Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi.

I've deregistered for VAT with HMRC and successfully submitted my final VAT return.

In QBO I've followed all the steps suggested in help such as turning off MTD, changing everything to No VAT etc but.....

I can't seem to change my invoice format to exclude all reference to VAT (the suggested 'Customise look and feel' option isn't there) also....

In Taxes<VAT the next return still seems to be active in spite of following the shut down steps

Can someone help with these issues please.

Many thanks

Solved! Go to Solution.

I appreciate you for following the steps provided by my colleague, Mr Tangerine Man.

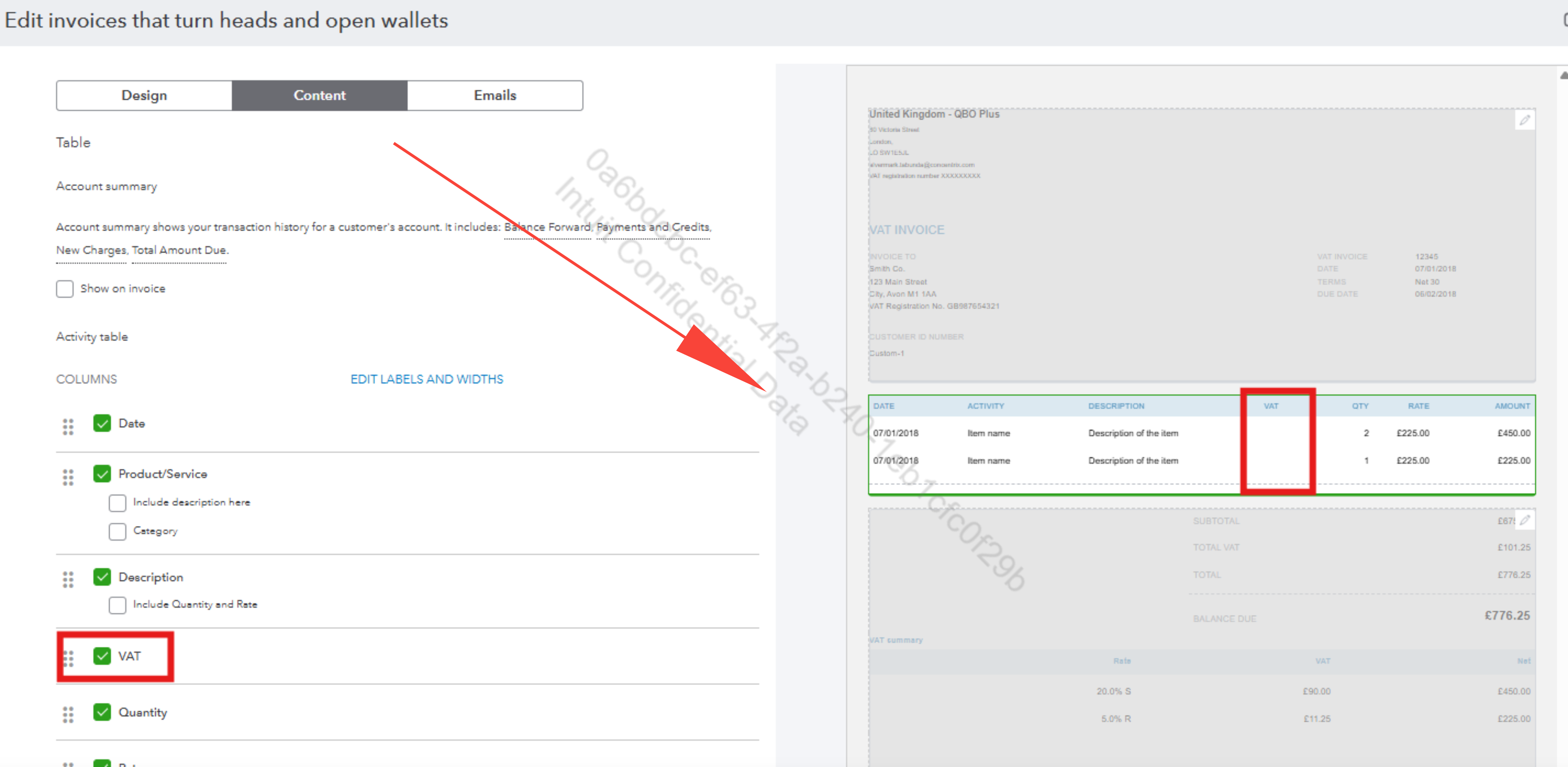

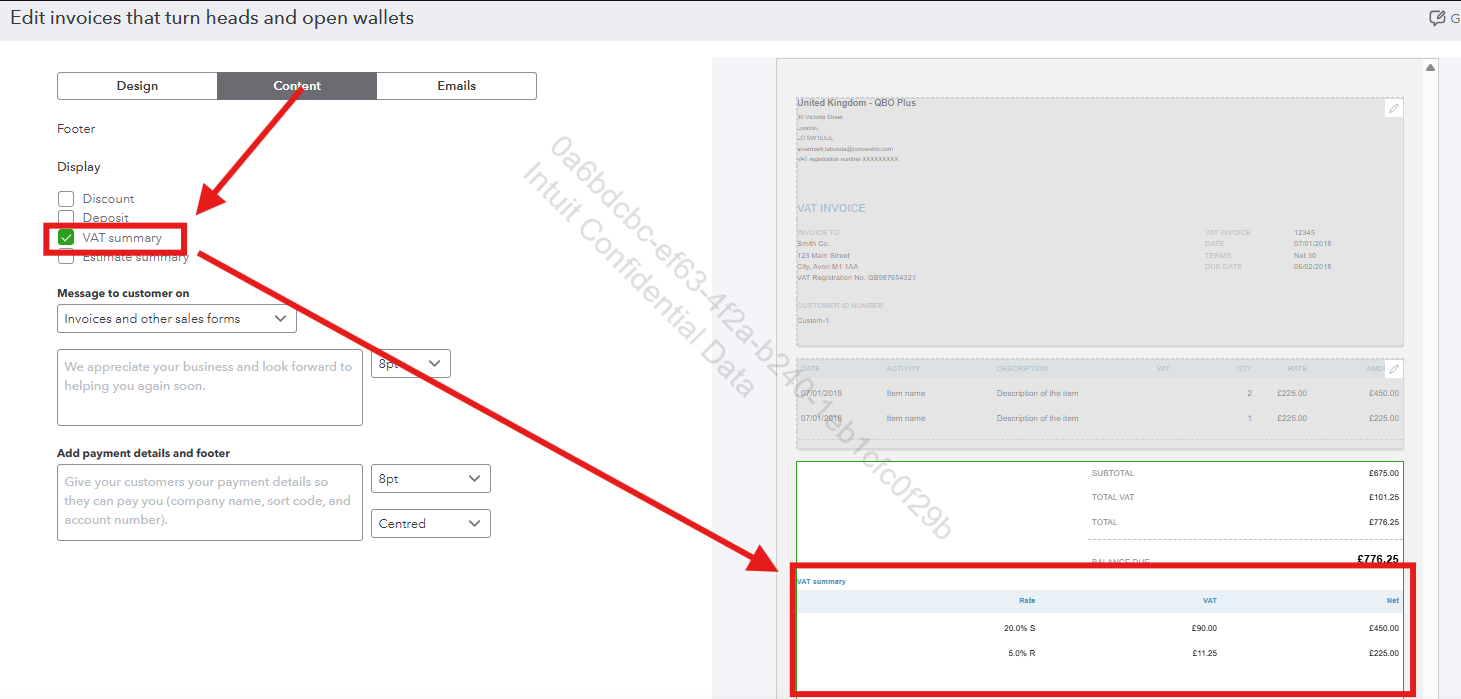

You're right that the VAT registration number still appears in the top section, and the VAT total is displayed in the bottom section of an invoice, even after configuring them in the Custom Form Style. It only happens when you apply the VAT to the invoice. Here's a visual reference you can refer to:

On the other hand, you can turn off the Form names or remove the name of the tax invoice in the header section of the Customs Form Styles to remove the VAT invoice name.

You can find more information on managing your sales form in QuickBooks Online (QBO) in this article: Customise invoices, estimates, and sales receipts in QuickBooks.

Also, if you need to generate VAT reports from the previous month, you can refer to this resource as a guide: Use VAT reports in QuickBooks to check what you owe.

Return to this thread if you need further assistance with the VAT on your invoice. The Community folks are here to help you out.

We're gonna need to customize your invoice forms to exclude all the VAT references, Mr Tangerine Man.

Follow these steps:

On the other hand, since you have successfully deregistered for VAT and submitted your final VAT return, you are no longer obligated to file any future returns. The active returns you see are automatically generated by the system and are simply a reflection of historical data. You can safely ignore these open returns.

If you wanna generate a VAT report from the previous periods, you can check this helpful article: Use VAT reports in QuickBooks to check what you owe.

Return to the thread anytime an additional query comes up. The Community team will loop back to assist you.

Thanks for the guidance but the 'Content' tab in edit invoice doesn't allow me to get rid of all BST references.

I can remove VAT from the middle detail box but it still shows in the top box i.e. VAT reg no xxxxxxxxxx, VAT Invoice

Plus

A VAT total in the bottom box

Editing in the top box says See and edit your VAT number in the VAT centre but I don't think this would change the invoice layout,??

Thank you

I appreciate you for following the steps provided by my colleague, Mr Tangerine Man.

You're right that the VAT registration number still appears in the top section, and the VAT total is displayed in the bottom section of an invoice, even after configuring them in the Custom Form Style. It only happens when you apply the VAT to the invoice. Here's a visual reference you can refer to:

On the other hand, you can turn off the Form names or remove the name of the tax invoice in the header section of the Customs Form Styles to remove the VAT invoice name.

You can find more information on managing your sales form in QuickBooks Online (QBO) in this article: Customise invoices, estimates, and sales receipts in QuickBooks.

Also, if you need to generate VAT reports from the previous month, you can refer to this resource as a guide: Use VAT reports in QuickBooks to check what you owe.

Return to this thread if you need further assistance with the VAT on your invoice. The Community folks are here to help you out.

Thank you so much.

That has worked :thumbs_up::thumbs_up:

I’m glad that the resolution outlined by my colleague has helped you with your VAT concerns in QuickBooks, @Mr Tangerine Man.

Also, check out this article for guidance on filing and recording VAT payments to keep your VAT payable up to date: File your VAT return and record VAT payments in QuickBooks.

Get back to us if you have any QuickBooks-related concerns. We're always here to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.