Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Solved! Go to Solution.

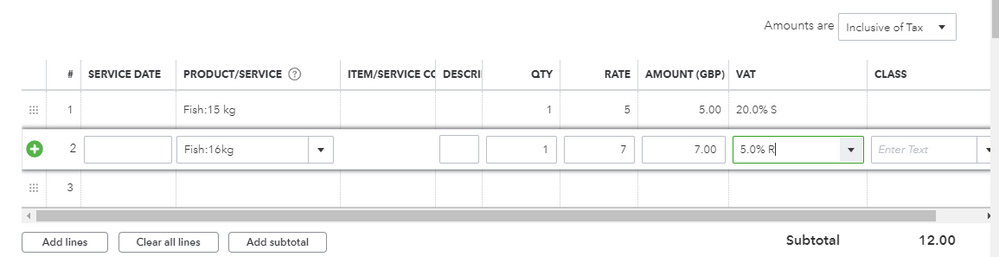

Hello Community Uers, Just wanted to add some clarification onto this thread for any visitors. Using the example given on this thread

And this has been paid as one single transaction where the VAT is not against every line item and therefore the individual rates are unknown.

If you do not know which items the VAT applies to/what should be Vatable on your expenses, that is something we can't advise you on it is worth looking at HMRC for that information. You would need to record the correct VAT https://www.gov.uk/guidance/rates-of-vat-on-different-goods-and-services. You could also confirm with an accountant.

Hi chrissmith,

You can both create a bill or an invoice and enter multiple items with different VAT codes. Then, apply the payment from there.

Let me show you how:

See the Create an invoice article for further guidance.

To enter a bill, check out this link: How to enter and pay bills.

I'm also sharing some of our great resources that will help you in the future:

If you have any follow-ups or other concerns, just let me know by leaving a comment below. I'll be here to help. Have a wonderful day.

Thanks for the help. As a follow up - what should I do if the receipt/invoice has multiple individual entries, but only one number for vat (ie I don’t know which vat rate applies to what line). How do you account for that using quickbooks? Many thanks again.

Thanks for coming back to the Community, chrissmith

In QuickBooks, you’ll have to manually enter the VAT for the specific item. If you don’t know what rate applies to it, you can use the default rate.

If the item is not subjected to VAT, then you can select the No VAT option under the VAT column.

Please follow the steps provided by my colleague to select a rate.

Feel free to browse the articles shared above about VAT.

I'm just a post away if you still need my help. Thanks!

Hi - does that mean you can manually enter a vat amount rather than having to use a rate or %age. That would make life much easier... could you please advise how to do that?

Thanks!

Hi @chrissmith,

I'll be joining this conversation to provide additional information on your query about VAT rates.

What my colleague, @Adrian_A meant above was, you'll have to manually select a VAT rate under the VAT column of your sales transactions. If you're not sure which VAT code to use, I suggest consulting your accountant to ensure that your VAT return will show accurate figures.

You mentioned manually entering the VAT amount, which is also possible. Let's take for example the screenshot provided above, which has 2 item lines with 2 different VAT codes. Below the Subtotal line, you'll also see 2 text boxes that contain the VAT amount for each line.

Keep in mind, the VAT amount shown in the text box is the total amount of all items using that specific VAT code. It isn't specific for a single line item unless there's only 1 item using the VAT code in question.

Take some time to view this article that contains the default VAT codes available in QuickBooks Online: Common VAT Codes. It's here you can see a list of VAT codes automatically generated by the system when you enable VAT. It also includes a table of how each VAT code affects your VAT 100 return.

Do you have any other questions I can help with? Post them below, and I'll get back to you as soon as I can.

Hi - thanks for the response - may be to help with the query:

If the firm has paid for a number of things on one bill e.g. food, stationary etc. and has received a VAT receipt - where you can't tell what VAT rates have been applied (only the total VAT), how can you account for it (as you can't use the rates in Quickbooks) - e.g.

And this has been paid as one single transaction where the VAT is not against every line item and therefore the individual rates are unknown.

Hopefully this may make the query a little clearer?

Ta.

Hello, @chrissmith.

If you mean that the amount of the items are inclusive of tax, the rate usually depends on the VAT you've selected under the VAT column. You actually view the rates under the Subtotal section or by pulling up the transaction journal by clicking on More and selecting Transaction journal on the Invoice page.

You can see these screenshots for additional reference.

Keep me posted if you have any other clarifications. I'll be always here to help!

Hi - please can you advise if there is a contact number to discuss further as the advice isn’t quite answering the query.

Many thanks for your help so far.

Good to have you back, chrissmith.

I can route you to our phone support team. They'll be able to assist you further with your concern.

Here's how to contact them:

If you have more questions, don't hesitate to post them anytime here.

Hello Community Uers, Just wanted to add some clarification onto this thread for any visitors. Using the example given on this thread

And this has been paid as one single transaction where the VAT is not against every line item and therefore the individual rates are unknown.

If you do not know which items the VAT applies to/what should be Vatable on your expenses, that is something we can't advise you on it is worth looking at HMRC for that information. You would need to record the correct VAT https://www.gov.uk/guidance/rates-of-vat-on-different-goods-and-services. You could also confirm with an accountant.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.