Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi there,

I made the VAT adjustment on my first VAT return for purchases of supplies and services within the 6 months prior to registration. This has been noted in my banking records and journal as a VAT adjustment and as a payment.

Following submission of my first VAT return, I received a refund for the VAT on purchases of supplies and services prior to registration plus purchases of supplies and services in my first quarter - which is what I expected. This VAT refund has been logged as a refund back into my banking records.

However, because of the VAT adjustment in the first instance is logged as a payment - my QB banking record is not showing the same amount as my actual bank account. I'm confused as to what has happened here! Is there a way for me to correct this? I am hesitant to delete the journal entry for the VAT adjustment as a shortcut to make my numbers look the same on QB and bank account.

Hope someone can help advise on this - thanks!

Solved! Go to Solution.

Hello SC028, It sounds like the reason this will be is when you did the VAT adjustment you selected a bank account to be the adjustment account, if you are doing a vat adjustment we'd usually advise to set up an account purely for that so you can see clearly any adjustments. It my have your bank account as the default account but as it is not a payment you would need to amend the account to something else specifically for adjustments. We'd advise speaking to your accountant as the adjustment would need to be corrected and it looks as if you have filed other returns since doing the adjustment. We've left an article here to help but we'd still advice consulting with an accounting professional.

Welcome to the Community, @SC028. I'm here to help ensure your VAT return in QBO UK matches with your bank and is recorded as a VAT refund.

When you record your VAT returns in QuickBooks, make sure that it is recorded as negative so it will appear as "Logged as VAT Refund" rather than "Logged as VAT Payment".

I also recommend you speak to your accountant and HMRC about the manual VAT adjustment you've made.

For future reference, read through this article: Record a VAT payment or refund in QuickBooks. It contains steps in recording the payment against a specific VAT period.

Feel free to post some more of your concerns in the Community. I'd be delighted to offer help.

Hi Katherine,

I have correctly logged my VAT refunds and this shows in my records.

I became VAT registered at the beginning of July 2020. I also uploaded my purchases (with VAT details) from pre-July 2020 on QB - as I also have the VAT adjustment included in my October 2020 VAT returns, I wonder if this is why I am negative on QB vs my actual bank account finances.

Would you advise me for me to delete the transactions from pre-July 2020?

Many Thanks,

Sharon

Hello SC028, It sounds like the reason this will be is when you did the VAT adjustment you selected a bank account to be the adjustment account, if you are doing a vat adjustment we'd usually advise to set up an account purely for that so you can see clearly any adjustments. It my have your bank account as the default account but as it is not a payment you would need to amend the account to something else specifically for adjustments. We'd advise speaking to your accountant as the adjustment would need to be corrected and it looks as if you have filed other returns since doing the adjustment. We've left an article here to help but we'd still advice consulting with an accounting professional.

Hi Emma,

As a small business, I am managing my own accounting through QB - I have no accountant helping me. Can you advise on the steps I would need to make adjustments or put me in touch with someone who can assist me with correcting my error?

Thanks!

I’m here to help and ensure it’ll be taken care of, @SC028.

We want to guide you every step so your QuickBooks banking records will match your actual bank account. But it would be best to reach out to our Technical Support team to help correct this error personally.

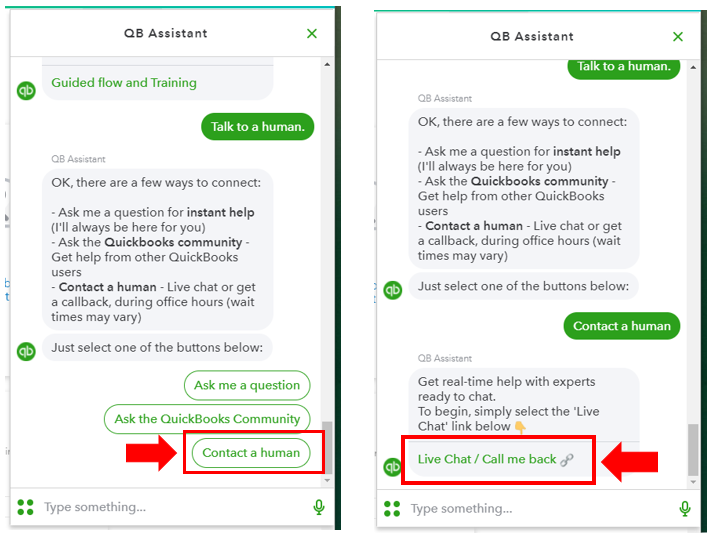

Contacting our live specialist can assist you further. They have specialised tools that can view your account to determine what causes the books to mismatch. You can follow these steps below to contact them:

These references give insights to keep your VAT records accurate. Here are some resources you can check for more information:

Don't hold back to drop a comment below if you have other concerns besides VAT adjustment. We’ll be right here to help. Always take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.