Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Solved! Go to Solution.

Hi bethany4,

The effective date will only show when switching VAT accounting schemes, instead, once you've entered all of the transactions for the period please select 'Prepare return' against the open return and change the start and end dates on the fields in the following screen - you'll then see the boxes 1-9 re-populate automatically with the transactions for that period.

Please get back to us below if there are any issues!

I can help you file the previous VAT returns in QuickBooks Online (QBO), @bethany4.

You'll need to select a VAT scheme to edit or enter a starting date of your return. I can walk you through the steps how:

Also, please ensure to record the historical transactions dated 2019 correctly. This way, you can file your return seamlessly.

When you're ready, you can now submit your VAT returns. Once done, you can record your tax payments in QBO to keep your information up-to-date.

Feel at ease to get back to me if you need more VAT insights. I've got your back always.

Hi there

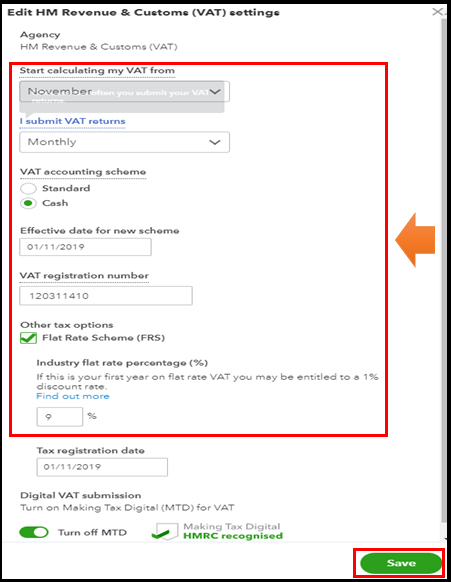

Thanks so much for getting back to me. I seem to be missing the Effectvie Date box (which is exactly what I need!). I only see the attached pic. Am I doing something wrong? Thanks

Hi bethany4,

The effective date will only show when switching VAT accounting schemes, instead, once you've entered all of the transactions for the period please select 'Prepare return' against the open return and change the start and end dates on the fields in the following screen - you'll then see the boxes 1-9 re-populate automatically with the transactions for that period.

Please get back to us below if there are any issues!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.