful articles to learn more about filing CIS in QuickBooks Online:

You can always visit us here in the Community if you have any general questions about QuickBooks. I'll be around to help you.

Did you ever have any joy with this? I have been going round in circles on quickbooks trying to unfile a return and the QB assistant is useless. I cannot see a box to select 'unfile return' after i view return! PLEASE HELP quickbooks, this is such a waste of time!!

I'll ensure you get the support you need because I understand how precious time is for you, @goldlineflooring. We'll take care of this as quickly as possible.

I'm determined to improve your experience with our support. I'll make sure that you can unfile the return as quickly as possible.

I'm delighted to unfile the return, however, I'm unable to pull up an account like what phone support does since Community is a public forum. I know you've already called in, but I'm still suggesting in touch with our Customer Care Team again. Our experts have special tools to unfile the form and help you from there.

Also, if you have the case ID handy, please provide that to our agents to quickly see the details of the problem. Doing so does not require you to reiterate your concern. Make sure to contact them within business hours to ensure a swift response.

Check out this article to know more on how to manage your taxes reports, VAT transactions, and other related topics: Taxes in QuickBooks.

If you still have questions in mind, please let me know by leaving a comment below. I'm always here to help you again. Keep safe, @goldlineflooring.

Hello Community Users! Just wanted to add an update. You can now unfile the CIS return directly in Quickbooks Online, instructions on how to do that are available here. Any questions feel free to reply to this thread.

Hi

I am trying to unfile a CIS return as inadvertently I filed it with a sub-contractor showing VAT and they aren't meant to pay VAT. However, the instructions that quickbooks give to unfile only work for a CIS return filed within a certain period. The CIS return I want to unfile is 3 months old and there is no unfile button at the bottom left-hand corner of the report. I now need to file my VAT and this is incorrect as it is showing VAT that was charged but shouldn't have been.

There seems to be a glitch in the system somewhere as even though I have input no vat on the sub-contractor when it comes to reconciling it comes up with vat.

Hope someone can help with this problem.

Thanks for reaching out to us about unfiling a CIS return, @Reggie11.

I can get you to the right department who can help you with this. You're right, the steps shared by my colleague applies only to a current closed period. Since you're dealing with prior month's data, you'll need to contact our support so they can unfile it for you.

This process will account data verification which only our live representatives can do. Here at our community, we discourage sharing your account or personal information for your security.

Contact our support using the steps below:

Please post here again for any updates about the call. I want to make sure this is resolved and I am here if you need further help with your QuickBooks Online account and CIS filings.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.