Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I would like to know how I can categorise payments I want to put aside for paying my quarterly VAT return.

Below I have transferred £500 into a seperate starling space for VAT contributions, but unsure on how I record it in quickbooks.

Solved! Go to Solution.

Hi @RobB81

Very simple. It's not an expense yet.

Record as Transfer.

You will need to create a new Bank-type account for the transfer to be sent to.

It's probably not even necessary to recreate this in QB because the money isn't actually going anywhere.

(a Starling Space is not actually a separate account - it's more like a sub-account of the main account).

In your Chart of Accounts, create a new Bank Account (this can be a current or savings account in QB, it doesn't really matter).

If you want it to be able to see the total in your Starling account (including VAT Space), set it as a Sub-Account of your main current account.

If not, leave it as a separate account in QB.

The payment from current to VAT Space is a simple bank transfer ... New > Other > Transfer if you want to enter manually rather than through the bank import/reconcile.

Hope this helps.

I'm glad to see you in the Community, RobB81.

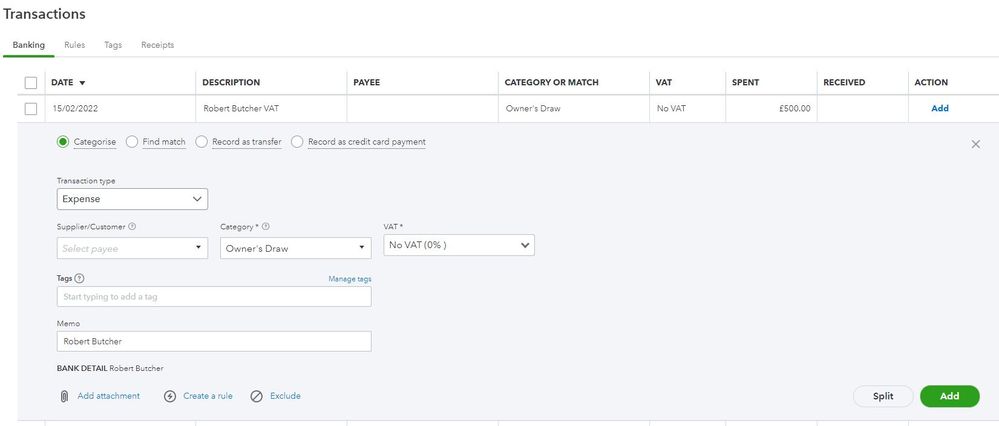

Let's use the Split feature to record the transactions in QuickBooks Online (QBO). This way, we can track the sales tax and other remaining amounts. I'm here to help walk you through the steps.

Before performing the troubleshooting steps, I suggest consulting your account for the specific transaction type to use for the other amount. They can also guide you on the category type to use for the entries. Once you have the information handy, follow the steps below to split them.

Here's how:

For more details, the following resource will guide you on how to classify downloaded bank data, split transactions between multiple accounts, exclude personal or duplicate entries, to name a few: Categorise and match online bank transactions in QuickBooks Online.

You can go over the links below for additional resources. These articles contain topics on how to handle any banking-related activities such as reconciling an account, adding deposits, managing your bank feeds, and sales taxes.

Stay in touch if you have other questions or concerns about recording transactions and VAT in QBO. I'll get back to make sure this is taken care of for you. Have a great day ahead.

Thanks for the reply,

I'm not sure if that's what i'm looking to do.

Lets say up to todays date my accounts show the amount due for this quarter of VAT to HMRC is £500

I want to keep that £500 in a separate account and want to know how I record that in quickbooks.

Hi RobB81 Have you, or are you going to physically/in real life transfer this amount to another account to make the payment to HMRC?

No it will be paid digitally when the time comes to pay it. I literally just want to keep it seperate from my main business account.

Hi RobB81, you can create a new chart of account to post the payment against however we'd recommend reaching out to an accountant if you're unsure on which account-type to use.

Hi @RobB81

Very simple. It's not an expense yet.

Record as Transfer.

You will need to create a new Bank-type account for the transfer to be sent to.

It's probably not even necessary to recreate this in QB because the money isn't actually going anywhere.

(a Starling Space is not actually a separate account - it's more like a sub-account of the main account).

In your Chart of Accounts, create a new Bank Account (this can be a current or savings account in QB, it doesn't really matter).

If you want it to be able to see the total in your Starling account (including VAT Space), set it as a Sub-Account of your main current account.

If not, leave it as a separate account in QB.

The payment from current to VAT Space is a simple bank transfer ... New > Other > Transfer if you want to enter manually rather than through the bank import/reconcile.

Hope this helps.

Hi Paul,

Yes that's quite right, the space is just a sub account of the main business account. So I have transferred it from my main account into the sub account.

Then I have created a savings account and named it VAT contributions in QB and directed it as a transfer in QB.

That's exactly what I was after, many thanks.

Rob.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.