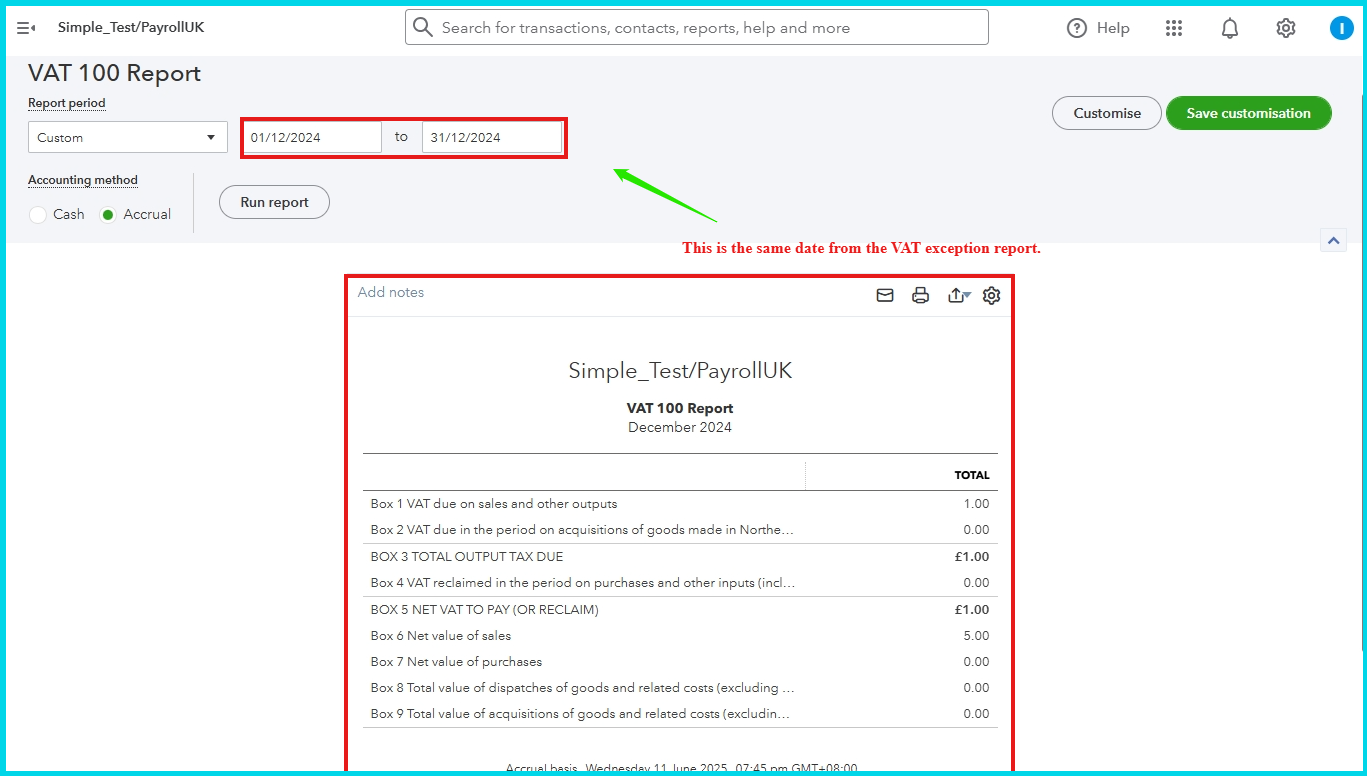

To view the exceptions in your VAT 100 report, please ensure that you have selected the correct date range when the adjustment was made, Mary.

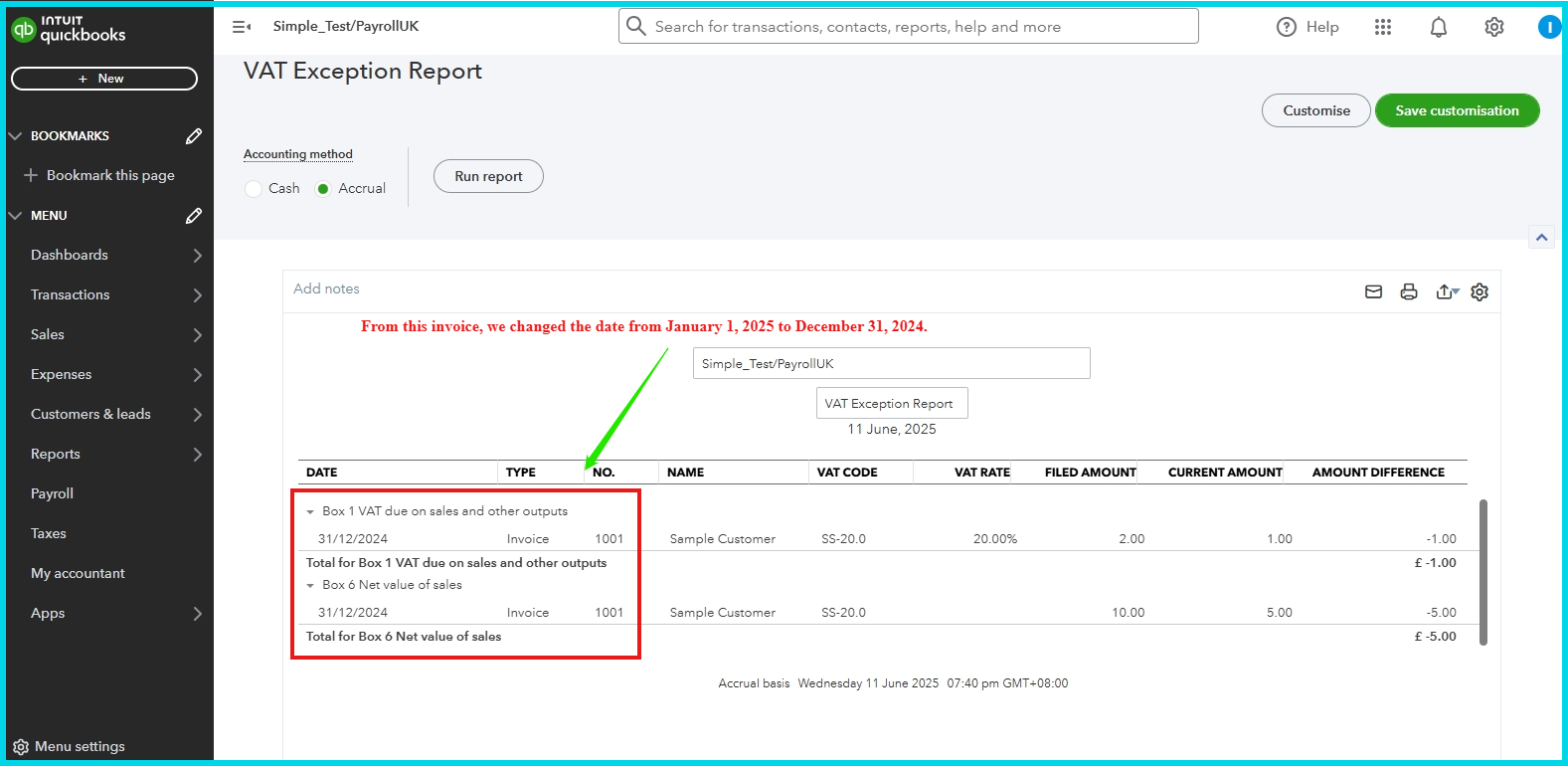

VAT exceptions will appear in your current VAT period, as these are the changes made after submitting the return to HMRC. To learn more about VAT exceptions, please check this article: Create and Manage VAT Exceptions in QuickBooks.

Below is a sample scenario for your reference:

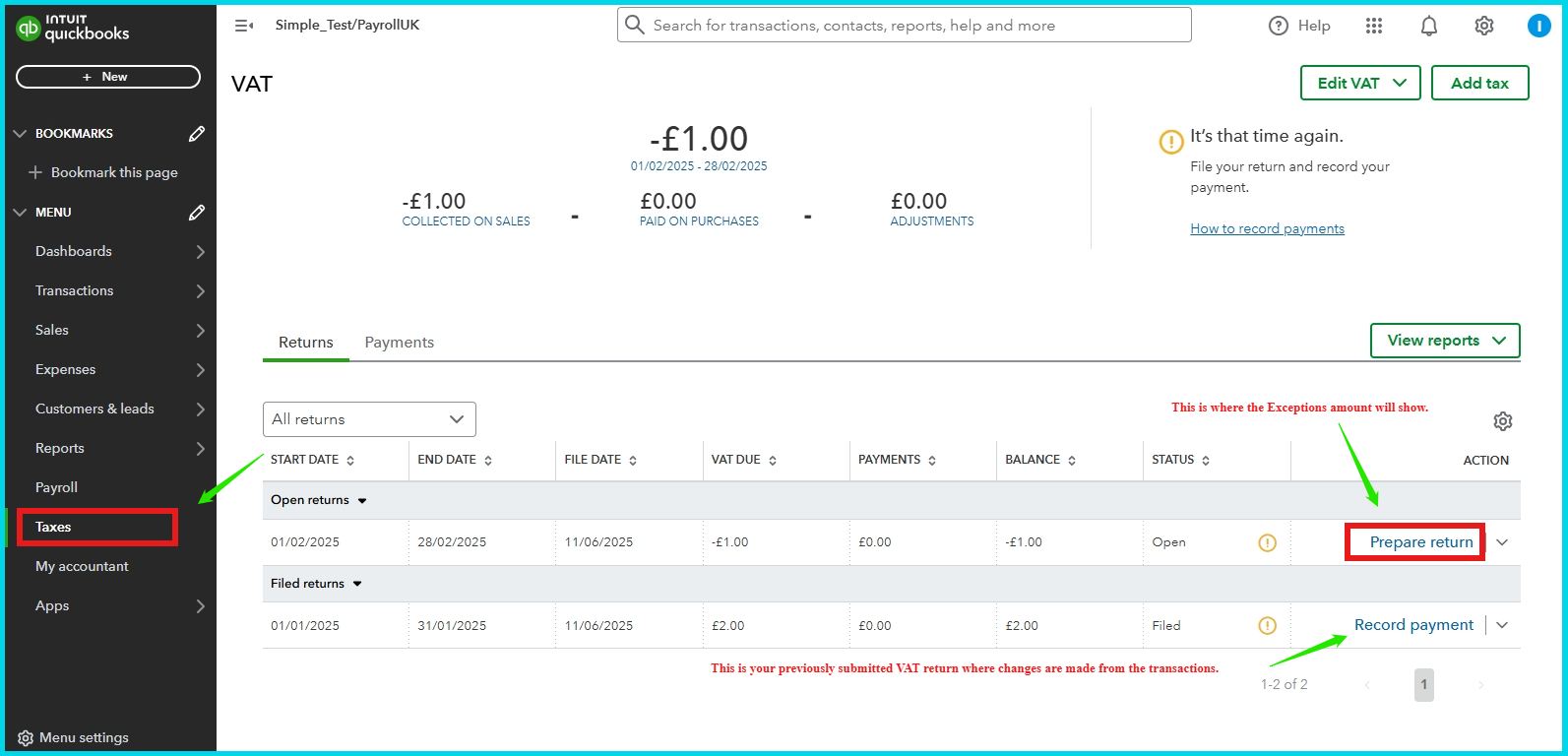

- Navigate to the Taxes menu.

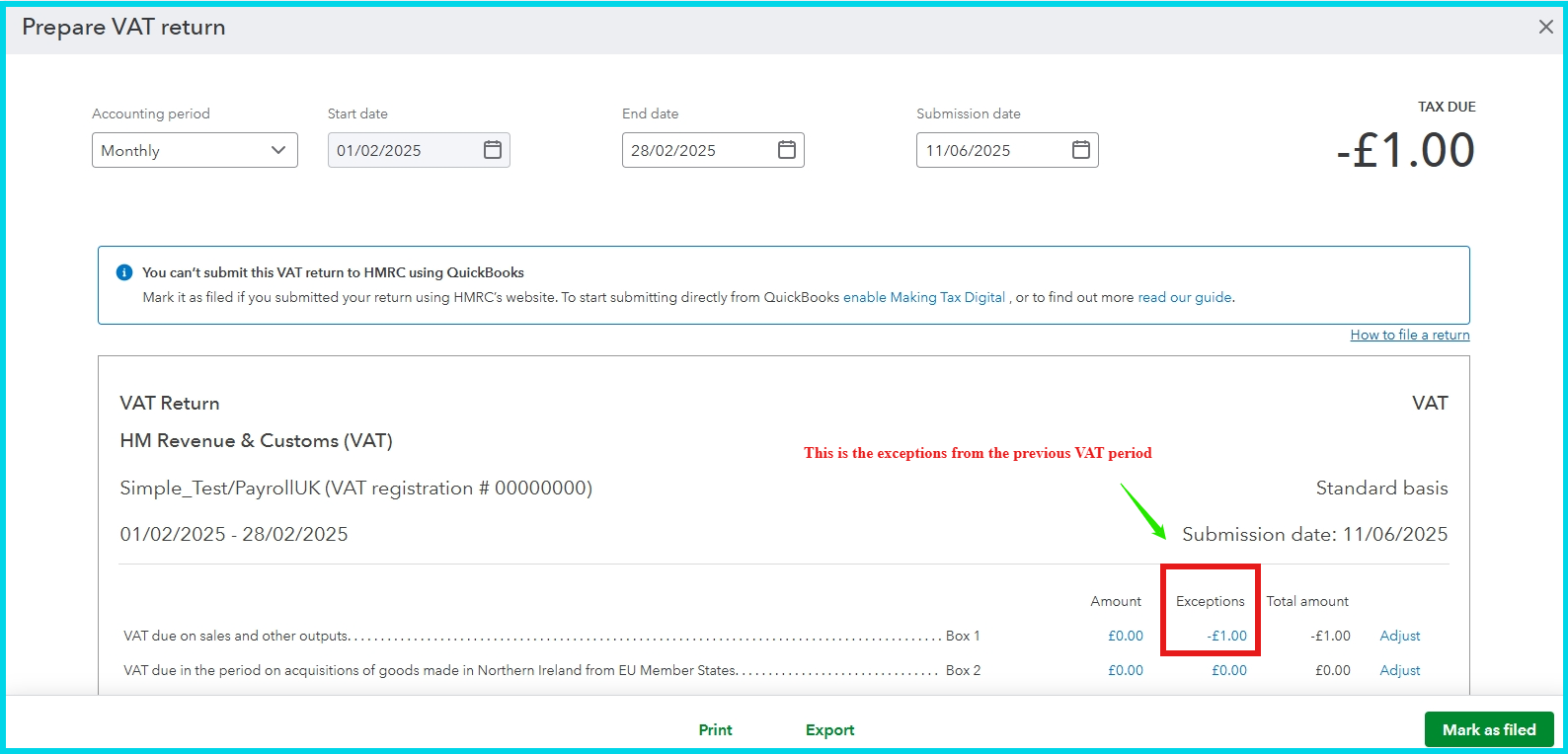

- Click on Prepare Return. Please note that this will be your current return.

- From there, you will see the Exceptions line. You can click on the hyperlinked amount to view the details.

- In VAT 100 report, filter the correct date range when you made the changes (exceptions).

If these changes affect your current VAT total, We recommend performing a VAT adjustment. Please note that this requires your accountant's advice.

Please know that the Community is always available to assist you with any of your QuickBooks concerns.