Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

LIMITED TIME OFFER get 90% off for 6 months

xyzSolved! Go to Solution.

Your voice matters to us, info-assl-co-uk.

I can see how the functionality to avoid future payments recorded for VAT showing in the current bank balance would be beneficial to your business. With this, I'd recommend sending a feature request directly to our Product Development team. This helps us improve your experience and the features of the program.

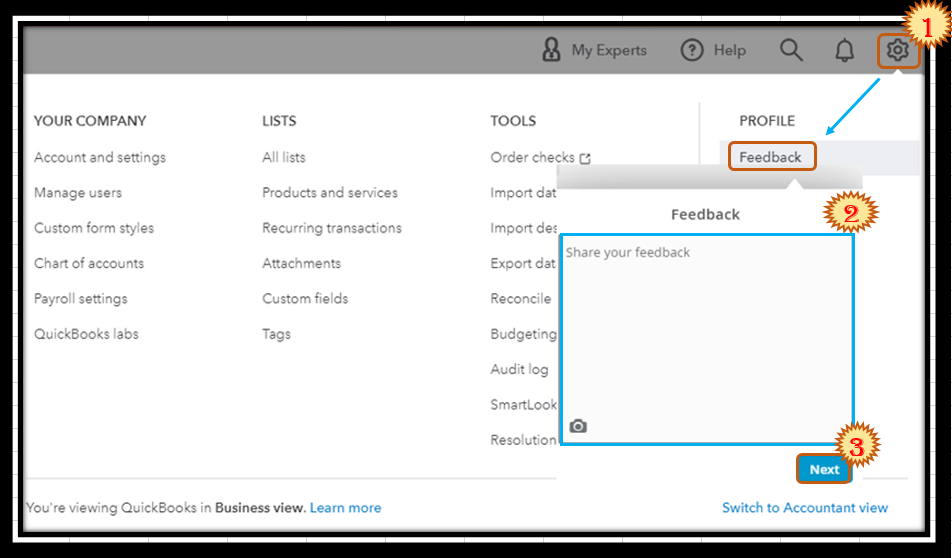

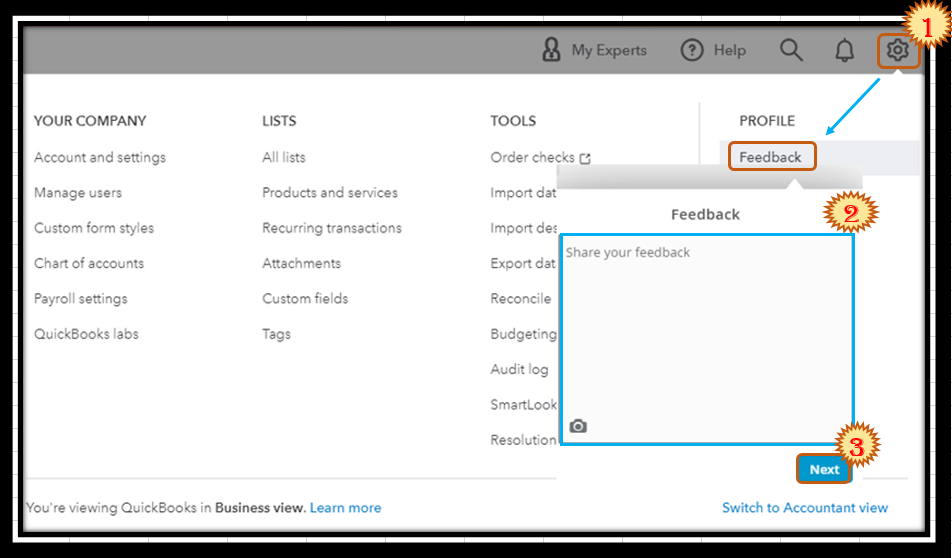

Here's how:

You can track your feature requests through the Customer Feedback for QuickBooks Online website.

Additionally, I've added these resources that'll help view the lists of transactions that are included in each box on the VAT return:

Let me know if you need assistance in managing your VAT in QuickBooks Online. I'm always here to help you out.

Hello Info-assl-co-uk,

Welcome to the Community page,

There is no way to avoid it hey unless they take the vat off the transactions. Are you recording the vat payments on the vat page and then matching them?

This is a payment to HMRC recorded from the VAT page for July 12th 2022 when they will take the direct debit. Although the transaction is forward dated it still shows in the current bank balance shown on the page linked to the bank account as the QuickBooks balance. It is correct in the Balance Sheet report.

Hello Info-assl-co-uk, thanks for that information, so when you record it on the vat page it will lessen on the balance sheet as money being paid out, if you dont want it recorded then deleted the record of payment on the vat page and then exclude the transaction on the banking page but this will then affect the vat suspense account showing not paid with an amount owing which will also show on reports just to make you aware of this.

Thanks for your answer. The transaction in question will not 'lessen' the Balance Sheet until July 12th when the transaction date is reached (I have just tested that). I was expecting the same logic to apply to the QuickBooks balance showing on the banking page.

Is this a glitch with the way QuickBooks works?

Hello Info-assl-co-uk, the current balance shows the total of everything, even if it is dated in the future. You would need to run a report on the bank account to get the correct figure for a particular date, or remove anything dated in the future.

Yes, that's what I thought, but surely the bank balance on the banking page should show the correct balance at the current date (same as the Balance Sheet). Can this be logged as an enhancement request please?

Your voice matters to us, info-assl-co-uk.

I can see how the functionality to avoid future payments recorded for VAT showing in the current bank balance would be beneficial to your business. With this, I'd recommend sending a feature request directly to our Product Development team. This helps us improve your experience and the features of the program.

Here's how:

You can track your feature requests through the Customer Feedback for QuickBooks Online website.

Additionally, I've added these resources that'll help view the lists of transactions that are included in each box on the VAT return:

Let me know if you need assistance in managing your VAT in QuickBooks Online. I'm always here to help you out.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.