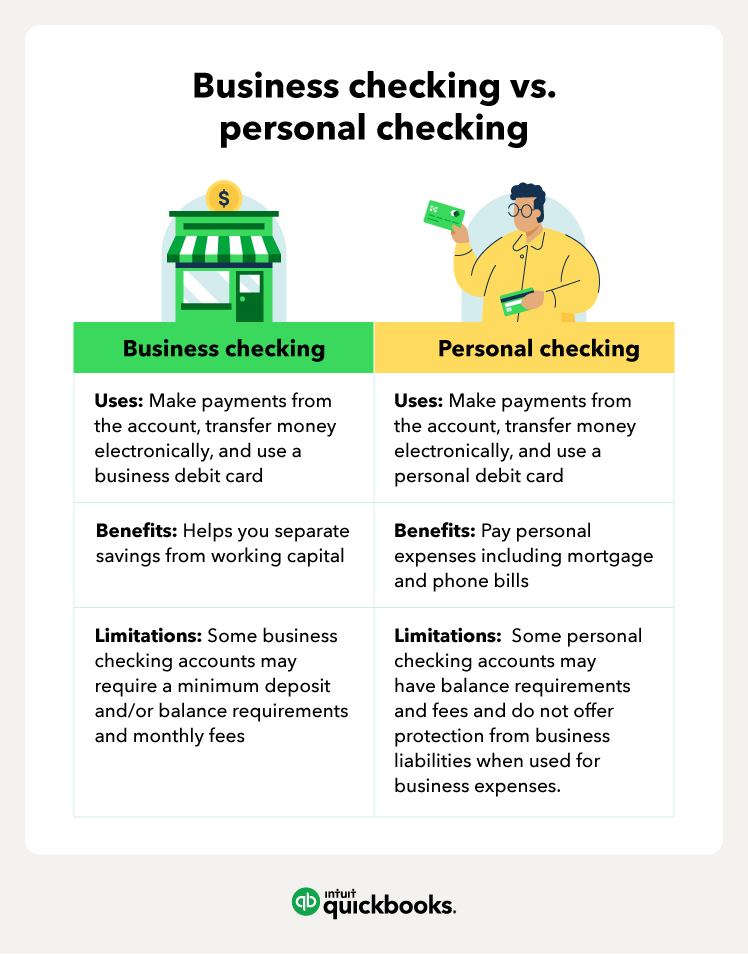

A business transaction account helps business owners hold and manage money made within a company. Personal transaction accounts help individuals hold and manage their personal funds. Some of the main differences include:

- Business bank accounts have more legal protections than personal bank accounts, meaning you won’t be offered protection from business liabilities when using a personal transaction account for business expenses

- Business bank accounts can do a better job at solidifying your brand

- Personal bank accounts and business bank accounts have a different fee structure

Individuals who operate under a trading name or as a company will have to open a business transaction account that’s separate from their personal transaction account.

Here are a few key factors of a business banking account:

- Includes a business transaction account

- Allows you to make payments from the account, transfer money electronically and use a business debit card

- Helps you separate savings from working capital

- May require a minimum deposit and/or balance requirements and monthly fees On the other hand, personal transaction accounts are intended for personal funds

Personal fund activities include:

- Depositing pay from an employer

- Paying personal expenses, including mortgage and phone bills

- Debit card purchases

- Transferring funds to personal savings accounts

- Withdrawing money from an ATM

- Gifts and personal payments to friends, family and acquaintances

Why should I consider a business bank account?

When it comes to business vs personal bank accounts, opening a dedicated business bank account can help you:

- Safeguard your business funds by separating your personal finances

- Easily monitor your business spending

- Create more realistic budgets

- Practise better bookkeeping habits that keep your business finances organised

- Help you get a business loan, line of credit or a business credit card when you need one

In short, even if a separate account isn’t required for your business, it’s still a good idea to get one. We’ll explore these benefits in depth below.

Can I use the same bank for personal and business banking?

Yes! When choosing a bank for your business bank account, many people start with financial institutions they know and like. If you have a personal bank account in good standing, you may get a better offer on a business bank account at the same bank.

Many banking institutions that offer consumer or personal bank accounts also offer business banking services. However, reviewing the specific features of a business bank account is always a good idea before you sign up.