You can delete and then recreate the paychecks, Kenny.

Then, add an addition item to add the £100 overpayment for the month of April, and a deduction of £100 for May. This is to mirror the actual amounts that were received by the employee for these months and to balance everything out.

Follow these steps on how to delete the paychecks:

- Go to the Employee's tab and click the Payroll payment list link.

- Look for the paychecks.

- Click the drop-down list under the Action column, then choose Delete.

Here's an article for more details about this process: Delete a pay run in QuickBooks Core Payroll.

Then, use these steps on how to create an addition item:

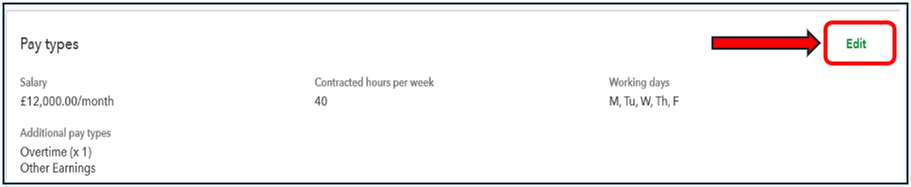

- Go to the employee's profile and scroll down to the Pay types section.

- Click Edit, then choose Additional pay types.

- Check Other earnings, then type in the amount.

- You can also rename the item by clicking the Pencil icon beside Other earnings, typing in the name, and then clicking Save.

Next, follow these steps on how to add a deduction item to be added for May's paycheck:

- Proceed to the Workplace pension, loan & other deductions section in the employee's profile.

- Click Edit, then choose Add deduction/contribution.

- Select Other deductions, then choose whether it's an After-tax deduction or a Repayment.

- Type in a description and the amount.

- Click Save.

Additional information about adding pay types is also discussed in these articles:

After setting them up, recreate the paychecks and add these items to adjust the amounts. This will balance everything out and will let you reconcile the amounts for the months of April and May.

Just in case you're using the Advanced Payroll subscription, use this article as a guide: Make changes to pay runs in QuickBooks Online Advanced Payroll.

However, I would still recommend reaching out to your accountant for additional advice on this matter.

Feel free to check out this article in case you need more guidance when it comes to the different type of payroll service that we offer: Choose the right QuickBooks Payroll product for you.

Don't hesitate to reach out and ask more questions in the forum if you need anything else. We'll make sure to provide help when needed.