Let me share some insights and clarify your confusion about QuickBooks adding VAT on your invoices, @gkgardner58.

QuickBooks is a versatile accounting software that caters to various business needs, including VAT management. By default, QuickBooks assumes that businesses are VAT-registered, as this is a common requirement for many companies. However, we understand that not all businesses are VAT-registered, which can lead to confusion.

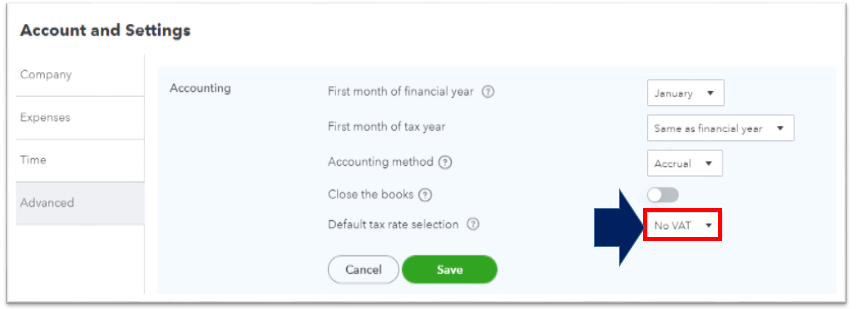

To address this, ensure that your QuickBooks settings are configured correctly. Change your default tax selection to 'No VAT'. By doing so, you can prevent QuickBooks from adding VAT to your invoices. I'll guide you on how:

- Go to the Gear icon.

- Select Account and Settings.

- In the Advanced tab, look for Accounting and select the pencil icon.

- Change the default tax selection to No VAT.

- Select Save and then Done.

I've added this resource for future reference in case you want to personalise and add specific info to your sales forms: Customise invoices, estimates, and sales receipts in QuickBooks Online.

Keep us posted if you have other questions about managing invoices. We'll be here to further assist.