Tools to make running your business in South Africa easier

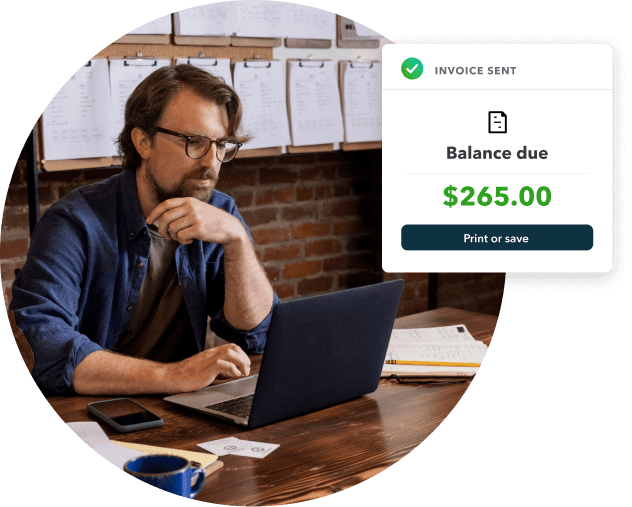

Create and send professional-looking invoices in seconds. Custom templates and automated reminders make getting paid even simpler.

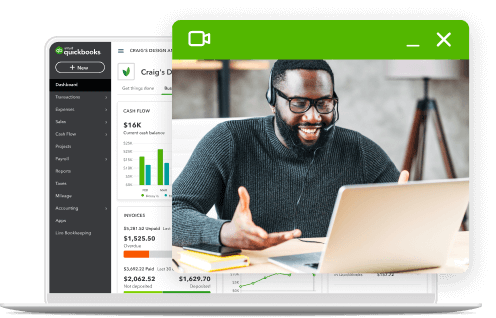

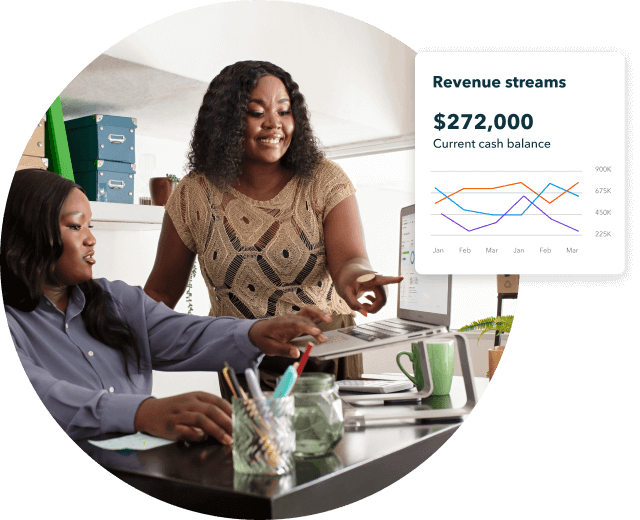

Make better and faster decisions with your financial data available in real-time. QuickBooks cloud accounting software gives you an up-to-date and accurate view of your cash flow with bank balances, transactions and financial reports instantly available.

Connect your bank to QuickBooks and set up bank feeds to save time and reduce errors. Your transactions will automatically and securely flow straight into QuickBooks.

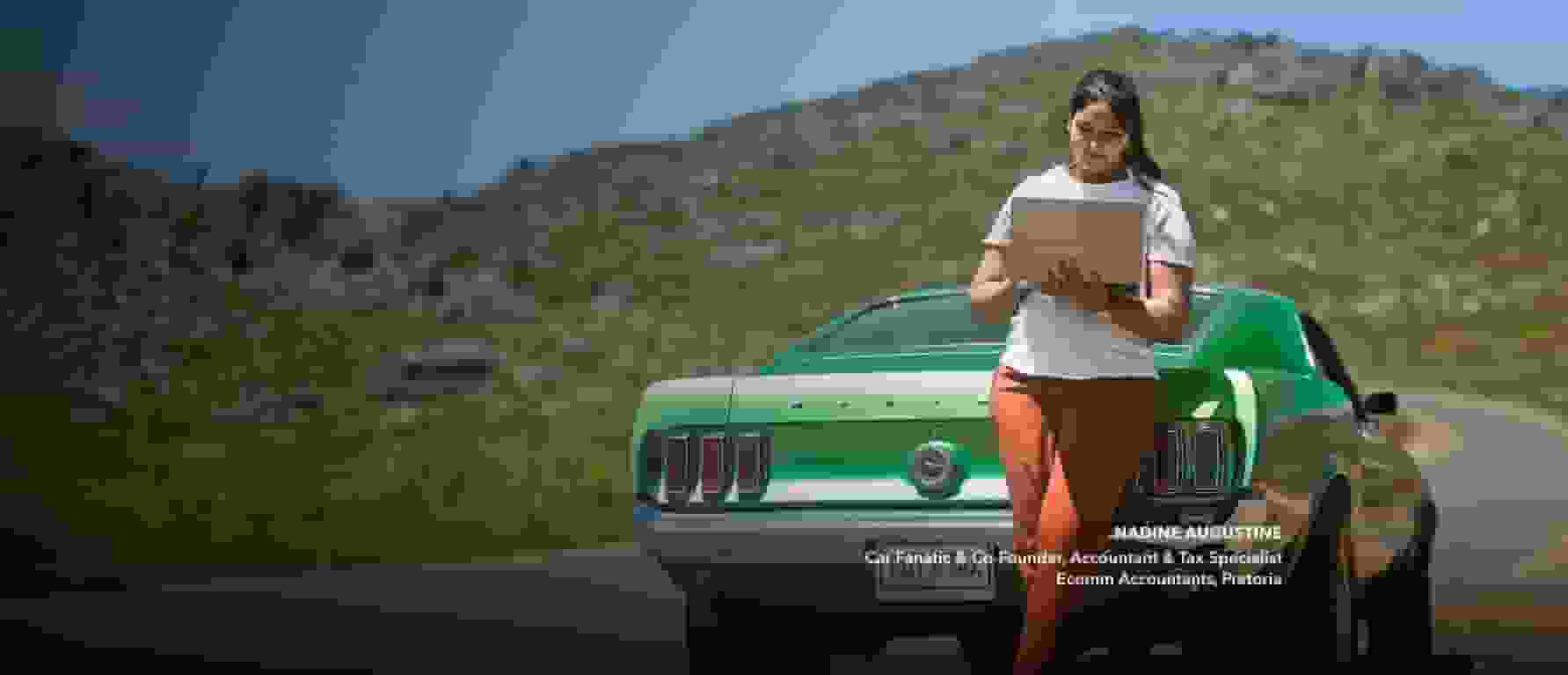

Run your business on the go. Access your business finances from any internet connected laptop, smartphone or tablet. Track sales, send invoices and see how your business is doing at any time from your office, home or even remotely.

Choose an affordable plan for your business

Features that help you run your business

Invoicing

Create professional custom invoices, send payment reminders, and match payments to invoices, automatically.

Bank Feeds

Save time and reduce errors when you connect your bank to get a full view of your finances.

VAT

Easily organise expenses into tax categories and track VAT on income and expenses, so you know where you stand and how much you owe.

Inventory

Stay on top of your orders and quantities while managing your inventory in real-time.

Capture & organize receipts

Use your phone to take photos of receipts. Match them to bills to stay organized and ready for tax season with everything in one place

Insights and reports

See how your business is doing, and how it could look in the next 90 days, with a range of popular reports and the cash flow planner.

Reviews that speak volumes

Discover what makes QuickBooks Online the #1 accounting software for small businesses.1

★★★★★

QuickBooks makes it easy to manage the finance operations of our business! We use QuickBooks daily to track expenses, revenue and to invoice our customers! It’s easy-to-use and allows us to easily collaborate with our bookkeeper!

★★★★★

I use QuickBooks on a daily basis for invoicing clients, bank reconciliation as well as looking at the various reports. I have customised the reports to show the time period and categories that are useful for our business.