Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi QB community, my company is reporting GST starting 2 Jul. I am looking for a GST report that will reflect all of the individual purchases and the corresponding individual GST for each day. Currently, the tax agency detail report reflects only total purchases and total GST for each day. We are using Desktop Premier 2013 edition.

To illustrate my point, 3 screenshots attached.

Screenshot 1 (tax agency detail report). For 2 Jul, total purchases is $1,342.27, corresponding GST 7% is $93.96.

Screenshot 2 is from the purchases account. The yellow highlighted reflects the individual purchases adding up to total $1,342.27 2 Jul. But this report does not reflect the individual tax amount. Also, this purchases account includes both GST and non-GST purchases. So it is difficult to identify at a glance the GST related figures.

Screenshot 3 is the write cheque feature where I enter the purchases and their related GST or non-GST status. Note the vendors do not have individual accounts. All payments are made to "cash in drawer".

Looking forward to your advice. Thank you very much.

Thanks for posting here in the QuickBooks Support page, @elaine.

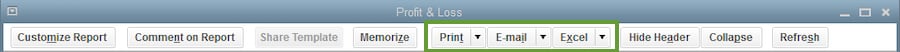

I want to make sure you're able to get the report you need for the tax agency. If there are columns in the report that you can't add, you can do it outside QuickBooks by exporting it to excel.

Here you will need 2 or ore reports, then you can combine them in an Excel worksheet. Here's how:

If you need further assistance with modifying the report, please mention me anytime. I'll be more than glad to share additional insights with you. Have a nice day!

Hi @Jen_D , I am not saying definitely that I can't add columns in the report in Quickbooks. If it is indeed possible, please show me how, with reference to my specific question on GST reporting.

Also, it is not a simple matter of exporting to excel as you had suggested. One report (screenshot) I showed earlier had a summary for each day, which the other report had other accounts' data by day. Do refer to my original post for the complete question, plus screenshots of quickbooks where I demo my issue.

Looking forward for advice. Thank you.

Hi QB Community, is anyone available to help me with my question please? Please see my original post. @Jen_D 's mention of exporting to excel is not quite the solution, as QB reports in itself doesn't generate the necessary data in the required details for export purpose. Thank you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.