Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi

I have quite a specific query. We import goods from France, before Brexit we recorded these invoices on QB online as 20%ECG.

After checking the guidance from QB I've enabled PVA import 0% and PVA import 20% via the VAT Rates screen.

I'm trying to post an invoice from a supplier from France, I can record this fine using the PVA 0% code, however my accountant thinks that the correct code is PVA 20%. When I try and use this QB won't let me and states that there is an error calculating the tax.

I've tried different configurations for the category and nothing works?

Can you help please? - screen shot below

Hello PRSpares,

Welcome to the Community page,

So we are aware of this and there is an investigation currently for this inv-53549, which we have added you too.

The workaround for it is to use the 20%RC MPCC code, and note the transaction to change it back to the correct code once resolved.

Don’t know whether it’s the same problem, but PVA20 adds 20% VAT to invoices - which also doesn’t see right.

The investigation is related to the error you're getting, Billharris.

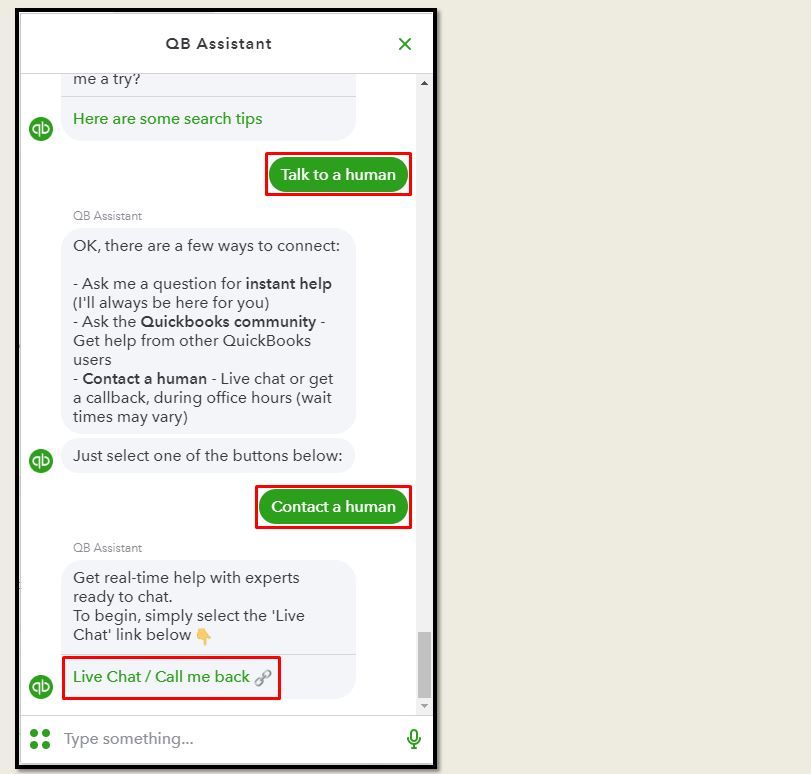

I recommend reaching out to our QuickBooks Online support so you will be added to the list of affected users. This will help them track the number of users. Here's how:

Keep in touch with me here should you have any additional questions or concerns.

Thanks for the advice, but I have not been able to get a response on live chat after several attempts. I do hope that fixing problems isn't dependent on the number of people that report them!

Hi Bill, we can add your company to the investigation as well. We'd look at if issues were company-specific it may take longer to establish a fix however in this case it is more than one userso the fix would be implemented as a product update.

Thanks EmmaM

Hi Ashleigh1,

I have the same issue, but wouldn't make more sense to temporarily use the old 20% ECG (0%) vs the MPCC code which says it is for reverse charges for phone and computer chips?

I hope quickbooks can resolve this quickly as the PVA codes not functioning correctly is a big issue as people try to get their heads around post Brexit trading and accounting.

Thanks

Hi CharlesS, It is purely a temporary way for it to calculate the right percentage on the invoice once this is resolved you can amend back to the correct code so the return records correctly, we are working to get this resolved ASAP

OK thanks, so 20% ECG, which calculates the same way, will work? Do you know how long it will before you have a fix for the PVA codes. FYI- I spent 2 hours with a QB rep earlier today, where they told me that the PVA codes were working exactly as they were designed and required!

Glad to have you back, @CharlesS.

Yes, you can use the 20% ECG VAT code to calculate VAT for your transactions, while PVA codes aren't available. We don't have a specific time frame as to when this is going to be ready to use.

Rest assured, we'll provide updates regarding this matter. I'd encourage you to visit our QuickBooks Online Blog site to stay in the loop with our latest news and product road-maps..

On the other hand, to give you more details about the different VAT codes that are available in the system, please scan through this link: Common VAT Codes.

Know that the Community got you covered if there's anything else you need. Have a lovely day!

Is there any further update when this is will be fixed?

I agree that you can temporarily use the '20%RC MPCC' code as it correctly posts to Boxes 1, 4 & 7.

For the record, the '20% ECG' posts to Boxes 2, 4, 7 & 9 so it is not a direct replacement.

The fact that there is this bug at all is odd because 'PVA Import 20%' is exactly the same as '20% RC MPCC' just with a different name. Surely it was just a cut and paste exercise for the developers...who obviously did not test their work!

My return is due after End-Jan. If this issue is not fixed I will then have to submit my MTD return using '20% RC MPCC' rather than 'PVA import 20%'. I am unsure if this actually makes any difference? Are the VAT codes for individual transactions sent to HMRC in a QB MTD VAT Return or just the total values for each Box on the return?

Scene, your remarks on RCMPCC vs ECG are very helpful and I'll now go back change my January entries to 20% RCMPCC.

You make a good point about why PVA20% is such a challenge given that one of the VAT codes does the same thing.

I too would be curious to learn whether the MTD includes vat codes are just values.

We're getting the same issue, have been sitting for a while waiting to be connected to the live chat to report it as requested but still haven't been put through to anyone. Client wants their return filed ASAP so need to get this sorted.

I’ve been looking into this a little more:

1. After reading the HMRC API it seems to me that MTD only transfers the totals for Boxes 1-9 and not the transaction data. Therefore it does not matter if you use 20% RC MPCC until the PVA 20% bug is fixed.

2. But thinking about it a little more I think that it might be better to enter all imports (supplier invoices) with a Z code and handle the PVA separately each month by entering the value from the new Monthly Postponed Import VAT Statements (MPIVS) from HMRC [how do you obtain them?]. You would have to check that all your imports are listed on the statement, but doing it this way saves having to make correction entries as required under PVA. I believe Xero will handle PVA in this manner. You would have to make a two line entry: Line 1 to enter the total amount the statement PVA value is calculated from and use the PVA (or RC) VAT code. Line 2 enter the same amount with a Z code to net it out of Box 7 on the return as this is already handled when you entered the original supplier invoice. Any Accountants care to comment?

I note this message started on the 12th Jan 2021 --- has it been resolved

we have the same problem

Thank you for joining this thread, @paul j2.

Currently, the investigation for Unable to save Bill/Expense using PVA 20% VAT code (INV-53549) is still in progress. You have two workarounds that can be used for this. First, you can use the 20% RC MPCC code and note the transaction to return to the correct code once solved. Another is to use No VAT, and note the transaction to change back to the right code once fixed and to create an exception if needed.

Then, to be notified of the INV updates, I suggest reaching out to our support team so you'll be added to the list of affected users. Here's how:

To learn more about the common VAT codes listed in QBO, visit this article: VAT codes and rates.

Let me know how this goes and leave a reply below. I'm always here to help you. Have a good one.

Same problem here for a client using QBO. Advising to use the MPCC code for the moment until resolved.

Can you add me to the list for people being affected please.

Thanks

Hi, I’m still trying to work out how to process international purchases on QB.

When entering a supplier invoice from Germany for example we’ve so far been entering all these as ECG zero but I’m getting the idea we should use the RC MPCC code??? so the transactions show in the correct box in the vat return?? Does anyone know if that’s correct?

I have just found how to get the PVA statement from HMRC but I don’t know how to enter these vat amounts in one lump onto QB??

Can anyone advise how I would enter the PVA vat on one monthly invoice???

help

thanks

Rosie

Nice to have you joined this thread, @RosieC.

I’d be glad to share with you some insights on how to correctly enter those codes in your QuickBooks Online (QBO) account. QBO automatically sets up a list of VAT codes you can enter. However, if you’re on the Flat Scheme, some codes will not post in the same way.

That being said, you’ll want to check this article for reference in entering the right VAT codes: Common VAT Codes.

In regards to entering those amounts into your invoice, you can follow the steps shared by colleague Divinamercy_N in one of your posts: https://quickbooks.intuit.com/learn-support/en-uk/vat/import-vat-pva/00/759304#

With this, I’d highly recommend reaching out to your accountant for additional guidance in recording this properly. If you’re not affiliated with one, you can visit our ProAdvisor page and we’ll help you find one from there.

Furthermore, let me add this link that serves as you guide in filing your returns in the future: Submit a VAT return in QuickBooks Online.

In case you have other queries or concerns about your taxes, tag me in your reply and I’ll be around to back you up. Have a good one and keep safe.

Hi Rosie

I wondered if you found out how to add the PVA amount to QB? I have to add all the imported goods as 0% otherwise it throws all my figures out. I just need to know how to adjust the VAT correctly but after hours trawling through QB I don't seem to be able to see what others are doing?

Hi Debby

I'm not 100% sure if i'm right (i'm not an accountant by any means) but where we know we are postponing the VAT on a purchase invoice (i.e its not already been paid at the border) – then we plan to use code PVA 0% for the goods. It's either that or use Zero 0% code.

Then I think we are only supposed to account for the import VAT that shows on our PVA vat statement that you get to download from HMRC. The total VAT amount has to match the statements & may need to be adjusted In the next quarter. (we have a lot missing consignments on our first months statement, presumably because of delays processing, i expect these will turn up on the next one)

Correcting the PVA figure in QB to match the HMRC statement

As far as I can tell we need to use PVA20% or until that works we use RCMCPP 20% as that’s like a reverse charge code (This code posts to box 1, 4 & 7 which is the requirement for PVA vat accounting)

What we plan to do is edit one of the international purchase invoices and add another line.

So the goods will be on there with PVA 0% or Z 0%

Then let’s say the total PVA VAT on the HMRC statement is £200 we need to account for.

We would add a new line to one of the bills underneath the goods line.

Eg: Expense Account?? £1000 + PVA 20% or until that one works use RCMPCC 20%

Then enter another line underneath that one

Expense Account?? -£1000 + Zero 0% VAT this makes sure we don’t have an amount in box 7

This will show £200 vat as a positive and £200 VAT as a negative on the bottom of the bill/expense so they cancel each other out but show on the return?

I THINK??

Hope that's helpful, I've tried looking at this problem on forums for ages and this as best I can come up with as a solution that should work for us.

Rosie

Thank you Rosie, this is really very helpful. There are so many posts on here which slightly differ.

I found trying to match the imports listed to invoices was a nightmare as no references matched, got there in the end.

Are you Accrual or Cash Accounting? We are Cash and considering changing to Accrual to perhaps make this a little easier.

Hi

We're accrual

Yes i can't exactly match mine either because the amount and references are different, that's why i think its easier to put the PVA through as a lump sum based on the statement figure.

We get a lot where we pay upfront to the courier too and have to claim it back.

Its a nightmare really

Rosie

Thanks for the additional insight RosieC & DebbyC. We too are struggling with same issue where by using the suppliers invoice to calculate PVA (like we use to with the VAT code 20% ECG) doesn't match the PVA Statement based on import declaration. I wish Quickbooks would provide an easy workaround where by it is straight forward to add the official value of Vat based on the import statement! I find it more amazing that still, after nearly 2 1/2 months, their PVA codes don't work properly. I have seen once can manual make adjustments to the Vat declaration in Quickbooks, but I am really frighted to tamper with these values. Your work around RosieC is helpful one, but we shouldn't have to be doing it this way. Anyway, thank you.

Charles

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.