I've got the steps you need to correct the last financial year's VAT payment in QuickBooks Online, Flex1.

To get this sorted out, as an initial step, you can delete the payment through the Taxes page on your QuickBooks.

Here's how:

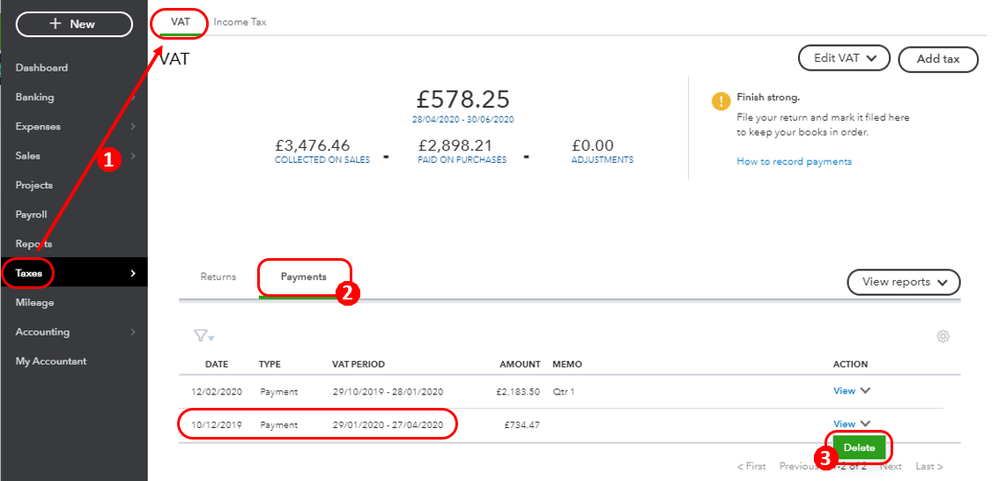

- Click Taxes in the left panel and choose VAT.

- Go to the Payments tab.

- Locate the VAT payment from last year and click the drop-down arrow beside View, tickle Delete.

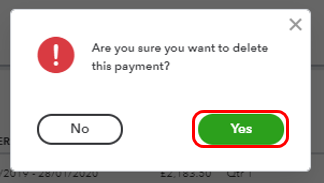

- Hit Yes.

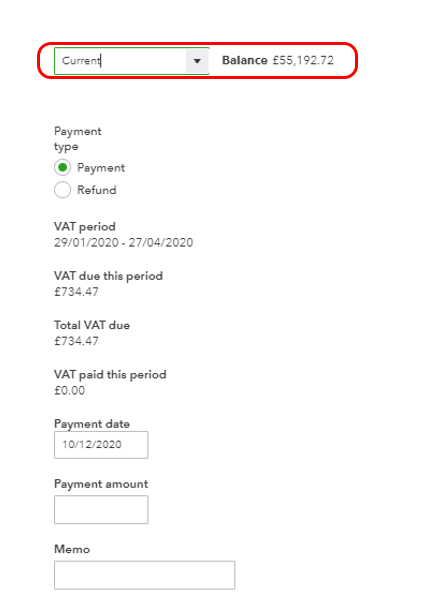

Once deleted, you can record the VAT payment again and make sure to select the correct bank account.

In case you want to reconcile the account, you can follow the guide in this article: Reconcile an account in QuickBooks Online. This will provide you steps on how to manually reconcile your account that's not connected to online banking.

You can always come back to our forum for other VAT questions or clarifications. I'm here to help. Have a nice day!