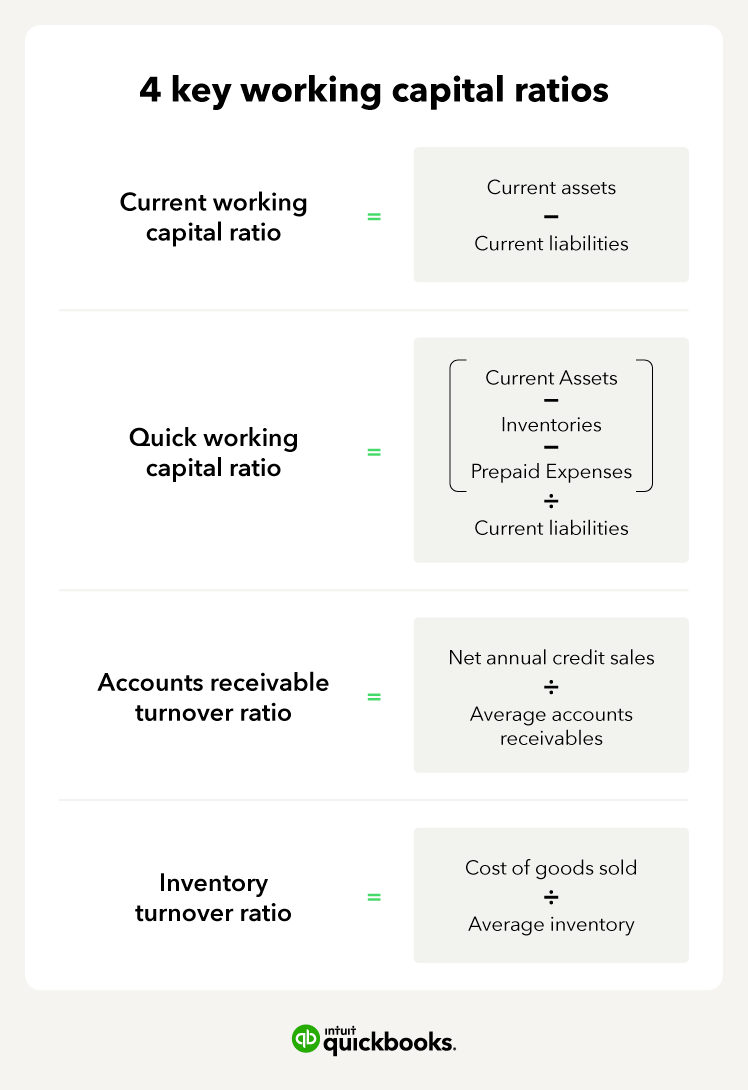

How to use working capital ratios

There are four key ratios you can use to monitor your working capital balance.

1. Current working capital ratio

The current ratio uses the same formula as the working capital formula. The ratio is current assets subtracted by current liabilities, and every business needs to maintain a ratio of at least 1.0.

Working capital = current assets – current liabilities

For example, a business with $120,000 in current assets and current liabilities totalling $100,000 has a current ratio of 1.2.

The owner has $1.20 in current assets for every $1 of current liabilities.

2. Quick working capital ratio

The quick ratio (or acid test ratio) adjusts the current ratio formula by subtracting some current assets that take longer to convert into cash.

There are several versions of the formula, but the most common subtracts inventory and prepaid expenses from current assets. The remaining balance is divided by current liabilities:

Quick ratio = (current assets – inventories – prepaid expenses) ÷ current liabilities

Using the same example as above, assume that the business has $10,000 in inventory and no prepaid asset balance. The adjusted current asset total is $120,000 minus $10,000, equalling $110,000. The quick ratio is $110,000 divided by $100,000, coming out to 1.1.

3. Accounts receivable turnover ratio

The accounts receivable turnover ratio is net annual credit sales divided by average accounts receivable.

Accounts receivable turnover Ratio = net annual credit sales ÷ average accounts receivables

The components of the formula are as follows:

- Credit sales: Sales to customers who don’t pay immediately.

- Net credit sales: Credit sales minus uncollectible accounts receivable balances.

- Average accounts receivable: The beginning balance plus ending balance for a month divided by two.

A business should strive to increase credit sales while also minimising accounts receivable. If you can increase the ratio, that means you’re converting accounts receivable balances into cash faster.

4. Inventory turnover ratio

The inventory turnover ratio is computed as the cost of goods sold divided by average inventory:

Inventory turnover ratio = cost of goods sold ÷ average inventory

If you can increase sales and minimise inventory levels, the ratio will increase. Increasing the ratio means that you are making more sales without having to increase the inventory balance at the same rate.

Put each of these ratios on a financial dashboard so that the information is right in front of you each month. These ratios are the best tools for assessing your progress and increasing working capital.