Retained earnings are a vital part of any business. Without them, many companies would have to borrow extensively from banks or flounder in the market. If you’re starting a business and in need of knowledge surrounding retained earnings, we have you covered.

What are retained earnings and how do you calculate them?

What are retained earnings?

At the end of an accounting period, whatever is left over of the net income of a business after dividends are distributed to the owners (sole trader or partnership) or shareholders (in a corporation) is referred to as “retained earnings.”

As the name suggests, it is the earnings retained by the company once all other profits have been distributed where they need to go. Retained earnings are one element of the owner’s equity, or shareholder’s equity, and are classified as such.

The purpose of these earnings is to reinvest the money to pay for further assets for the company, which continues its operation and growth. Thus, companies do spend their retained earnings, but on assets and operations that further the running of the business.

Retained earnings formula

Businesses calculate their retained earnings at the end of every accounting period—typically on a monthly, quarterly and yearly basis. The formula is as follows:

Retained earnings (RE) = beginning RE + net income – dividends

This accounting formula takes the retained earnings from the previous period, plus the company’s net income, minus all dividends paid out to the owner and shareholders, to calculate this period’s earnings.

Net income vs retained earnings

Net income and retained earnings are not the same things. However, net income, along with net losses and dividends, directly affects retained earnings. Net income is the total amount a company makes after taxes and expenses.

A company is taxed on its net income. Retained earnings are the amount a company gains after the taxation of its net income. Therefore, retained earnings are not taxed, as the amount has already been taxed in income.

Dividends and shareholders

Dividends refer to the distribution of money from the company to its shareholders. Many corporations keep their dividend policy public so that interested investors can understand how the shareholders get paid.

Dividends are typically paid in cash to shareholders; to do this successfully, the company first needs enough cash, as well as high enough retained earnings. Other times, corporations may decide to distribute additional shares of their company’s stock as dividends. This is known as stock dividends, as they issue common shares to existing common stockholders.

Learn more with our guide to Division 7A.

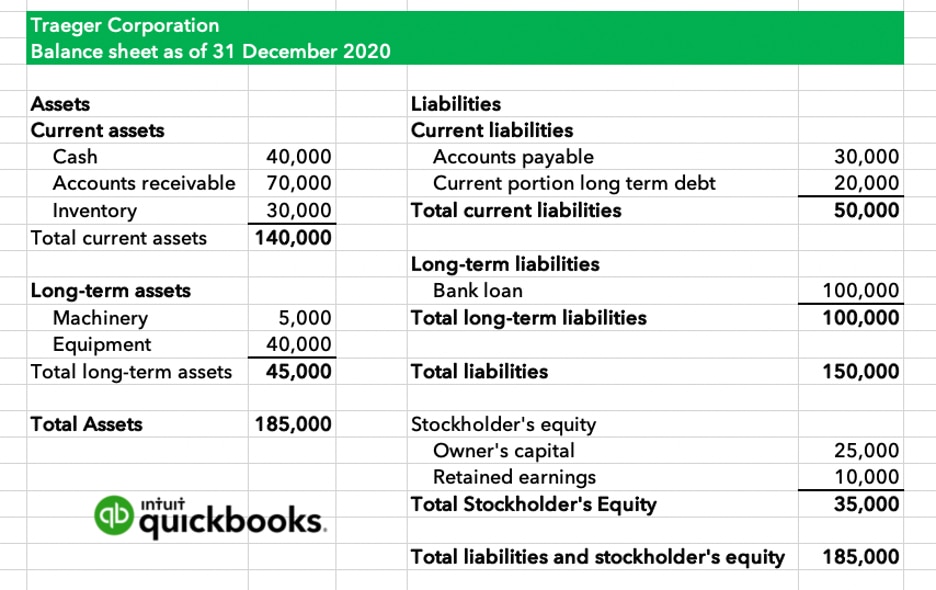

Retained earnings on a balance sheet

Retained earnings can be found on the right side of a balance sheet, alongside liabilities and shareholder’s equity. Check out the balance sheet example below.

A balance sheet is a snapshot in time, illustrating the current financial position of the business. At the end of an accounting period, the income statement is created first, and then the company can decide where the allocation of cash and earnings will go.

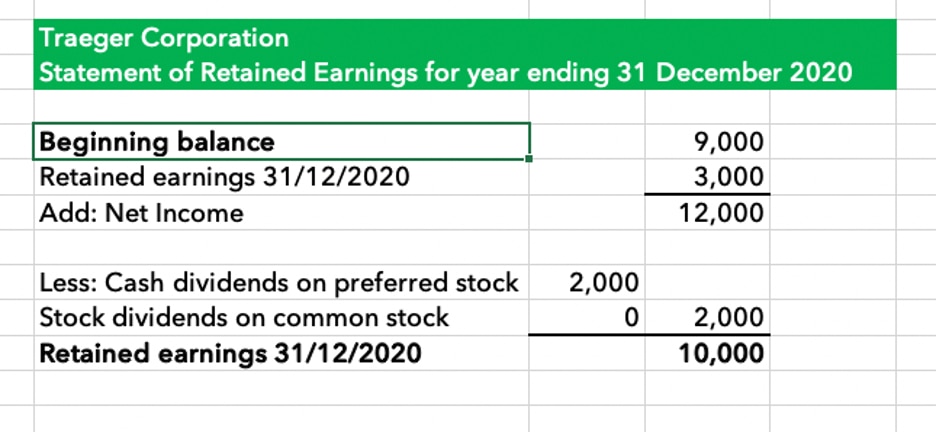

Statement of retained earnings

Depending on the company’s management, it will either create a separate retained earnings statement or, sometimes, prepare a combined statement of income and earnings. A retained earnings statement displays what’s going in and out of the retained earnings account. It reflects the accumulation of profits and the distribution of those profits to the owner or shareholders.

This statement is a vital indicator of a business’s overall financial standing. A high retained amount typically illustrates that a company is in good financial health, while long-term negative amounts could be a sign of financial distress. It also displays all dividends—cash and shares—that have been given to shareholders per accounting period.

Frequently asked questions

Related Articles

TAKE A NO-COMMITMENT TEST DRIVE

Your free 30-day trial awaits

Our customers save an average of 9 hours per week with QuickBooks invoicing*

By entering your email, you are agree to our Terms and acknowledge our Privacy Statement.