Let's ensure to accurately record the payment and maintain clear financial records in QuickBooks Online (QBO), Ccelec.

When your customer gives you a partial payment you want to make sure to record that payment in the following way.

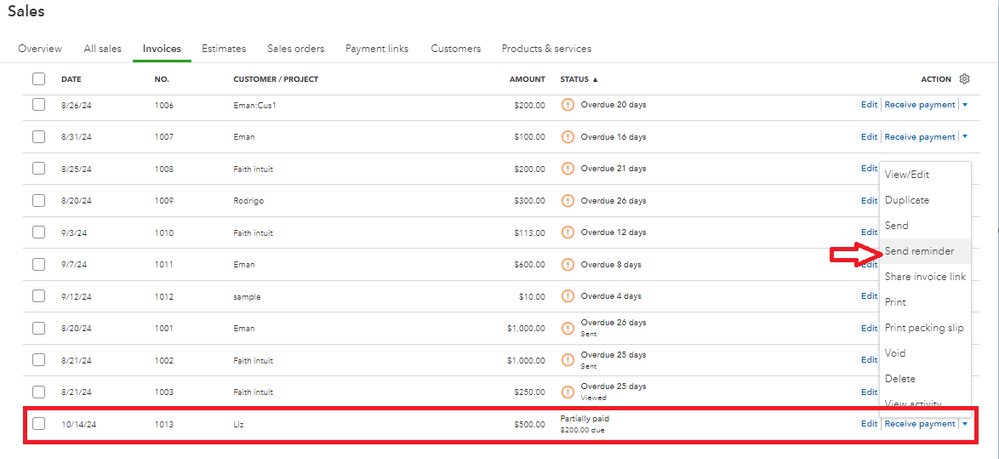

- Go to the Sales menu and select the Invoices tab.

- Find the invoice you sent to your customer.

- Click on the Receive Payment from the Action column. This will allow you to apply a payment against the invoice.

- Enter the payment details.

- Once done, click Save and Close to record the payment.

The invoice will remain partially paid until you apply the rest of the payment. You can consider sending a reminder to your customer about the outstanding balance.

I've added a screenshot for your reference.

To get in-depth information about invoice payment, refer to this article: Record customer payment in QuickBooks Online.

Please don't hesitate to hit the Reply button if you need further assistance managing your invoices and receiving payments in QBO. I'll be right here to help you thoroughly. Take care and have a good one.