Keeping track of the revenues and finances of your small or big business is surely a full-time job, so you may need to create a financial position to handle these duties within your business.

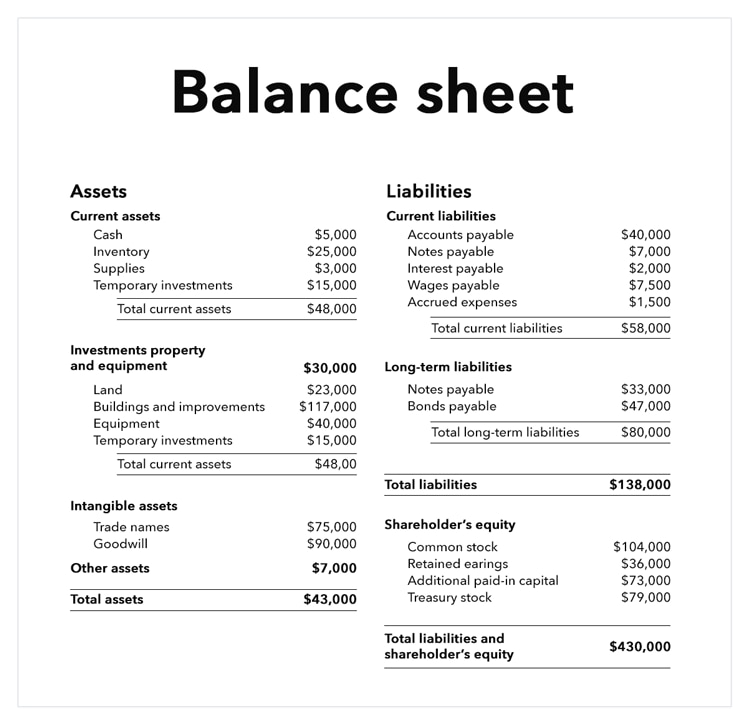

However, many small businesses—especially new businesses—prefer to handle this aspect of their businesses themselves, forgoing the help of an accountant to manage the balance sheet, business transactions, cash flow statement and financial statements

If you’re a small business owner who would prefer to monitor your company’s cash flow statement with your own eyes, there are financial accounting formulas that you should be familiar with. These basic accounting equations are rather broad, meaning they can apply to a variety of businesses. Combined with an understanding of accounting basics for small businesses, the accounting formulas will provide you with the figures needed to understand your business’s viability and health to make more informed business decisions.

Below, we’ll cover the fundamentals of the accounting equation and the top business formulas businesses should know. Read from start to finish for a thorough understanding of accounting formulas, or use the list to jump to an equation of your choice.