Bank Reconciliation Defined

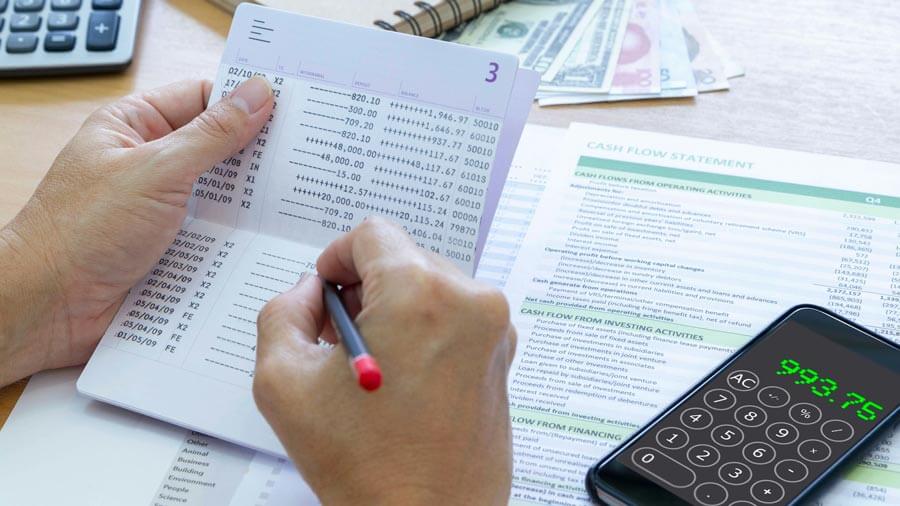

A bank reconciliation is a process in accounting where a company ensures its business account transactions within their journal entries and ledgers are reconciled with the financial institution’s most recent bank statement. Reconciliation is a vital part of the accounting process. It ensures that the financial information of your business account matches that of the bank’s records.

Rectifying the bank statement against your business account’s financial information should happen monthly, as it is every month that you receive a bank statement. Your account statement will either come in the mail or be accessed online, depending on your banking preferences. This bank statement is a record of all transactions your company made that month.

You don’t necessarily need an accountant or financial professional to reconcile your statements. As the small business owner and account holder, you can rectify the records yourself.