- UK QuickBooks Community

- :

- QuickBooks Q & A

- :

- VAT

- :

- Re: I am filing my first VAT return. I have VAT expense receipts that I can claim back from 4 years ago, How do I add this into QB and/or box 4 on the VAT return?Cheers Neil

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

I am filing my first VAT return. I have VAT expense receipts that I can claim back from 4 years ago, How do I add this into QB and/or box 4 on the VAT return? Cheers Neil

Solved! Go to Solution.

Labels:

0 Cheers

Best answer November 11, 2022

Solved

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

I am filing my first VAT return. I have VAT expense receipts that I can claim back from 4 years ago, How do I add this into QB and/or box 4 on the VAT return? Cheers Neil

Hello Community Users! We just wanted to clarify when it is the first ever filing in Quickbooks and you are looking to backdate expense receipts for dates prior to that return we'd recommend that you do an adjustment on the VAT return itself. To do this you prepare the return and click on the box you want to adjust and adjust the amount. We'd always recommend speaking with an accountant as a sounding board on this.

The alternative would be filing the 1st return as normal and waiting on the next return and creating transactions for the expenses with the original dates on them which will create an exception for the amount on the current return. Any questions just ask

0 Cheers

4 REPLIES 4

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

I am filing my first VAT return. I have VAT expense receipts that I can claim back from 4 years ago, How do I add this into QB and/or box 4 on the VAT return? Cheers Neil

Hello NeilC1,

You can either make an adjustment on your open return and note in the memo box that this includes your expenses from previous years (by selecting prepare return and 'adjust' next to the relevant boxes), or you can make a 0 filing going back the 4 years. Once you have created this 0 return and marked as filed, you can then enter the expense transactions dating them within this 4 year period which will create exceptions for these transactions in your open period.

To create this 0 filing, set up your VAT and select prepare return on the open period. Once in this screen, change the start date to 4 years previous and the end date to the end of the month before your current return starts. Select the drop down arrow next to submit to HMRC and select Mark as filed.

Please let us know if you have any further questions.

Thanks,

Talia

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

I am filing my first VAT return. I have VAT expense receipts that I can claim back from 4 years ago, How do I add this into QB and/or box 4 on the VAT return? Cheers Neil

I am in a similar situation and using QBO. Your first example is easy to follow if you only have a few expense transactions. I can’t see how to “create a 0 filing” so don’t understand your second method. However in my case I have quite a lot of setup expenses all incurred during the 3 months before we started trading on 1 January 2022, all entered correctly in QB. If I change the VAT period in QB to six months it gives me the figures I want for entering our first VAT return at end of March. Will HMRC accept a six month return like this as a one-off? Do I have to change our VAT reporting period to six months with HMRC? If I change it can I then change it back to 3 months after submitting the first VAT return?

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

I am filing my first VAT return. I have VAT expense receipts that I can claim back from 4 years ago, How do I add this into QB and/or box 4 on the VAT return? Cheers Neil

I appreciate the additional information you've added, J1801.

Base on your describe situation, it would be best to reach out to our QuickBooks Support. This issue requires a deeper investigation which our chat support can look into. They can guide you through the whole process of handling VAT expense receipts that was claimed 4 years ago.

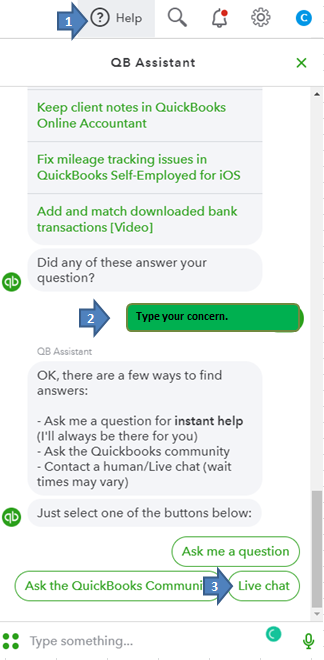

The instructions are outlined below:

- Go to the Help menu at the upper right.

- Type in your concern.

- Choose Live chat.

You can check out this article for our most updated contact information: Support hours and types.

For your reference with VAT processing in QBO, check our Resource page through this link: VAT for QBO United Kingdom.

Visit us again if you need help or other questions. It will be my pleasure to help. Stay safe and have a nice day.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

I am filing my first VAT return. I have VAT expense receipts that I can claim back from 4 years ago, How do I add this into QB and/or box 4 on the VAT return? Cheers Neil

Hello Community Users! We just wanted to clarify when it is the first ever filing in Quickbooks and you are looking to backdate expense receipts for dates prior to that return we'd recommend that you do an adjustment on the VAT return itself. To do this you prepare the return and click on the box you want to adjust and adjust the amount. We'd always recommend speaking with an accountant as a sounding board on this.

The alternative would be filing the 1st return as normal and waiting on the next return and creating transactions for the expenses with the original dates on them which will create an exception for the amount on the current return. Any questions just ask

0 Cheers

Recommendations

Featured

Ready to get started with QuickBooks Online? This walkthrough guides you

th...