Hello, griffinJG.

I'll walk you through the steps to change the reconciled payment to a VAT payment for the second quarter.

First, manually unreconciled the payment transaction that is listed as an expense. Then, delete the transaction and record it as a VAT payment for Q2. I'll show you how.

- Sign in to your QuickBooks Online (QBO) account.

- Go to the Accounting menu. Then select Chart of Accounts.

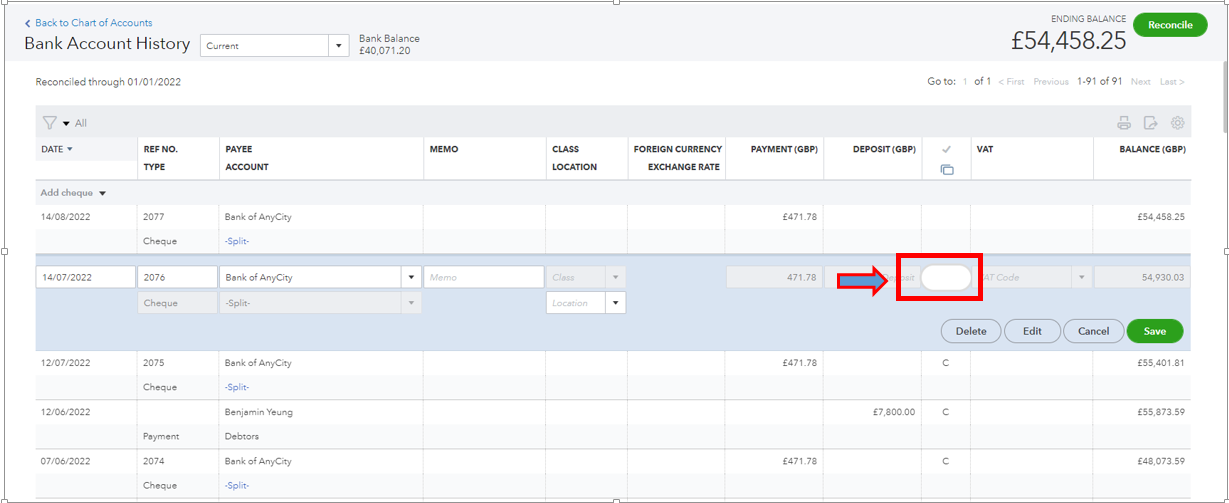

- Locate the account and Click Account history.

- Select the payment transaction you want to unreconciled.

- Review the check column. If the transaction is reconciled, you’ll see an “R.”

- Click the box shown on the image until it's blank. This removes the transaction from the reconciliation.

- Once done, hit Save.

- After that delete the payment transaction by selecting the Delete button.

Now, you can record the VAT payment for the second quarter.

Here's how:

- Go to Taxes and click VAT.

- Find the return you just filed, then select Record payment.

- Add these payment details:

- Bank account

- Payment type

- Payment date

- Payment amount

- Memo (optional)

- Once done, hit Save.

Return to your bank register and manually reconcile the transactions using the steps outlined above until you see an R.

For your reference, you can read this article for more insights: Undo or remove transactions from reconciliations in QuickBooks Online.

I've added this resource to help you if you want to adjust the VAT for future use: Create or delete a VAT adjustment.

Don't hesitate to post again if you need further about VAT. We're always here to help you.