New! Spreadsheet Sync

QuickBooks Online Advanced

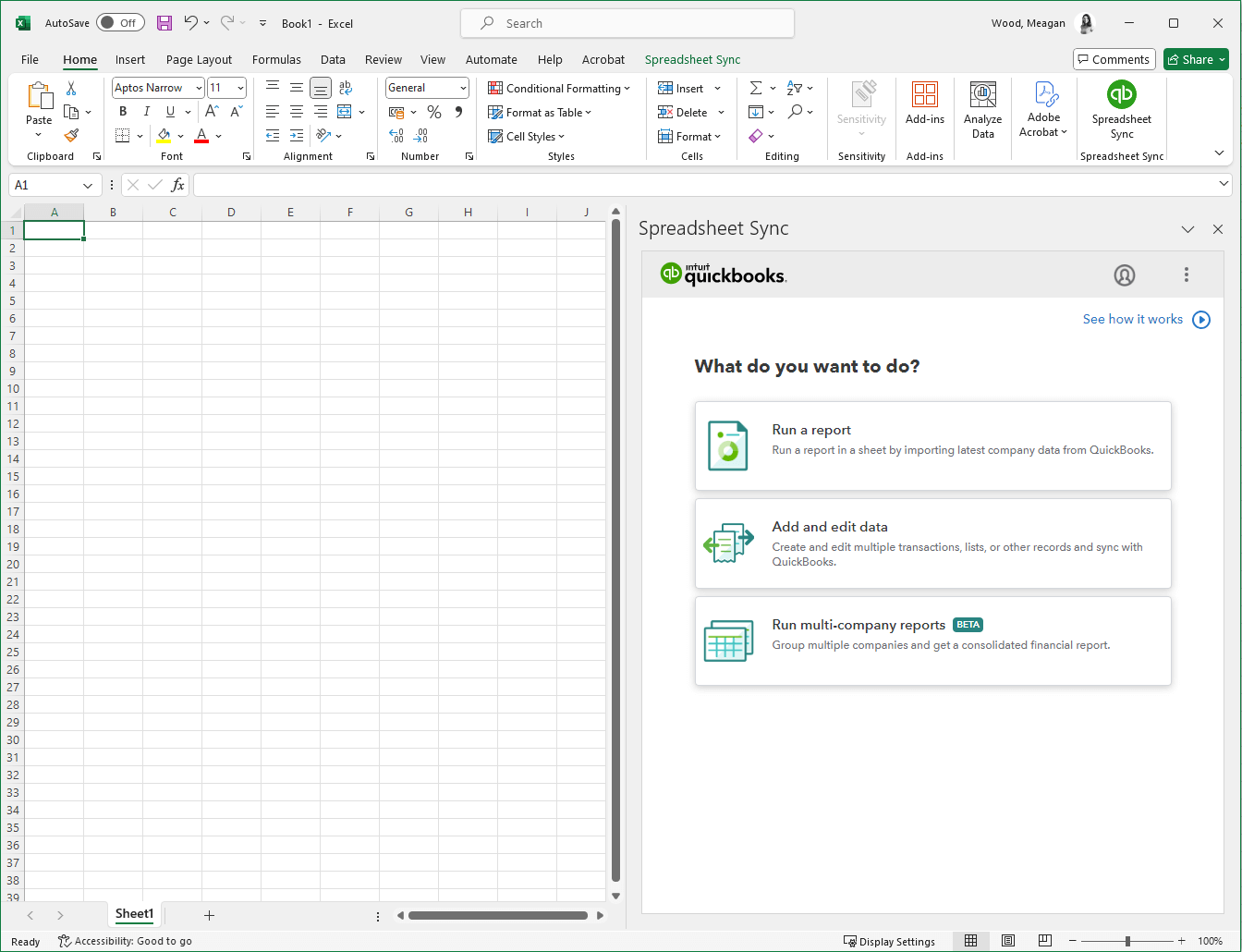

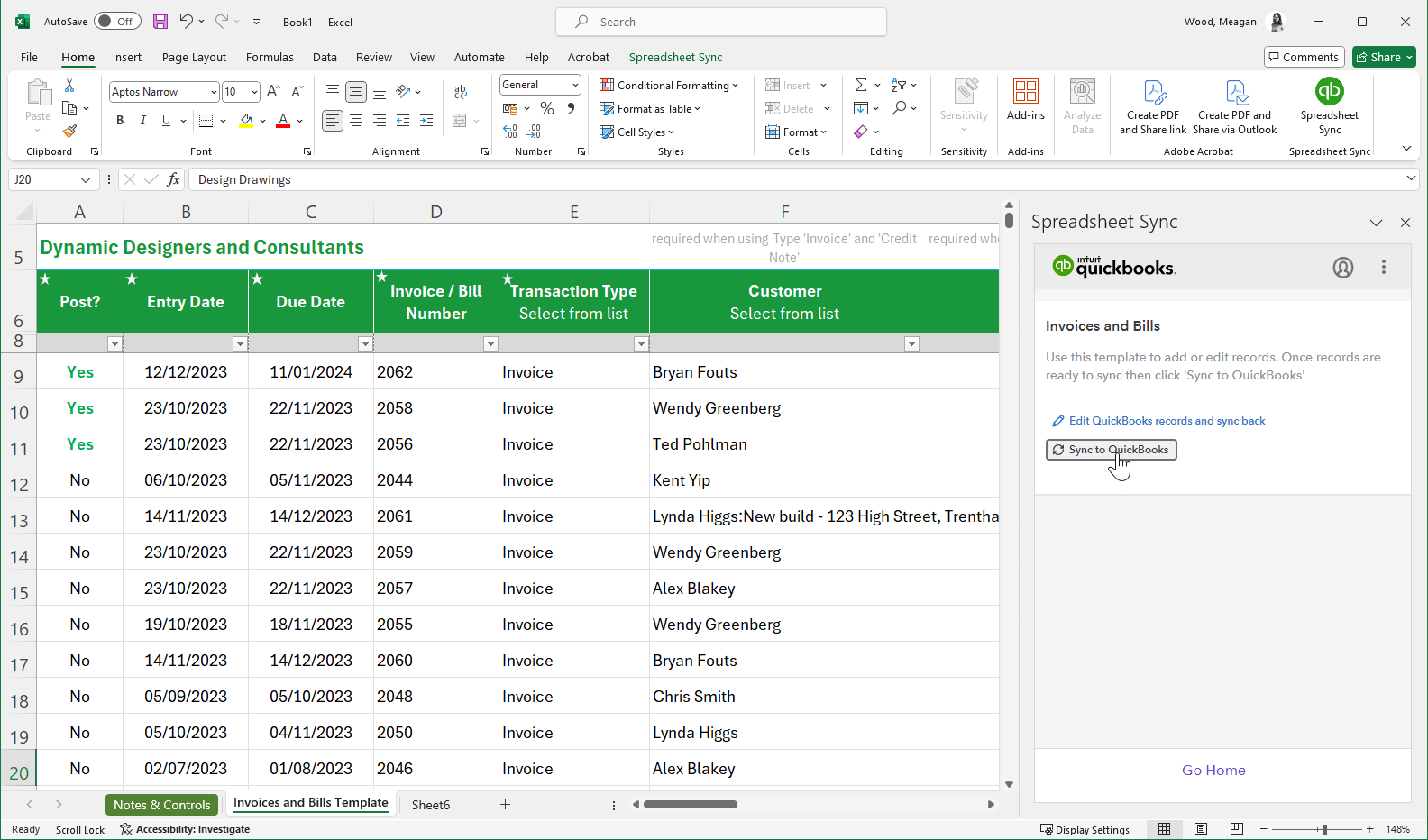

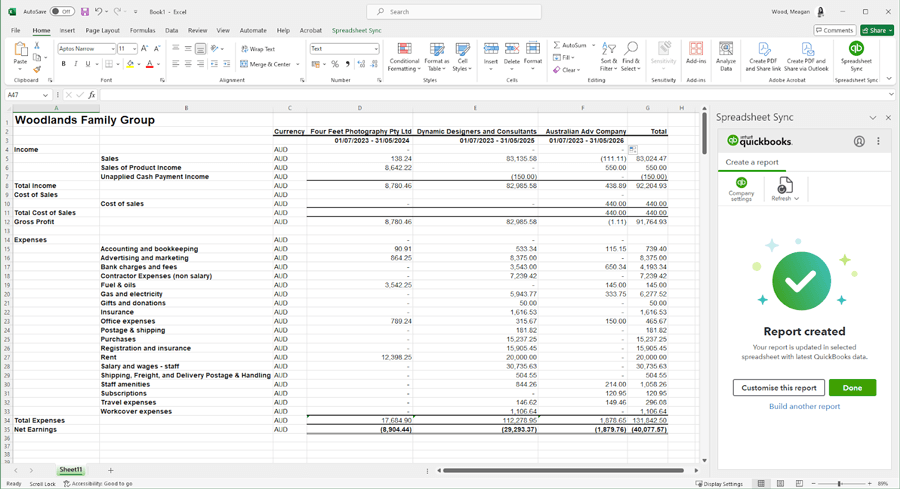

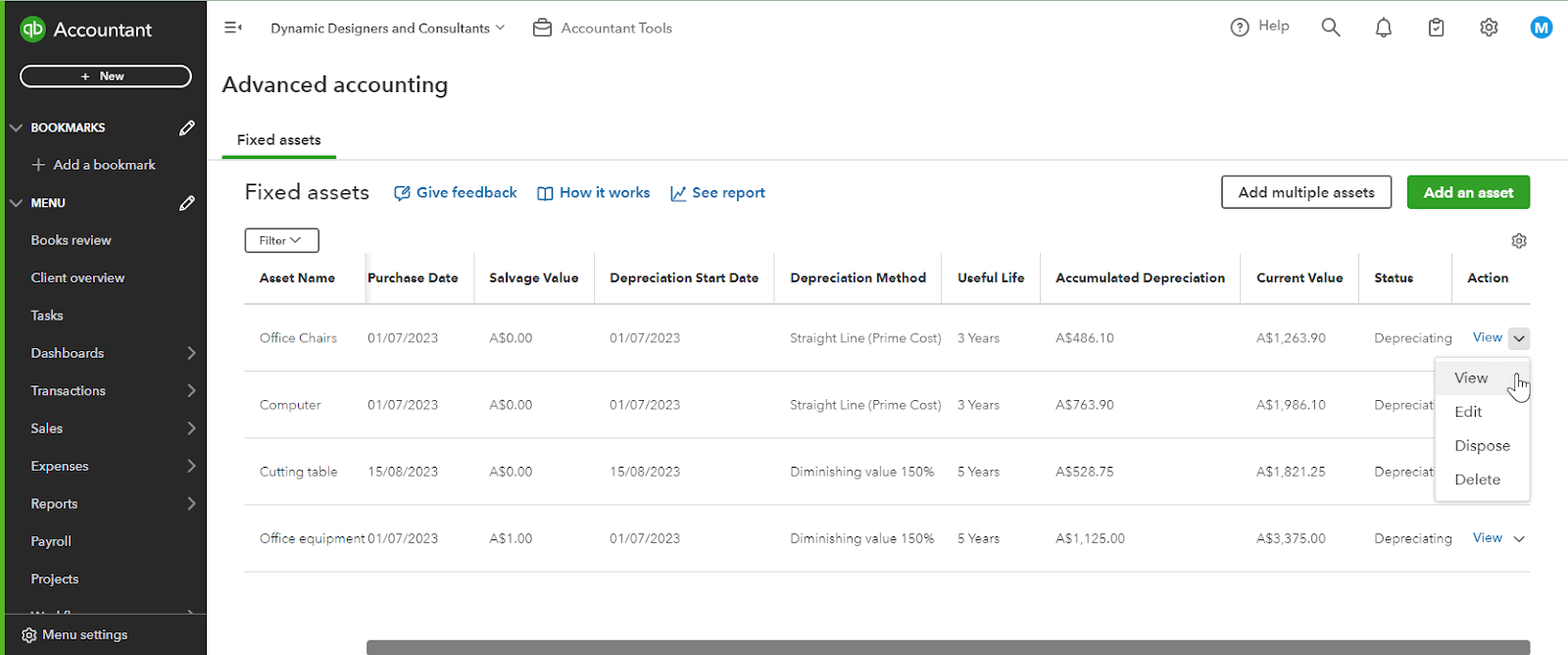

Spreadsheet Sync is set to change the way you use QuickBooks with Excel. Using Spreadsheet Sync you can move data back and forth between QuickBooks Online Advanced and Excel, creating another level of functionality and reporting possibilities.

Connecting Advanced to Excel is easily enabled through the Spreadsheet Sync option in the Settings area or heading into the Reports area and clicking on the Spreadsheet Sync tab.

After establishing a connection, you'll have access to a range of powerful features including the ability to run reports using data imported from Advanced. You can further tailor your reports using the functionality of Excel, giving you even more insights into your data.