There are many elements of the accounting process to keep track of, beyond crunching numbers and building budgets. The accounts payable process is one of the most important. Accounts payable describes the various amounts your business owes to external suppliers for goods and services that you have not yet paid for, for example credit card purchases, production costs, inventory, and repair services.

In this post, we’ll dive deeper into the accounts payable process, its significance, how it works, and how you can save time by streamlining your workflow. Use the links below to navigate our guide, or read through for a detailed overview of the accounts payable system.

- What is the accounts payable process?

- Why is the accounts payable process important?

- Who handles accounts payable?

- Common examples of accounts payable debts

- Difference between accounts payable and accounts receivable

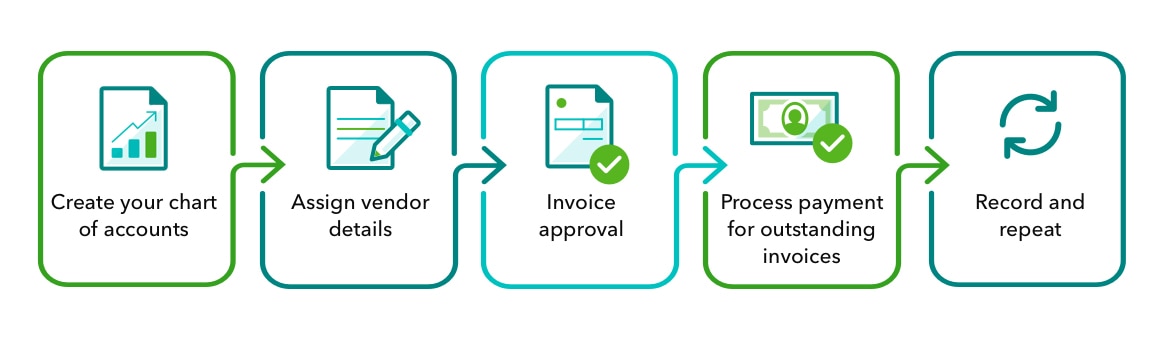

- How to manage your accounts payable in 5 steps

- Automate the accounts payable process with QuickBooks