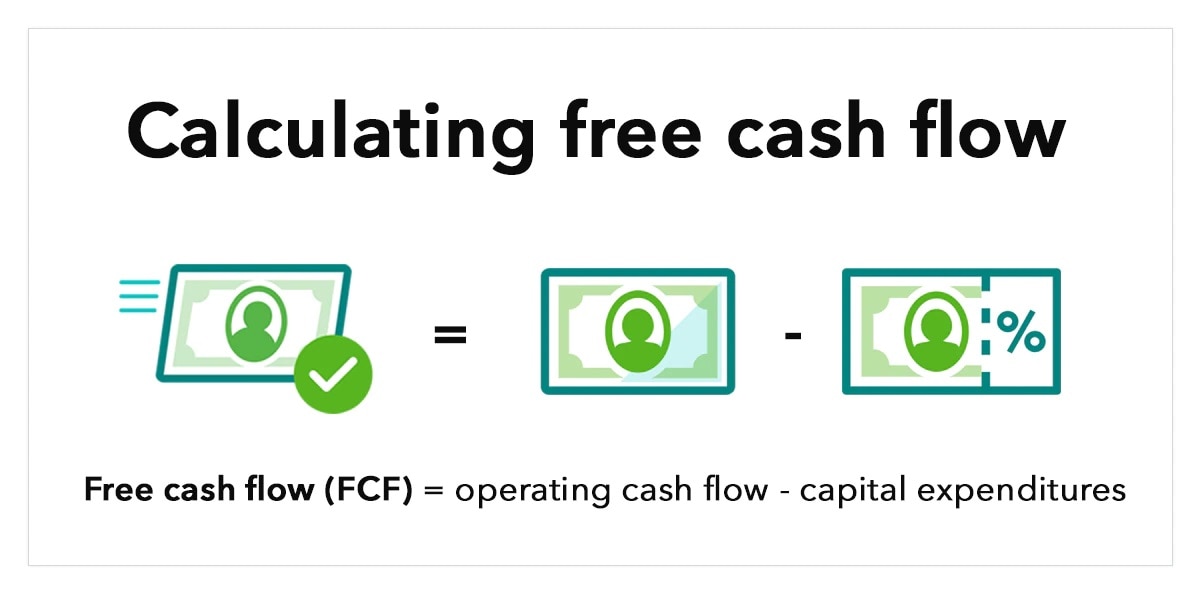

Free cash flow (FCF) is a metric business owners and investors use to measure a company’s financial health. FCF is the amount of cash a business has after paying for operating expenses and capital expenditures (CAPEX), and FCF reports how much discretionary cash a business has available. For investors, free cash flow is an indicator of a company’s profitability, which influences a company’s valuation.

- Below, we will explore the importance of free cash flow and what it reveals about a company’s financial performance. Keep reading for a comprehensive explanation of free cash flow or navigate directly to a section you’d like to learn more about.

- What is free cash flow?

- Why is free cash flow important?

- How free cash flow works

- When to use free cash flow analysis

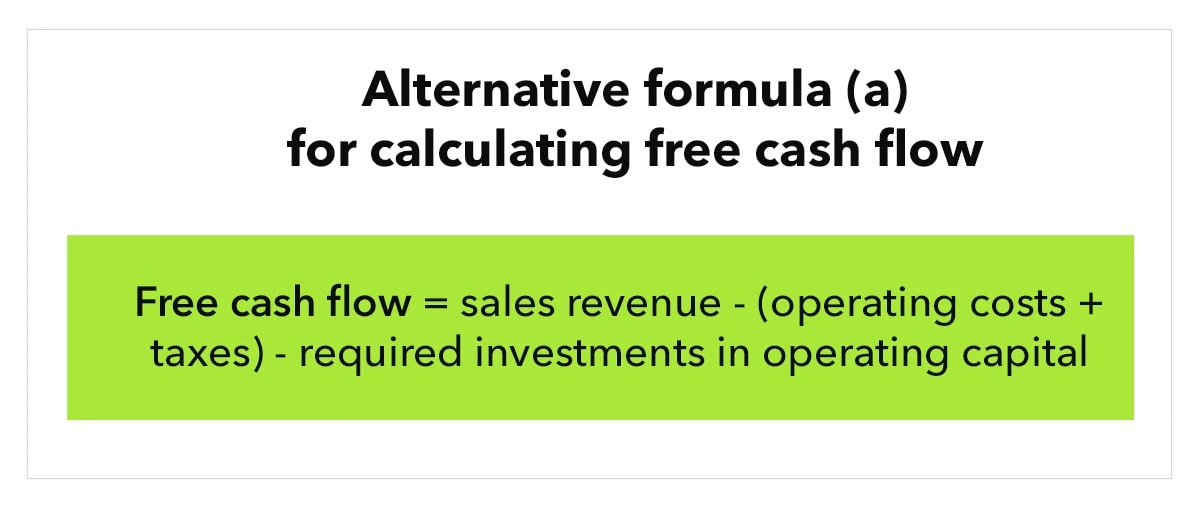

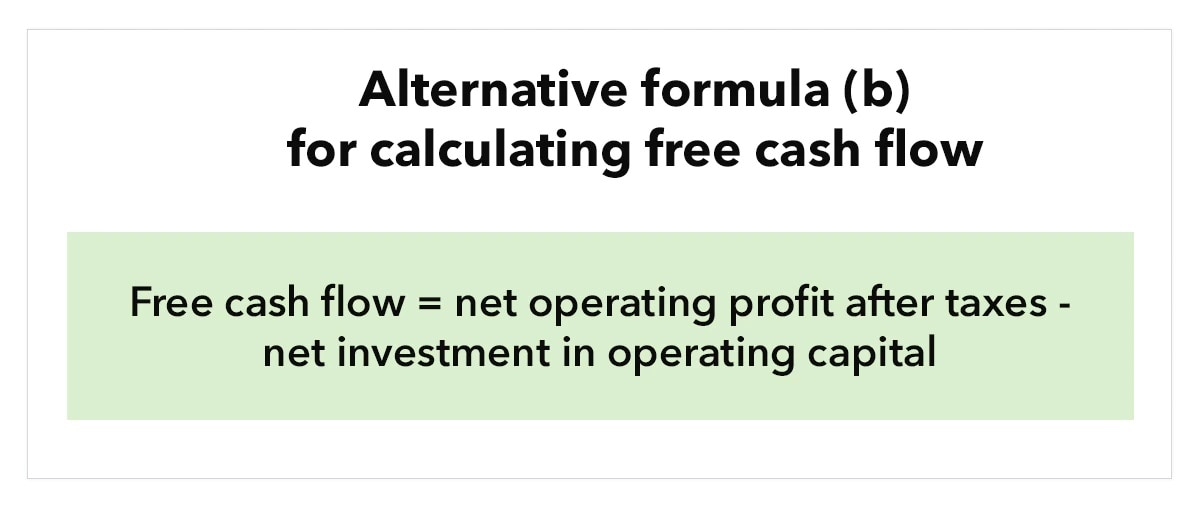

- How to calculate free cash flow

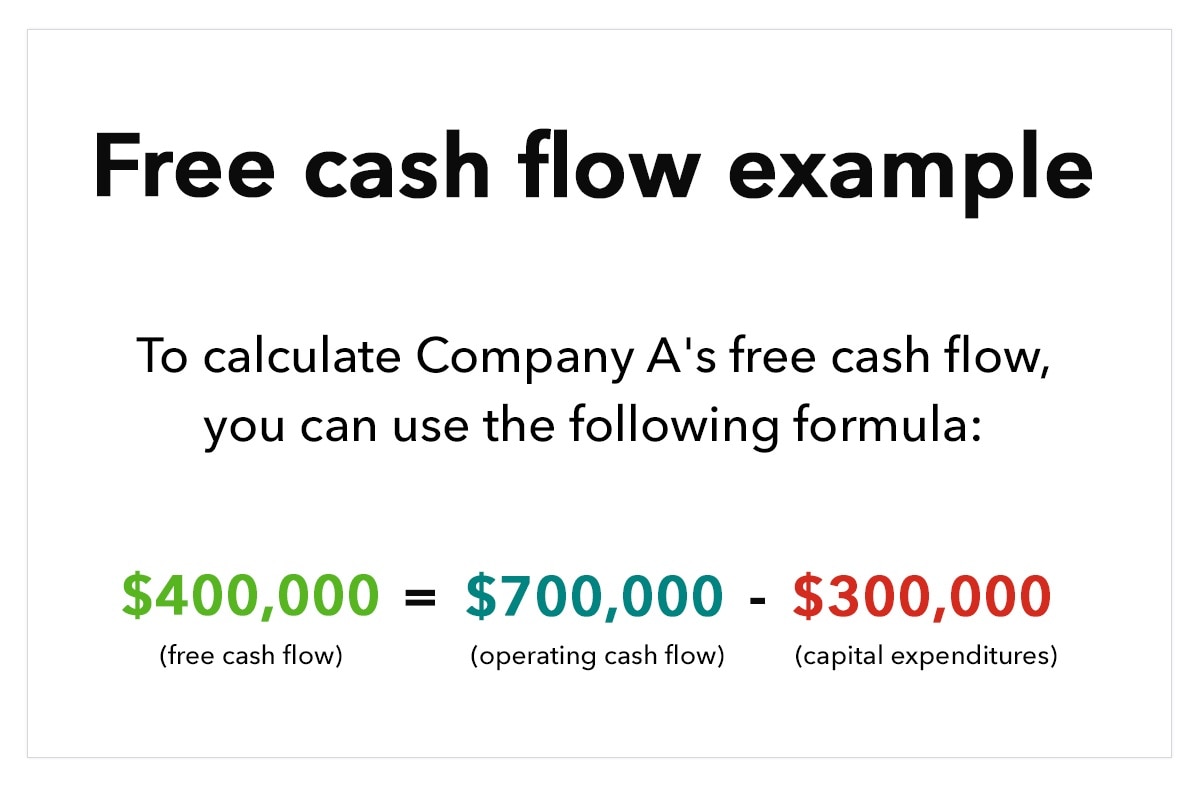

- Free cash flow example

- Getting insights from free cash flow analysis

- Limitations of free cash flow analysis

- Other types of cash flow