Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

My FRS VAT % has reduced from 12.5% to 4.5% from 15/07/2020. My quarterly VAT100 is from 01/05/2020 to 31/07/2020. If change the VAT % to 4.5% in the setting, will the whole quarter turnover VAT tax be charged by 4.5%? Need help.

Solved! Go to Solution.

Hello @CoastersCoffee,

Thank you for posting here in the Community. I can share some details about how to handle changes with the flat rates in QuickBooks.

Currently, the investigation regarding the flat rate is still ongoing. For now, you can follow the workaround confirmed by HMRC.

For hospitality reduction (between 15/7/20 and 15/1/21), you can reduce the rate for the VAT period that 1/8/20 falls in and increase it for the period that 1/2/21 falls in. Effectively deferring the start and end of the reduction by half a month.

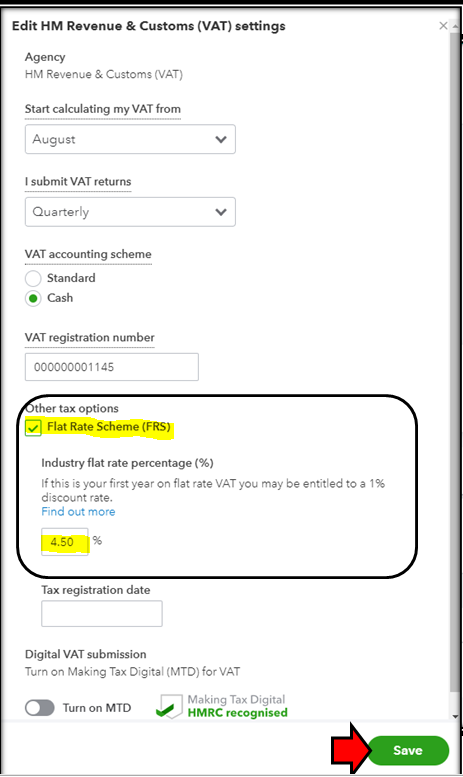

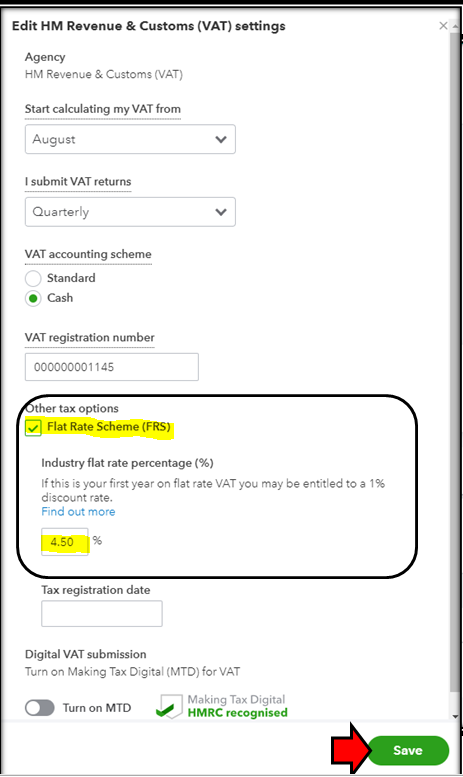

To change the rate:

Our team has not declared a specific time-frame yet for the complete fix. They are still working on it and conducting a further investigation because of the changes to the flat rates.

But rest assured, we take cases like this with urgency and high regard. Also, I recommend contacting support to be part of the notification list.

This way, you'll be able to get updates about it via email. To contact them, you can follow these steps:

You can also check the articles for more details about the flat rate scheme in QuickBooks: UK Flat Rate Scheme: How does it work?.

Please know that I'm just a post away if you have any other questions. Take care.

Thanks for your interest about how the VAT system in QBO works for updated FRS rates, UK190501,

That's correct. When you update the FRS rate in the VAT Settings, the new percentage will apply when you submit the return. This is because the system only uses one FRS rate at a time. See this:

If you are required to file a return using the two FRS rates, I would recommend contacting HMRC to get further help with this. They can provide a proper advise on how to record and file your return with the correct rates applied.

If they allow manually filing from their website, you can just manually mark the return as filed after. You will see this option when you click the drop-down beside Submit ti HMRC.

For your reference with VAT processing in QBO, check our Resource page through this link: VAT for QBO United Kingdom

Let me know if you have additional questions or clarifications. I'll be right here to help whenever you needed it. Have a lovely day!

Thanks for suggestion. I trust it is not just my problem whom using QBO to submit the FRS VAT 100 Reports. Due to COVID-19, FRS rates has been reduced for some type of business, e.g. catering services including restaurant & takeaway reduce from 12.5% to 4.5% for period from 15/07/2020 to 12/01/2021. Because my client has already signed up for MTD for VAT of which must use commercial software to submit and cannot use VAT online to submit. I believe it is the responsibility of QB as a software provider to solve the changes instead of the end users asking help directly from HMRC.

Thank you for the feedback about the VAT set up, UK190501.

I'll take note of your concern and pass it along to our Product Team. We stay compliant with the Government's regulations when it comes to paying taxes and filing returns.

For now, you can follow the information provided by my colleague above. This is to ensure you have accurate VAT records on your books.

I've added this page to keep you updated with what's new and coming in QuickBooks Online: Firm of the Future Team.

Don't hesitate to post again if there's anything else you need. The Community is always here to answer your concerns.

Thanks for your advice to follow your colleague's suggestion. However, I'll not do this because the whole quarterly ended 31/07/2020 VAT 100 Report will be calculated at 4.5%. This is not correct because the Tax Liabilities will be understated for the period before 15/07/2020. I trust your Product Team may find a solution to allow two rates at the same quarterly/monthly FRS VAT 100 Report. Let's think more about: how to handle the change back to normal rate after the first year 1% reduce benefit of a new FRS register? Hope to have your solution very soon because my client's quarterly ended 31/07/2020 VAT 100 Report will be due to submit by 07/09/2020.

Hi,

I am now in the same situation - has the QB team come up with a solution yet?

Hello @CoastersCoffee,

Thank you for posting here in the Community. I can share some details about how to handle changes with the flat rates in QuickBooks.

Currently, the investigation regarding the flat rate is still ongoing. For now, you can follow the workaround confirmed by HMRC.

For hospitality reduction (between 15/7/20 and 15/1/21), you can reduce the rate for the VAT period that 1/8/20 falls in and increase it for the period that 1/2/21 falls in. Effectively deferring the start and end of the reduction by half a month.

To change the rate:

Our team has not declared a specific time-frame yet for the complete fix. They are still working on it and conducting a further investigation because of the changes to the flat rates.

But rest assured, we take cases like this with urgency and high regard. Also, I recommend contacting support to be part of the notification list.

This way, you'll be able to get updates about it via email. To contact them, you can follow these steps:

You can also check the articles for more details about the flat rate scheme in QuickBooks: UK Flat Rate Scheme: How does it work?.

Please know that I'm just a post away if you have any other questions. Take care.

The deferring may only worked for quarter ended 31/07/2020. I think the deferring may not worked for quarters ended 31/08/2020 and 30/09/2020 because the deferred period is too long. Please refer to the suggested posts in Intuit Quickbooks UK users group @ FB (started from 7 Aug).

Thanks, My period ends 30/9/20 - so I guess the work around above is of no use ?

Hello CoastersCoffee,

Thanks for commenting back on this thread,

Yes you will be able to use the workaround as it says the period that 1/8/20 falls in and not that it starts on 1/8/20. so your period of 30-9-20 you can do the workaround for.

Great thanks.

How would the workaround work now the VAT reduction period has been extended to the 31st March 2021?

Hello there, CoastersCoffee,

Thank you for the information. I'll be sure to inform our product engineers about this.

HMRC have previously confirmed they're good with the workaround. You can use that for now while waiting for the confirmation with the extension.

I'll be sure to update this thread once confirmed. I'll be here if you have other questions.

Hi

Could someone explain why the 4.5% rather than inputting 5%?

Hello Debs7,

Thanks for posting on this thread, you would need to speak to HMRC themselves and ask them why it is 4.5% rather than inputting it as 5%

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.