- UK QuickBooks Community

- :

- QuickBooks Q & A

- :

- Employees and Payroll

- :

- Cannot change journal mapping account for standard payroll for quickbooks online

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Cannot change journal mapping account for standard payroll for quickbooks online

Solved! Go to Solution.

Labels:

0 Cheers

Best answer April 08, 2022

Solved

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Cannot change journal mapping account for standard payroll for quickbooks online

Hello there, Andrew678.

Welcome to the Community. I'm here to share some information to help you change your journal mapping account for standard payroll in QuickBooks Online.

Here are some steps that might just be the trick to getting your payroll back on track.

First, simply turn off ‘Close the books’ by going to:

- Payroll, and choose the gear icon.

- Tap Account and Settings, and then Advanced.

- Edit the Accounting section, and use the toggle to switch off ‘Close the books’.

- Go back to payroll, and rerun the payroll to create a journal entry.

Second, ensure 'Net pay account' isn’t mapped in a foreign currency

- In Payroll, and hit the gear icon.

- Tick Account and Settings, and then Advanced.

- In Currency, set ‘Home Currency’ to British Pound Sterling.

- Go back to payroll, and rerun payroll to create journal entries.

You can view this article for more details: What to do if you can't create journals in Standard Payroll.

Once done, run a payroll report to check if the amounts are accurate in your QBO.

Do get back to me if you have other concerns about standard payroll. I'm always here to back you up. Have a great day!

0 Cheers

11 REPLIES 11

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Cannot change journal mapping account for standard payroll for quickbooks online

Hello Arichards1,

Welcome to the Community page,

We would not recommend changing the mapping of the journal account. You can only change the mapping of the bank within the settings but if you change any of the mappings or manually change anything within the journal you run the risk of the journals not being created in the future going forward.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Cannot change journal mapping account for standard payroll for quickbooks online

This isn't great - you used to be able to change the mapping of items to the account you needed them show in. I already had all the correct liability accounts and expense account linked and labelled as payroll. Now the new system has duplicated the labelled liability accounts. And it has posted individual journals for each employee! This is absolutely crazy when trying to review things. I am seeing 7 journals for PAYE for the period of April 20 (there are 7 employees) when I should see one journal labelled April 20. The reports give you the breakdowns and the journal posts the months summary. Please can this be amended asap. Can you imagine how many journals there will be at the year end. There should be 12 in total. Now there will be 168 journals in the tax and ni account. Not great for the reviewer. Seriously this has to be amended! I will be looking into other payroll software in the meantime if this continues.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Cannot change journal mapping account for standard payroll for quickbooks online

Same problem and I have 60 odd employees over three different sites and head office. I'd prefer no mapping at all tbh, then I could post my neat journal to the right account and class and have it deducting from the right bank accounts too!

Looking forward to the answer....

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Cannot change journal mapping account for standard payroll for quickbooks online

Hi,

Any answer on this?

It's frustrating having to do a correction journal each month.

Thanks,

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Cannot change journal mapping account for standard payroll for quickbooks online

Hello, CJ34.

Having to do everything manually is indeed frustrating and can take a lot of time. However, I have more information regarding the journal mapping in QuickBooks Online Payroll.

As mentioned by Ashleigh1, we can only change the journal mapping of the bank account in Account and settings for the Standard Payroll subscription. You'll want to continue doing correction journal for each month.

For reference, you can take a loot at this article: Customise Transaction Mapping in QuickBooks Online Payroll.

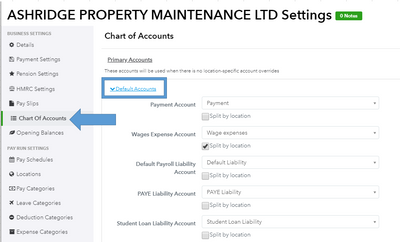

Although if you have QuickBooks Advanced Payroll, you're able to do this easily. Here's how:

- Go to the Gear icon.

- Choose Payroll settings.

- Click the Chart of Accounts tab.

- Expand the Default Accounts section (or the categories section).

- Change the accounts, then click Save.

If you need more help with this, you can check this article: Mapping General Ledger Accounts in QuickBooks Advanced Payroll.

I'd also recommend checking our QuickBooks Online Payroll articles if you need assistance managing or process your payroll. If you need help with regular processes such as managing income, customers, suppliers and expenses, change the product to QuickBooks Online under Select a product.

If you have other concerns for QuickBooks Online or your payroll subscription, do let me know in the reply section below. I'm willing to listen and address them.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Cannot change journal mapping account for standard payroll for quickbooks online

Why does Basic payroll assume that all employees are expenses and not Cost of Sales?

You are given the option to choose the Nature of the organisation. For example - Restaurant then codes the the Chef's wages to expenses rather than COGS.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Cannot change journal mapping account for standard payroll for quickbooks online

Hello there, @juliancalverley.

Thanks for joining in this conversation. As additional insights, wages should always be categorized as expenses.

We only categorize the wage as COGS if the employee is billable with inventory items.

You'll want to turn on billable expenses in QuickBooks so you can make any expense or timesheet in QuickBooks billable.

Let me know if you have additional questions, @juliancalverley. We're always here to guide.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Cannot change journal mapping account for standard payroll for quickbooks online

Bit arrogant to say wages should always be categorized as expenses....in no accounting text book will you see that. No government agency dictate how you should categorize expeniture. No accounting standards dictate that wages should always be categorized as expenses. If Quickbooks can't do it because coders decided it was not how things should work, then say that, but don't dictate how users must categorize and analysis their business expenditure.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Cannot change journal mapping account for standard payroll for quickbooks online

Hello there, Andrew678.

Welcome to the Community. I'm here to share some information to help you change your journal mapping account for standard payroll in QuickBooks Online.

Here are some steps that might just be the trick to getting your payroll back on track.

First, simply turn off ‘Close the books’ by going to:

- Payroll, and choose the gear icon.

- Tap Account and Settings, and then Advanced.

- Edit the Accounting section, and use the toggle to switch off ‘Close the books’.

- Go back to payroll, and rerun the payroll to create a journal entry.

Second, ensure 'Net pay account' isn’t mapped in a foreign currency

- In Payroll, and hit the gear icon.

- Tick Account and Settings, and then Advanced.

- In Currency, set ‘Home Currency’ to British Pound Sterling.

- Go back to payroll, and rerun payroll to create journal entries.

You can view this article for more details: What to do if you can't create journals in Standard Payroll.

Once done, run a payroll report to check if the amounts are accurate in your QBO.

Do get back to me if you have other concerns about standard payroll. I'm always here to back you up. Have a great day!

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Cannot change journal mapping account for standard payroll for quickbooks online

Sadly having switched off close the books, and checking currency I tried once again to amend the mapping accounts for payroll and it lets me enter data but then when I save it, it vanishes.

Any other thoughts - clearly we are supposed to be able to change these mappings, but why won't the changes save?

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Cannot change journal mapping account for standard payroll for quickbooks online

Thanks for joining the thread, Chris. We don't want you to have this problem. Let's work hard together to help the situation.

We can perform basic troubleshooting steps to see if it's a browser issue. Sometimes your browser's cache and cookies become corrupted, causing problems when accessing websites or setting up accounts. To begin, open your QBO account in an incognito window. It will prevent the browser history from being saved. Please refer to the following keyboard shortcuts based on your browser type:

- Google Chrome: Ctrl + Shift + N

- Mozilla Firefox: Ctrl + Shift + P

- Microsoft Edge: Ctrl + Shift + P

- Safari: Command + Shift + N

If the private browsing session works, you can clear the browser's cache so the system can restart. This task is also possible in other supported, up-to-date browsers. Clearing the cache will reboot the system, allowing you to work with clearing the cache. It will also help you get rid of any junk files that might be slowing down your work.

You can visit this article to learn ways to customise your reports: Common custom reports in QuickBooks Online.

I'd appreciate hearing any updates after you've completed the steps, as I want to make sure this resolves your concern. Please don't hesitate to contact us again. Have a fantastic day!

0 Cheers

Recommendations

Featured

Ready to get started with QuickBooks Online? This walkthrough guides you

th...