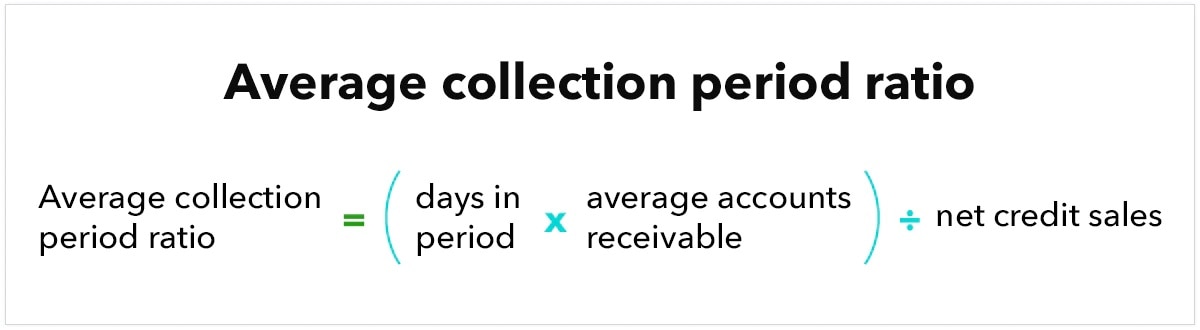

Every entrepreneur knows that it takes money to make money. But in order to make money, you actually have to collect it. The average collection period, also known as the average collection period ratio (ACP), estimates the timeline a company can expect to collect its accounts receivable. The number of days can vary from business to business depending on things like your industry and customer payment history.

Here, we’ll take a closer look at the average collection period, how to calculate it and more. Read on for an overview on the topic or use the links below to skip ahead.