As a small business owner, you set an ultimate goal to turn a profit on your passion project. Offering a variety of payment options gives you more opportunity to boost your bottom line, while also giving your customers the flexibility to pay with the method that works best for them.

Customer credit is a popular payment option for both B2B and B2C transactions, but incorporating customer credit into your accounts receivable can be intimidating at first.

In this guide, we’ll define customer credit and its pros and cons, discuss credit policy options, identify how to mitigate risk with credit reports, and explain how your business can start offering customer credit if it makes sense to do so.

In this article, you will learn:

- What is customer credit?

- Why is customer credit important to businesses?

- Benefits of offering customer credit

- Risks of offering customer credit

- What is a credit policy?

- Why are credit policies important?

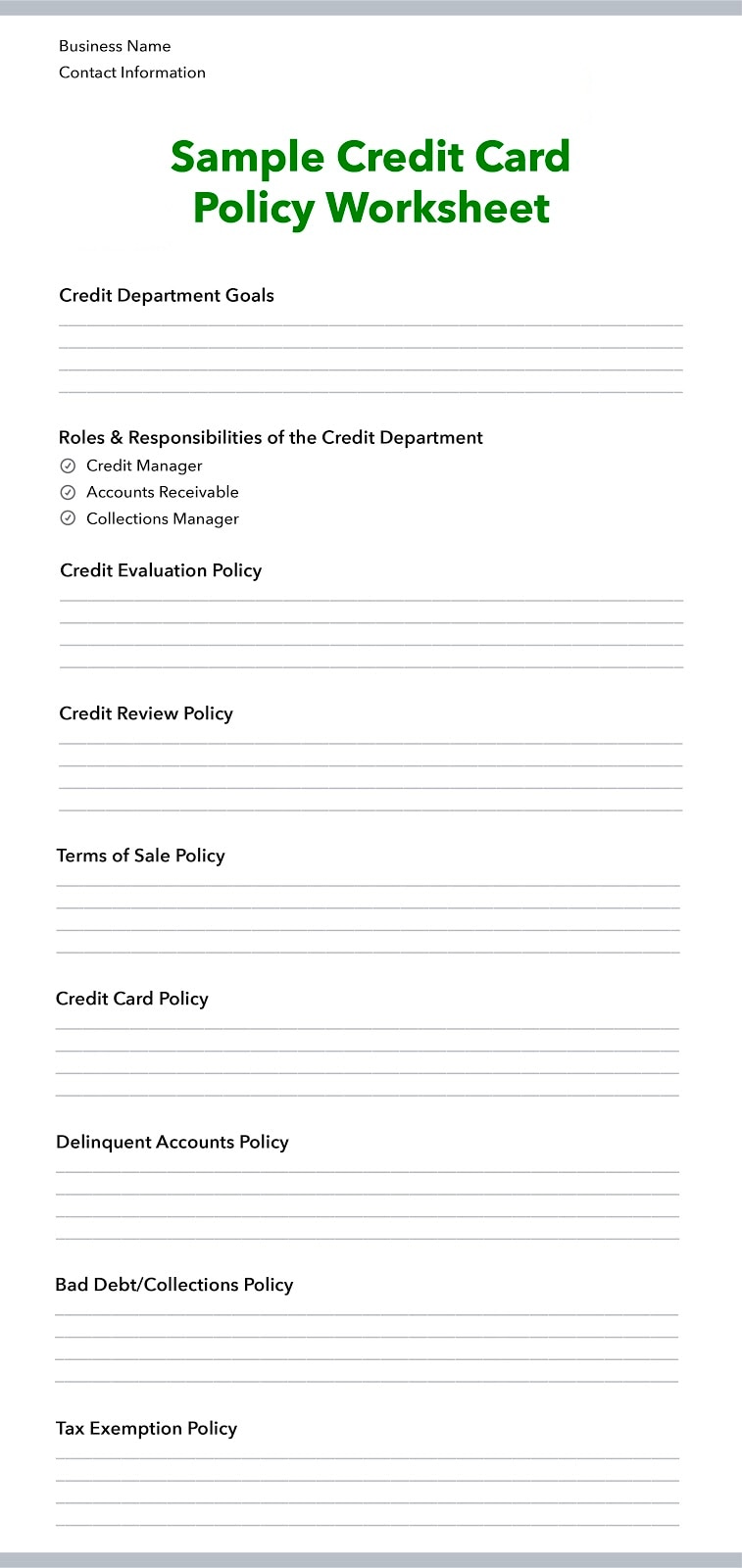

- Components of a credit policy

- Customer credit policy example

- Best practices for offering credit to you customers

- Accounting for customer credit