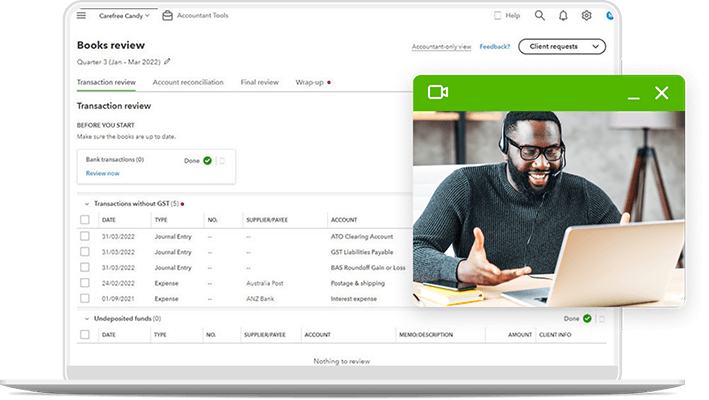

What is Books review?

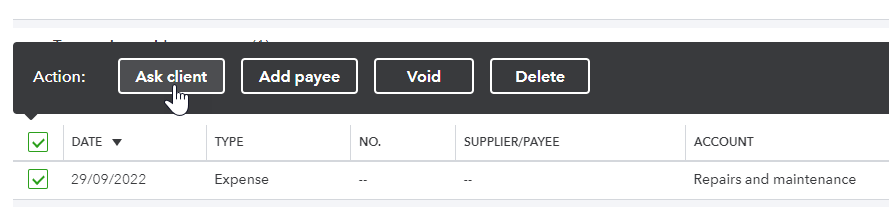

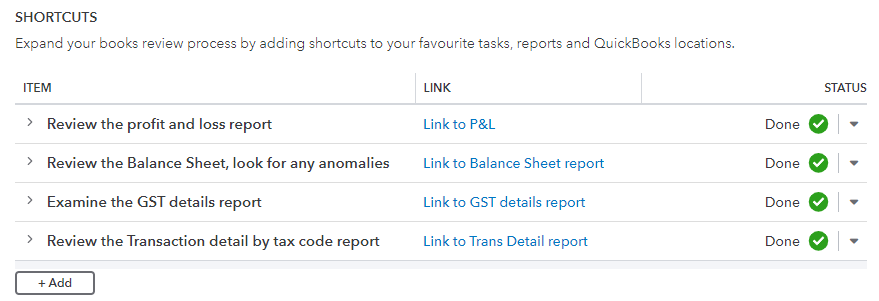

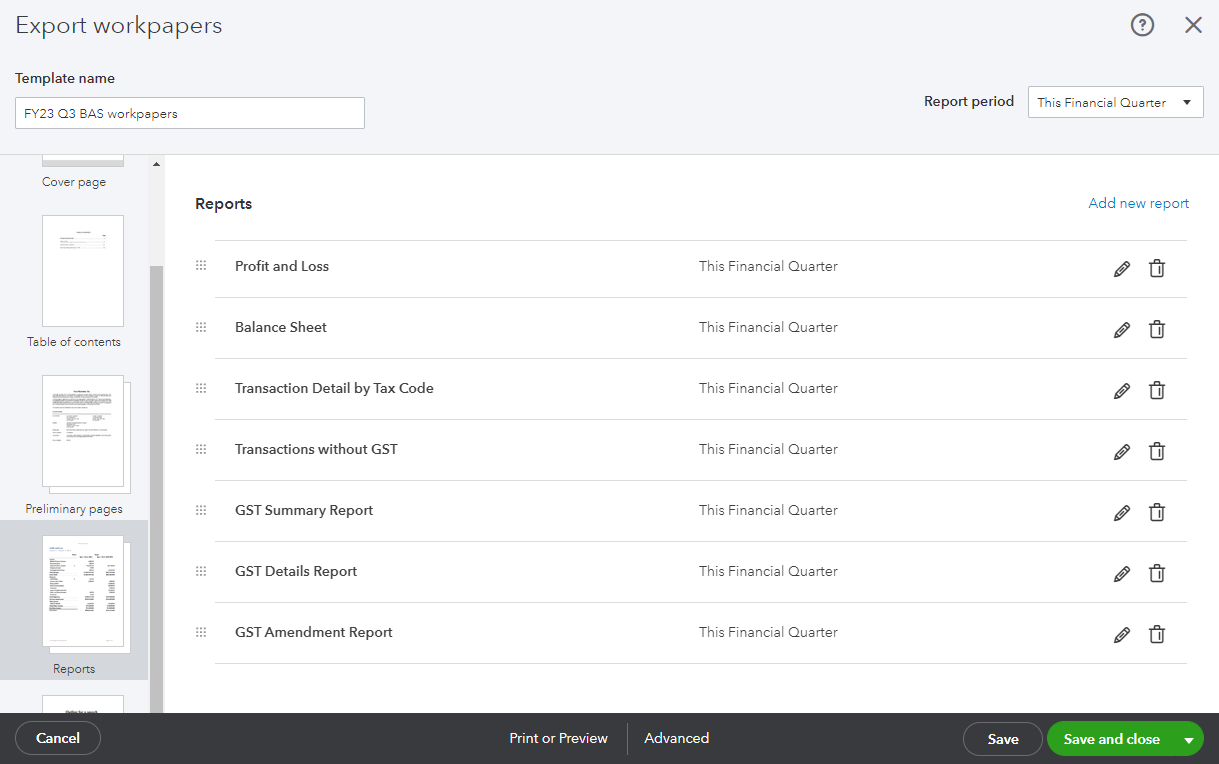

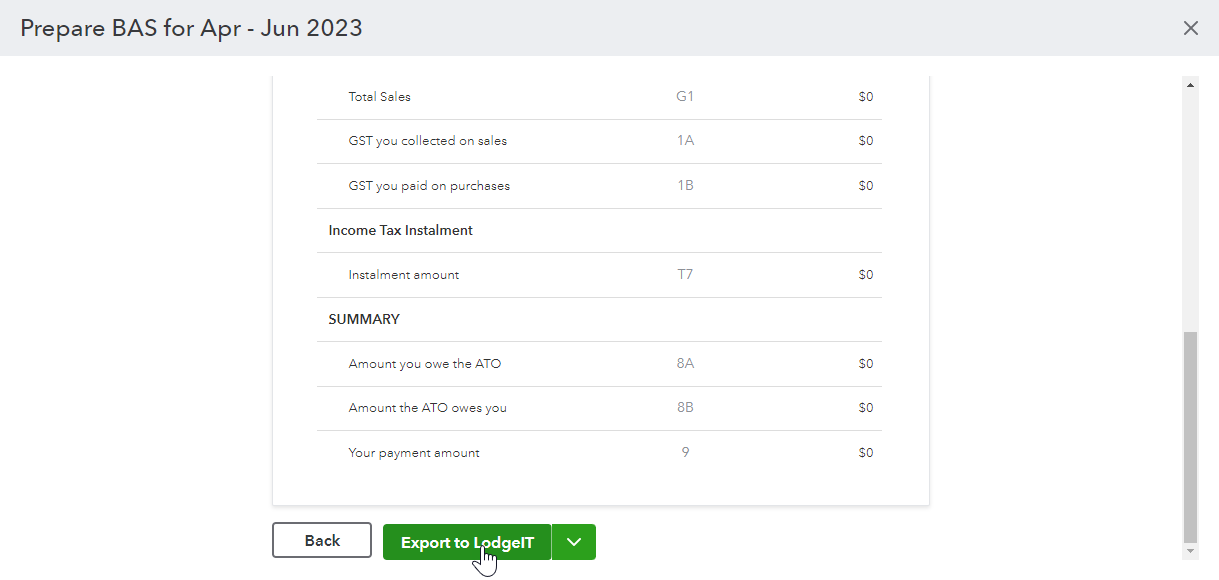

Books review is a tool within QuickBooks Online that’s designed to support accountants and bookkeeping streamline the BAS preparation and lodgement process. You can set up Books review to reflect your own processes, you can easily see where someone is up to in the BAS process, you can ask your clients queries and anomaly transactions are surfaced automatically for you. Let’s see how it works.

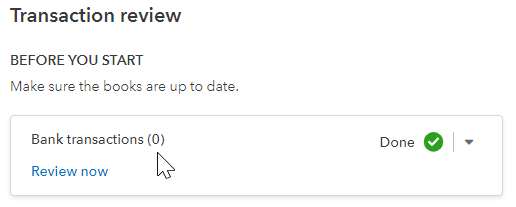

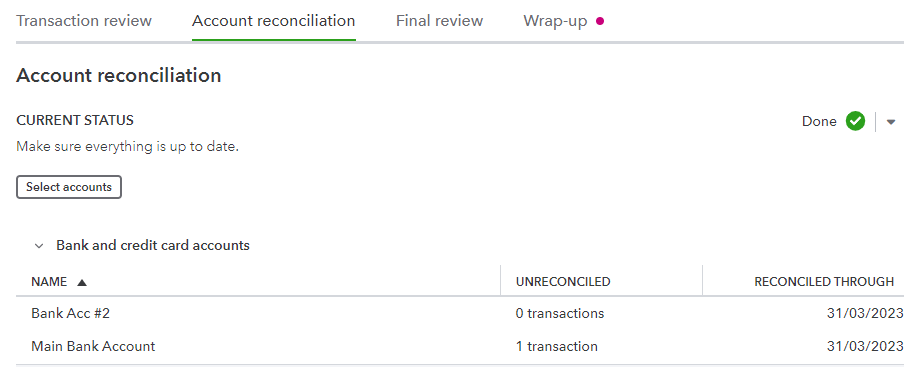

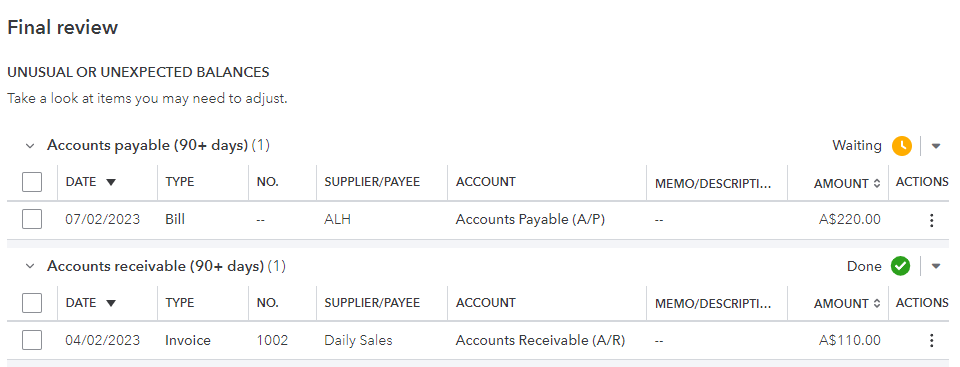

To access Books review, head into QuickBooks Online and select Books review from the left hand menu. From there, you’ll see four distinct steps to help you prepare and lodge a BAS - Transaction review, Bank Reconciliation, Final Review and Wrap Up.