- UK QuickBooks Community

- :

- QuickBooks Q & A

- :

- VAT

- :

- Re: Do I change tax status "Tax Inclusive/Tax Exclusive" of PO, It changes the products rate inst...

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Do I change tax status "Tax Inclusive/Tax Exclusive" of PO, It changes the products rate instead of changing the tax and grand total. Any one faced similar issue?

Changing the tax status "Inclusive / Exclusive" should change the tax and total instead of changing the products rate.

Solved! Go to Solution.

Labels:

0 Cheers

Best answer July 30, 2020

Solved

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Do I change tax status "Tax Inclusive/Tax Exclusive" of PO, It changes the products rate instead of changing the tax and grand total. Any one faced similar issue?

Hello cyrusacuna16, Welcome to the Community :waving_hand:. This is the way that QuickBooks has been designed and set up, it's asking is the number you are typing including or excluding tax, so when you change it after typing it in it recalculates it all to keep the overall total of the transaction the same.

0 Cheers

13 REPLIES 13

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Do I change tax status "Tax Inclusive/Tax Exclusive" of PO, It changes the products rate instead of changing the tax and grand total. Any one faced similar issue?

Hello cyrusacuna16, Welcome to the Community :waving_hand:. This is the way that QuickBooks has been designed and set up, it's asking is the number you are typing including or excluding tax, so when you change it after typing it in it recalculates it all to keep the overall total of the transaction the same.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Do I change tax status "Tax Inclusive/Tax Exclusive" of PO, It changes the products rate instead of changing the tax and grand total. Any one faced similar issue?

But that shouldn't be the case. Why would I want to change the rate of producT? The total and tax should be changed instead.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Do I change tax status "Tax Inclusive/Tax Exclusive" of PO, It changes the products rate instead of changing the tax and grand total. Any one faced similar issue?

Hello there, cyrusacuna16.

I understand that you don't want to change the product rate when you update the tax tagging.

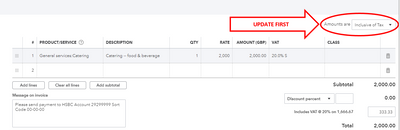

Though this is how it's designed, there's a workaround I want to show you. Let's update the tax tagging first before adding the products and rates.

If you have added the products already, you'll want to delete them. Then, change the tax type and add them back.

Also, you'll want to check this article to learn how to handle changing tax rates.

I'll be here if you need more help with this. Have a great day and stay safe!

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Do I change tax status "Tax Inclusive/Tax Exclusive" of PO, It changes the products rate instead of changing the tax and grand total. Any one faced similar issue?

Hi,

I can't find anywhere in my invoice or in my settings to change sales tax from exclusive to inclusive. Where can I find this??

Thank you!

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Do I change tax status "Tax Inclusive/Tax Exclusive" of PO, It changes the products rate instead of changing the tax and grand total. Any one faced similar issue?

Hi omingollc Are you wanting to set the default tax rate on your account?

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Do I change tax status "Tax Inclusive/Tax Exclusive" of PO, It changes the products rate instead of changing the tax and grand total. Any one faced similar issue?

No. I'm a photographer by trade and the majority of the time sales tax is calculated exclusively. Occasionally however, I have a project arise that needs sales tax to be calculated inclusively.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Do I change tax status "Tax Inclusive/Tax Exclusive" of PO, It changes the products rate instead of changing the tax and grand total. Any one faced similar issue?

Nice to have you in the Community space, @omingollc. I'll make sure you can find the option to change the tax rates in QuickBooks Online (QBO).

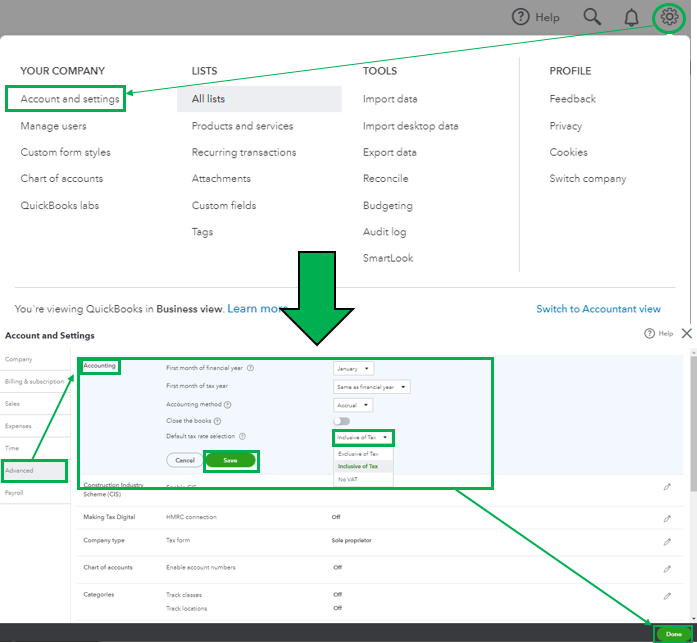

Follow these steps to change the default tax rate in QBO:

- Click the Gear icon in the upper-right corner and select Account and Settings.

- Choose the Advanced tab and go to the Accounting section.

- Choose Inclusive of Tax in the Default tax rate selection field.

- Select Save and Done.

I'm including a screenshot below for visual reference:

I've included a few resources about sales taxes that will come in handy moving forward:

Hit the Reply button below if you need anything else besides changing the sales tax rates in QBO. I’ll be more than happy to help. Take care and have a wonderful day!

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Do I change tax status "Tax Inclusive/Tax Exclusive" of PO, It changes the products rate instead of changing the tax and grand total. Any one faced similar issue?

Hi Kevin,

Thank you so much for your reply. I continue to have two issues. The first is that the default tax rate selection shown in the screen shot your provided doesn't appear in my accounting menu. (screen shot attached)

Second, I don't want this to change as an account default, I only want to change one invoice.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Do I change tax status "Tax Inclusive/Tax Exclusive" of PO, It changes the products rate instead of changing the tax and grand total. Any one faced similar issue?

Thanks for the prompt response, @omingollc. Let me clarify things for your concern about being unable to see the tax rate selection in your QuickBooks Online (QBO) account.

The option to change the tax rates in QBO Simple Start and Essentials subscriptions is unavailable. It's exclusive to the QBO Plus subscription.

Moreover, if you have the option to change the default tax rate, you can still return it to exclusive of tax after you've created that one invoice.

I'm also providing an article to learn more about how you can customize your invoices, estimates, and sales receipts: Customise invoices, estimates, and sales receipts in QuickBooks Online.

If you have more questions about changing the tax rates in QBO, you can always tag me or post a new question in the Community. Have a good one!

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Do I change tax status "Tax Inclusive/Tax Exclusive" of PO, It changes the products rate instead of changing the tax and grand total. Any one faced similar issue?

So I have to pay $80 a month for this extremely basic feature? Yay that's amazing.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Do I change tax status "Tax Inclusive/Tax Exclusive" of PO, It changes the products rate instead of changing the tax and grand total. Any one faced similar issue?

Hello,

I have a related problem.

My default VAT is set to inclusive in 'settings'.

I have also set VAT to inclusive when assigning VAT to each purchase transaction.

However, each transaction is showing up in the P&L and the B/S as exclusive of VAT.

This means that all my accounts are wrong: the total is exclusive of VAT, so it's 23% less than it should be.

Do you have any suggestions?

4 of your colleagues have responded to my query about this today, and none of them knew the answer.

Thanks.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Do I change tax status "Tax Inclusive/Tax Exclusive" of PO, It changes the products rate instead of changing the tax and grand total. Any one faced similar issue?

I appreciate you for joining this thread, Zac.

Please know that I understand the urgency of this matter, and I want to ensure you can get through this situation. I suggest contacting our Customer Care Team since they're the only ones who can access your account in a secure environment and investigate to determine why this occurs in your QuickBooks Online (QBO) account. To get you going, here's how:

- Sign in to your QuickBooks Online company.

- Select Help (?).

- In QB Assistant, enter the topic you need help with. You can also enter questions.

- Select Contact Us to connect with a live support agent.

- Choose a way to connect with us:

- Start a chat with a support expert. Live chat all day, M-F.

- Call us. M-F, 8:00 AM to 10:00 PM and S-S, 8:00 AM to 6:00 PM.

For more details, please see this article: QuickBooks Online Support.

In addition, here's an article that you can check if you want to edit tax rates inside QBO: Edit sales tax rate in QuickBooks Online.

Feel free to let me know how it goes, Zac. I've got you covered, and I'll gladly help you out again. Stay safe, and have a nice day!

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Do I change tax status "Tax Inclusive/Tax Exclusive" of PO, It changes the products rate instead of changing the tax and grand total. Any one faced similar issue?

@Kurt_M- the gaslighting is strong with you!!

1. You say that you appreciate the urgency of the request, so (a) don't answer it; and also (b) say to ask someone else and (c) wait until monday to ask those people.

2. You already send me that b/s text earlier.

0 Cheers

Recommendations

Featured

Ready to get started with QuickBooks Online? This walkthrough guides you

th...