3. See the future of your cash flow

We use your bank and QuickBooks activity to predict money-in and money-out up to 1 year ahead

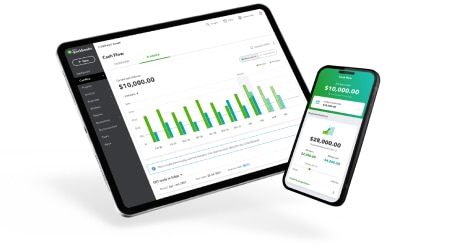

4. Check your cash flow on-the-go

Now available on the QuickBooks Online iOS app and coming soon to Android

How to use QuickBooks Cash Flow

QuickBooks cash flow has two main sections:

- Cash Flow Overview – Go to Cash Flow > Overview

- Cash flow planner – Go to Cash Flow > Planner

Cash Flow Overview

This page shows your money in and money out for this month. You can view your overall net position or click in the sections to dig deeper and take action towards proactively managing your cash flow, including:

- Following up overdue invoices with clients

- Invoicing for unbilled time

- Reviewing overdue bills

- Reviewing PAYG obligations

Cash Flow Planner

The Cash Flow planner is an interactive tool that forecasts your cash flow, the money going in and out of your business. It looks at your financial history from your bank feed to forecast future money in and money out events. You can also add and adjust future events to see how certain changes affect your cash flow.

Note: If you disconnect a bank account, the data won’t appear on the chart anymore

How to add events for possible money in or money out?

You can manually add events for potential income and expenses. For example, if you have a big sale coming up, add it as an event so it’s part of the forecast.

Important: Events aren’t actual transactions and won’t affect your finances in QuickBooks.

Select the Add Event button.

- Select Money in if the event is income, or Money out if it’s an expense.

- Give the event a name and enter an amount, then select Continue.

- Select the date when the event will occur.

- When you’re done, select Save.

To edit or delete an event:

- Select and open an event.

- Select the Date, Merchant Name, or Amount field, or change whether it’s Money in or Money out.

- When you’re done, select Save.

Login and select the ‘Cash Flow‘ left menu item to get started today

FAQs

What is a cash flow prediction?

A cash flow prediction is a forecast of how your cash flow will look in the weeks and months ahead. By analysing your scheduled income and outgoings, QuickBooks can indicate whether there’s any cause for concern about running out of cash up to 1 year in the future based on past numbers.

How can I improve my current cash flow situation?

Communication is the key. If you have bills coming up, get in touch with your suppliers and ask them if you can arrange a payment plan. If you have customers who haven’t yet paid, don’t be afraid to give them a polite nudge – you can even set automatic reminders for QuickBooks invoices. Depending on your situation, it could also be worthwhile offering customers a small discount for early payment. You might decide it’s worth taking that small hit to keep your money inflows in a healthy state and save yourself a few sleepless nights.

Why is a cash flow prediction important?

It gives you time to take the appropriate action. With a 1 year warning that you may be facing some issues, you may be able to cut some of your costs, look at alternative income streams, or even consider applying for a loan. If you rely on your current figures, you might not spot a problem before it’s too late.

When it comes to understanding my financial situation, how can QuickBooks help?

As a business owner, you may have one main bank account for your business, but it’s likely that you’ll also be using credit cards, and possibly supplementary accounts too. By connecting all of your bank accounts and credit cards to QuickBooks, you’ll be able to see your overall balance at a glance and have a better understanding of your cash position in real time.