Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello there!

In QuickBooks Online (QBO), we want to make sure that the VAT settings are configured properly and the right tax codes are set up. Don't worry, it's not too complicated. Here's a step-by-step guide that can help you get started:

Set up VAT on Purchases:

Record your Purchase VAT

Similar to VAT on sales, you will also need to record any VAT on purchases. Here's how:

In addition, it's important to note that there's an expiry date for backdating and reclaiming your VAT on purchases and how the setup is done in QuickBooks. Please refer to the HMRC website regarding this for the complete details.

Commonly, VAT on purchases is not charged when the supplier is located overseas, yet there are some exceptions to this rule. For further guidance on this, please refer to HMRC.

Moreover, you can check out these articles to get more insights and information related to your concerns:

Please let me know if you have further questions about tax setup-related concerns in QuickBooks Online. I'm always here to help. Have a great rest of the day!

Hi there, thanks for getting back to this thread.

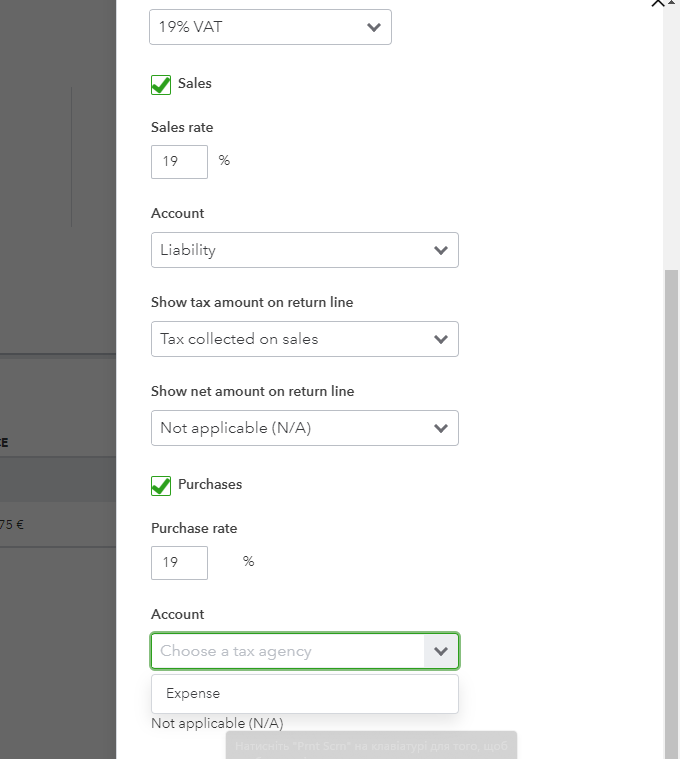

When creating a new tax rate, you should be able to choose between the options of Liability, Expense, and Non-tracking on the Account drop-down for Purchases.

To check for any browser issue that may be causing an issue, please clear the cache and Intuit-specific cookies or log into QuickBooks through a different web browser to create the tax rate.

If you do not see the option to select the liability account following this, please begin a chat or call our support team on 0808 234 5337 (M-F, 8 AM - 7 PM, free from UK mobile & landlines). The agents available here will have access to set up a remote screenshare where they can take a closer look with you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.