Welcome and thanks for being part of the QuickBooks family, MakLow.

Creating an expense and posting it to the VAT Suspense account can help track the tax payment in your account.

The process can easily be done. I'm here to walk you through the steps.

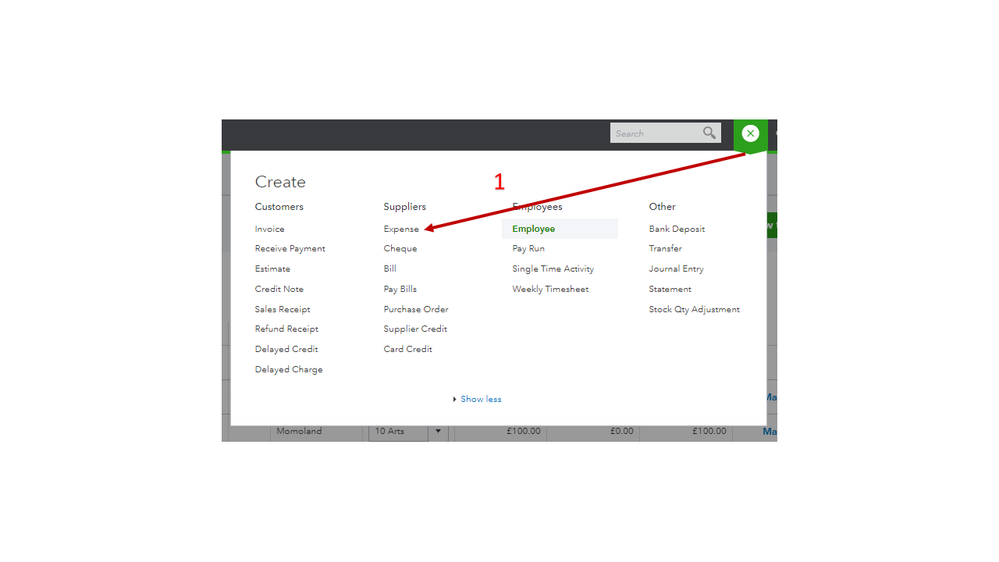

- Sign in first to your company and go to the Plus icon at the top to see the Expenses tab.

- Select it to open the Expense page.

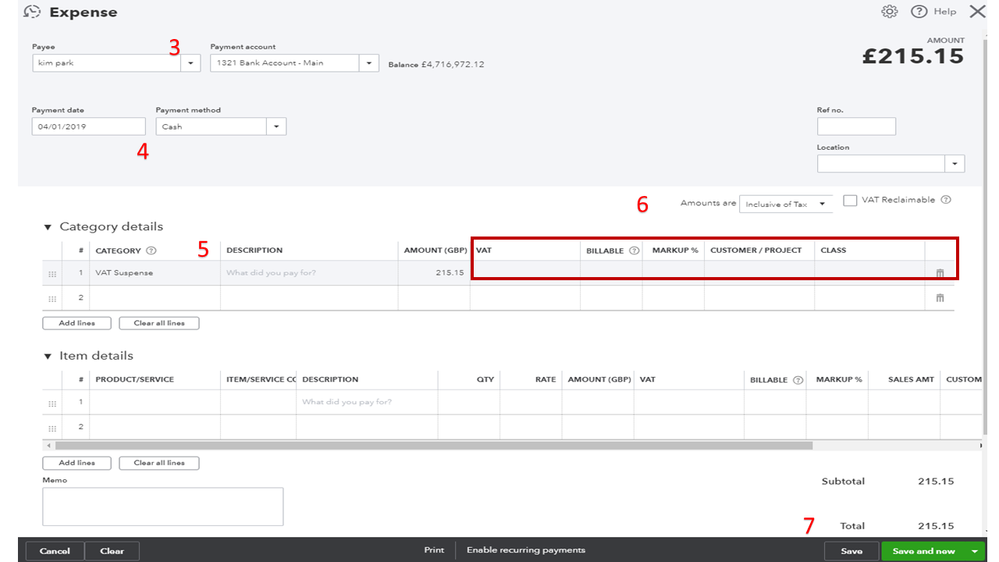

- Pick the payee by clicking the drop-down and choose where to post the payment by entering it in the Payment account field.

- Input the correct date in the Payment date field, then select the payment method.

- Under Category, choose the Vat Suspense account and enter the tax payment in the Amount field.

- Fill in the remaining fields.

- Click on Save.

With these steps, your April 2019 tax return is now recorded in QBO.

For additional resources, I'm adding a link where you can view our handy tutorials. It contains videos and articles that will show you how to set up the account.

Stay in touch if you have additional questions about QuickBooks. I’m always ready to help.