Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I set up a self employed account, through my desktop via Google Chrome and choose to pay with google pay, (because OBVIOUSLY Google Chrome syncs easily to my Google Pay account). Due to me choosing to pay via this method I don't have full access to all that's available on self employed! I have just found this out after 2hrs on a useless chat forum.

I have now been told by the (useless) chat forum after waiting that I have to cancel my account and start up a new one! WHAT A WASTE OF TIME! If Quickbooks Self Employed has such stupid policies in place, why did it not warn me on checkout that if I choose to pay with Google Pay it will limit my access? And why can I now not just simply change my payment method. A payment method cannot determine how much access you have on an account! Especially without making the customer aware on checkout. I was mis-sold a product. That is fraudulent.

To confirm all I want to do is allow my accountant access to my account but apparently because I've paid via Google Pay it is not possible to allow her access! But if I chosen a different payment method she would be allowed access. In what world does that make sense??

Solved! Go to Solution.

Hi Maddie, thanks for getting back to us.

Accountant users have specific billing permissions within QuickBooks which means they're unable to be invited to accounts that are billed via a third party. You can continue to use the account that you've set up with Google Play by cancelling this within the Google Play store and waiting for this to expire which will be on your next regular bill date with Google (you'll still have full access to your accounts within this period). Once cancelled, sign in to your account on the web (not the app) and you'll be re-directed to enter billing details to resubscribe, which will automatically place you on Intuit billing and unlock the accountant feature (no data will be lost during this process).

If you have any Q's, please get back to us below. :)

I can see how the benefit of being able to let your accountant access your QuickBooks Self-Employed (QBSE) account would aid you in keeping your financial data accurate, @Maddie Leicester. That's why I'm here to share further details about this.

When your subscription is paid through a third party (i.e., Google Play), you've purchased the app version of QBSE. Not all features of the app are the same as the browser platform that's why you're advised to migrate your subscription to Intuit. This way, you'll have the option to invite your accountant.

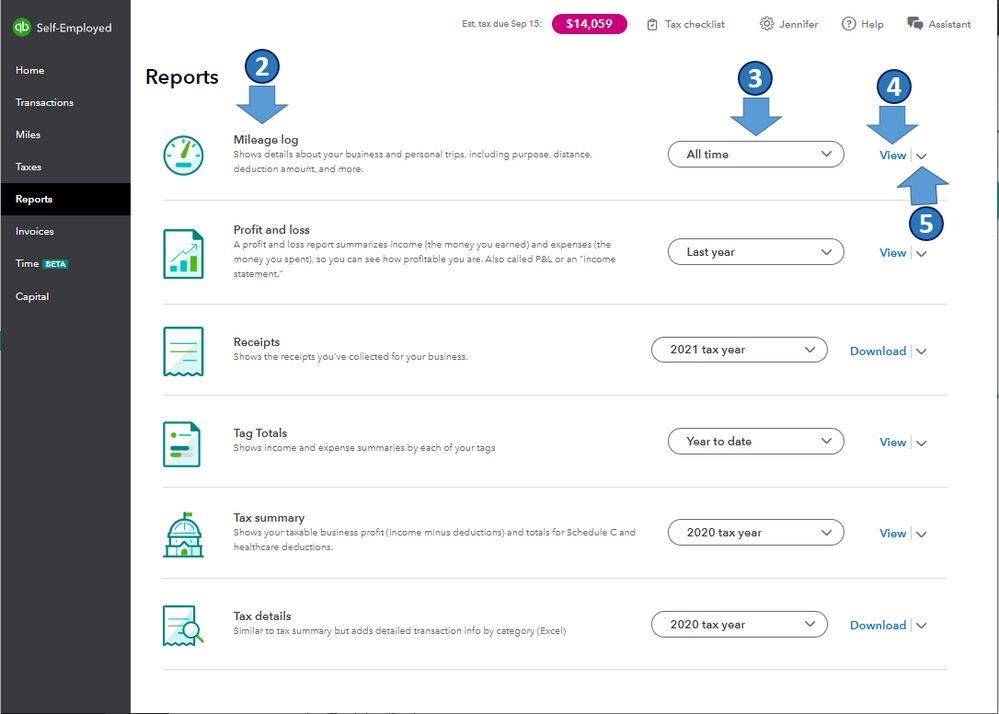

However, you can share reports and other tax info with your accountant, especially during tax season. To do this, you need to download the reports you need by following these steps:

In case you've decided to cancel your Google Play subscription, you can refer to this article for the detailed steps: Cancel your QuickBooks Self-Employed subscription. Then, re-subscribe directly from QuickBooks.

Also, I'm adding this article to further guide you in managing your business calendar, tax reports, and self-assessment return using QBSE: QuickBooks Help Articles. It also includes topics about the system's overview, mileage, and year-end taxes, to name a few.

I'm all ears if you have other account management concerns or questions on tracking self-employed transactions in QBSE. I'm always around to help. Take care, and I wish you continued success, @Maddie Leicester.

Hi Rea,

Thank you for your reply, I appreciate your help.

I totally understand what's gone "wrong" in the sense of my chosen payment method limits my access, however I don't understand how this is acceptable without any warning on checkout and why I can't simply change my payment method to allow me full access. Also if I want to cancel, I will loose all of the data that's taken me months to input. It feels completely illogical.

Thank you for the step by step on downloading the reports to send to my accountant, fingers crossed this is enough or I will have to leave QB.

I would really appreciate your help, if you can sort my account out or talk me through setting it up so that I don't loose any of the data I have on there.

Many thanks,

Maddie

Hi Maddie, thanks for getting back to us.

Accountant users have specific billing permissions within QuickBooks which means they're unable to be invited to accounts that are billed via a third party. You can continue to use the account that you've set up with Google Play by cancelling this within the Google Play store and waiting for this to expire which will be on your next regular bill date with Google (you'll still have full access to your accounts within this period). Once cancelled, sign in to your account on the web (not the app) and you'll be re-directed to enter billing details to resubscribe, which will automatically place you on Intuit billing and unlock the accountant feature (no data will be lost during this process).

If you have any Q's, please get back to us below. :)

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.