Small and medium businesses play a key role in the global economy and macro economics. Yet, given their size and the workforce, such businesses fail to generate big revenue.

For example, small businesses that do not have any employees average just $44,000 a year in annual revenue with two-thirds of these companies earning less than $25,000 per year.

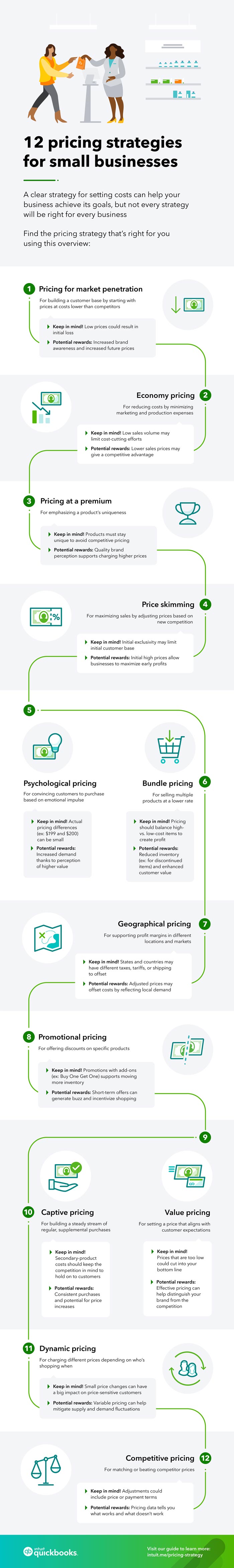

Even though there are numerous factors, including market research and profit margin, that affect their revenue, the pricing models play a key role.

To get this right, it’s critical to use financial reporting and insights to guide small businesses. Additionally, it is quite important to get a thorough understanding of different pricing models to attract the target customers. To make it easier for you, here are different strategies that might help you set a proof margin with economy pricing.