Accountants will use the general journal as part of their record-keeping system. The general journal is an initial record where accountants log basic information about a business transaction, such as when and where it occurred, along with the total amount. Each of these recorded business transactions are referred to as a journal entry.

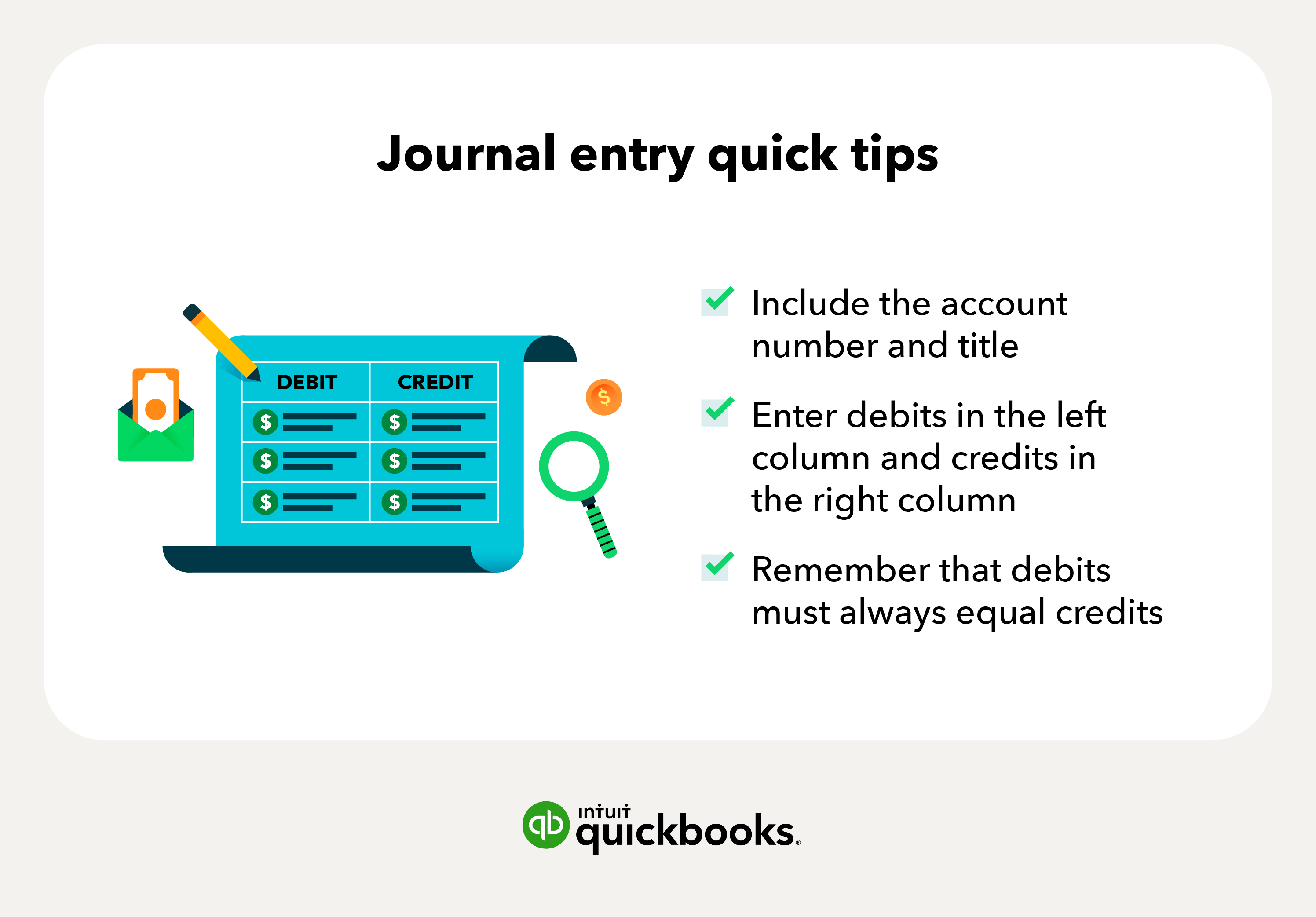

A journal entry records debits and credits to post an accounting entry, along with a description of the transaction. You post journal entries into columns, and the left-hand column lists the account number and account title. To the right, you have two columns, one for debits and one for credits. A detailed explanation of the transaction is posted below each journal entry.

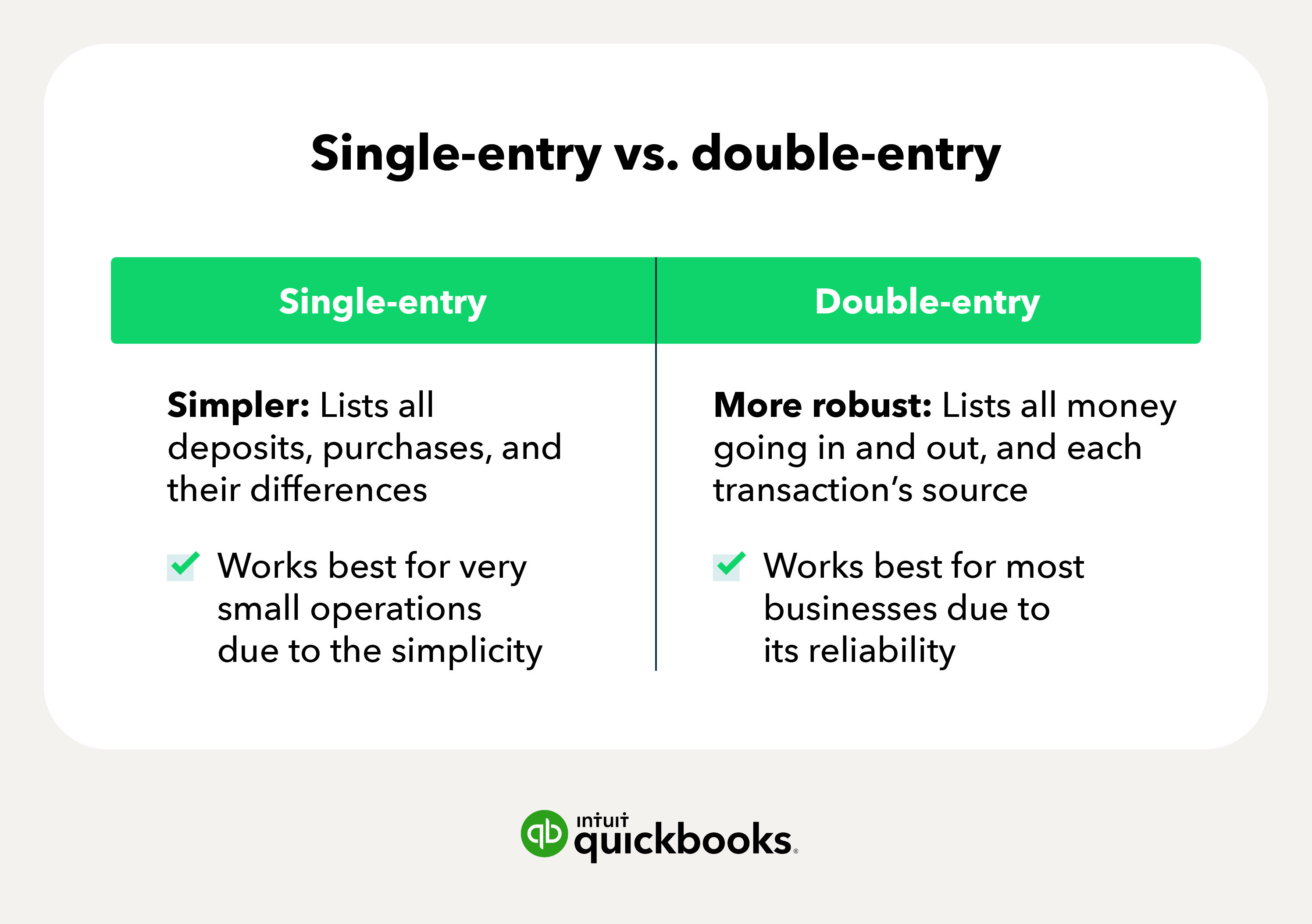

The double entry bookkeeping system uses debits and credits to post accounting transactions and keep the balance sheet equation equal.

This method is often misunderstood, so it’s essential to understand these ground rules:

- A debit entry is on the left side of the accounting entry, and credit entries are on the right side.

- Most asset accounts and expense accounts are increased with a debit entry, while most liability and revenue accounts are increased with credit entries.

- The total dollar amount of debits must always equal the total dollar amount of credits. If you attempt to post an entry into accounting software that is not balanced, you’ll get an error message.

What causes confusion is the difference between the balance sheet equation and the fact that debits must equal credits. Keep in mind that every account, whether it’s an asset, liability, or equity, will have both debit and credit entries.

When using the double entry accounting system, two things must always be balanced. The general ledger, which tracks debit and credit entries, must always be balanced. Additionally, the balance sheet, where assets minus liabilities equals equity, must also be balanced.

The examples below will clarify the rules for double entry bookkeeping: