Improve marketing results

Give your customers a strong reason to stay with you by using these tactics:

Promotions: use data analytics to promote products and services that your customers want. If a sporting goods company knows that many customers buy cricket gloves and bats during the same shop visit, they can promote the products together.

Rewards: thank your customers by rewarding them. When a customer makes a certain number of purchases, or reaches a specific dollar amount of activity, offer a discount on new business.

Testimonials: if you’re marketing to influence buyer behaviour, don’t forget about gathering testimonials. When a customer explains why they purchased your product, they may impact other people’s buying decisions.

Surveys: if you want to know what your customers want, ask them. Include surveys in each of your marketing channels, and emphasise that the survey won’t take much time to complete.

Use your data analytics and survey results to make product improvements and to add new product offerings.

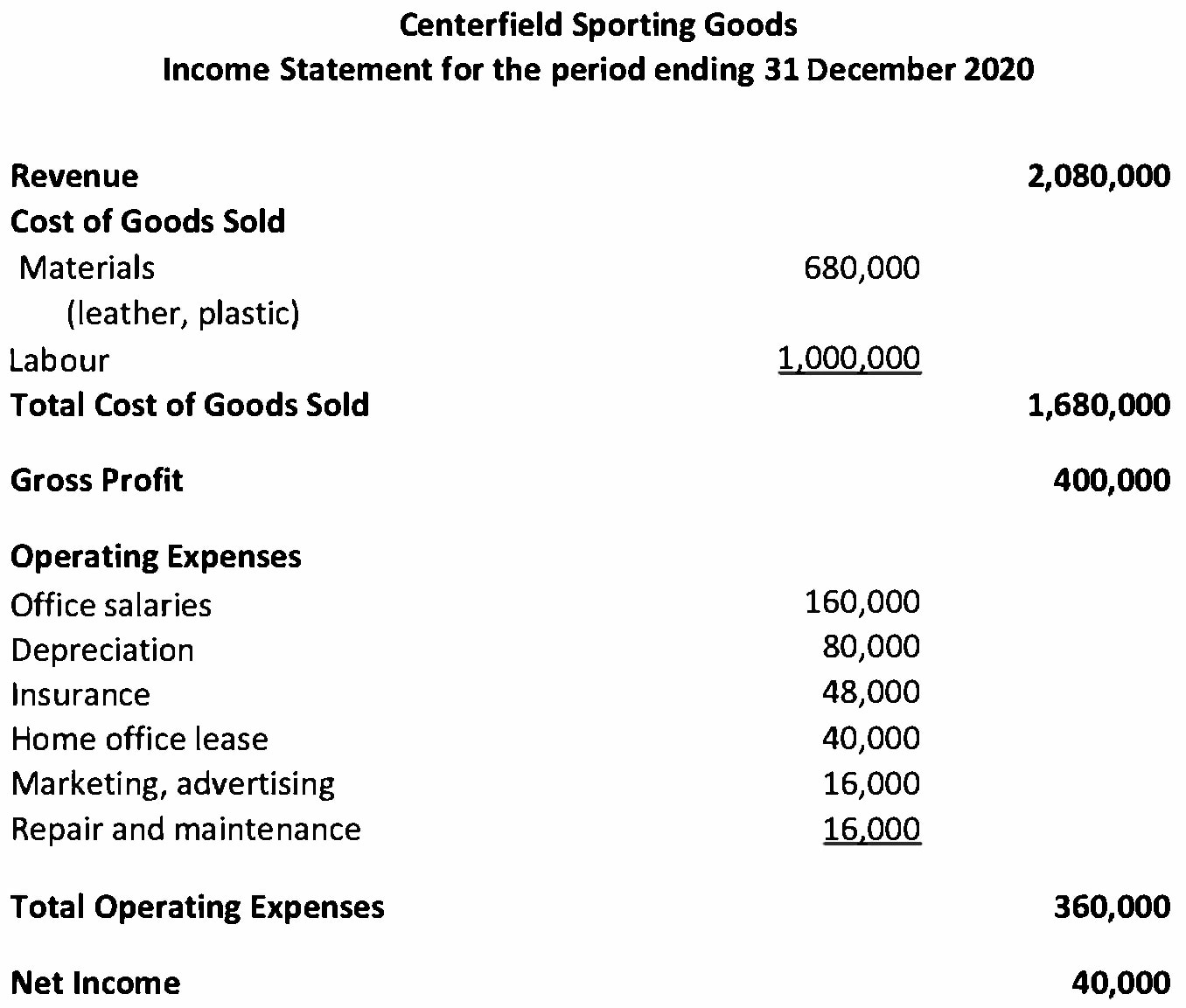

Another strategy to increase gross margin is to reduce costs.