- UK QuickBooks Community

- :

- QuickBooks Q & A

- :

- Employees and Payroll

- :

- Re: Has the way QB Advanced deals with small employers NI allowance been fixed? My NI is still sh...

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Has the way QB Advanced deals with small employers NI allowance been fixed? My NI is still showing as an Expense, via the payroll journal.

Solved! Go to Solution.

Labels:

0 Cheers

Best answer October 16, 2020

Solved

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Has the way QB Advanced deals with small employers NI allowance been fixed? My NI is still showing as an Expense, via the payroll journal.

Hi 1935 1451 4278 549 At the present time, as previously stated, to account for the Employment Allowance (EA) you'll have to create two additional lines for the amount of the EA on the journal, the first line would be crediting the Payroll Taxes expenses account and the other would be debiting the Payroll liabilities account/Employer National insurance. We appreciate that this is additional work and time consuming and that the standard payroll accounts for the allowance automatically. Our engineers are aware of the issue and hopefully they will update the product accordingly near future.

0 Cheers

13 REPLIES 13

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Has the way QB Advanced deals with small employers NI allowance been fixed? My NI is still showing as an Expense, via the payroll journal.

Hi there,

Thanks for your post - I'm unable to locate an active investigation for this, would you be able to reply with a screenshot of the journal below, covering any sensitive info so we can take a closer look? 🧐

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Has the way QB Advanced deals with small employers NI allowance been fixed? My NI is still showing as an Expense, via the payroll journal.

Do you really need a screenshot? There are plenty of questions and comments about the topic already on the forum, so it should be well known to QB staff. To recap, we receive the £3k employers allowance and as a result our Employers NI shouldn't show as an expense and liability to HMRC. (we are less than £3k so don't pay any at all). When the payroll is run, the amount we would have paid if not for the allowance goes to Employers NI expense and liability. When it should actually be zero.

This was easily handled in QB Standard, but for those of us force to migrate to Advanced this was no longer the case.

Andrea

p.s Being told to do a journal myself to correct it, is not the service QB clients want. That's the answer previously given.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Has the way QB Advanced deals with small employers NI allowance been fixed? My NI is still showing as an Expense, via the payroll journal.

Thanks for getting back to us, @1935 1451 4278 549.

I'll share some information about the employer NI. For QuickBooks Advanced, the company portion of NI will be posted to an expense account and will be totaled in the liability account.

To apply the credit, you'll have to create a journal entry. Just go to +New, and then Journal entry under Other.

I've added these articles about QBO Advanced payroll for more information. It has links and resources that'll help you with other payroll tasks.

Please let me know if you still have questions or concerns. Just drop them in the reply section below and I'll be glad to answer them for you. Take care!

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Has the way QB Advanced deals with small employers NI allowance been fixed? My NI is still showing as an Expense, via the payroll journal.

Yes, that's what I"m saying happens . But it shouldn't because there is no liability. QB needs a facility to apply the credit. Just like the simple and cheaper standard version does. I'm not in other videos for other problems, this is the issue I'm asking about.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Has the way QB Advanced deals with small employers NI allowance been fixed? My NI is still showing as an Expense, via the payroll journal.

I'm here to ensure this gets sorted out, @1935 1451 4278 549.

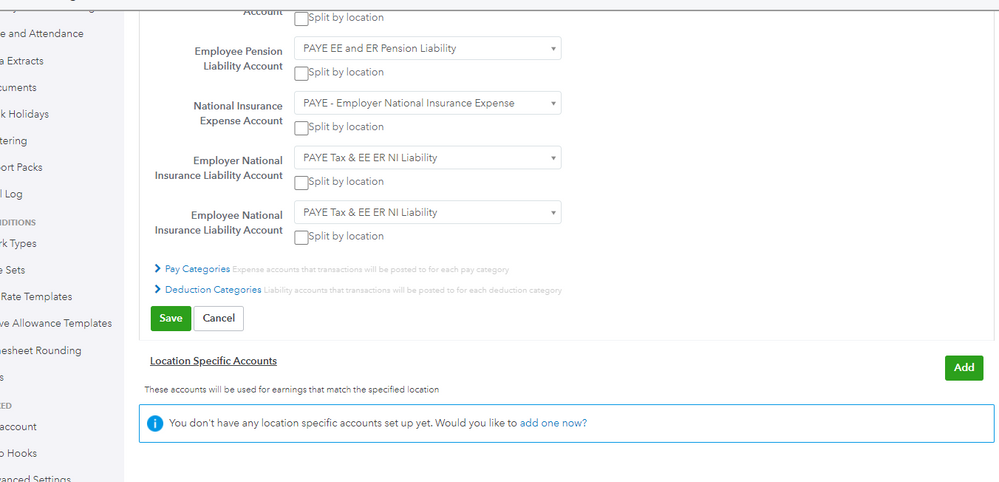

You'll want to check the default account on your Payroll Settings so we can verify what account is associated with NI. For more details, feel free to check out this article: Mapping General Ledger Accounts in QuickBooks Advanced Payroll.

Once you already verified the account, find and open the payroll journal and check if the amounts posted from that account.

If the same thing happens, I recommend contacting our Phone Support Team. This way, they can check on this matter and help you from there.

To reach them, click the ? Help button at the top-right corner and select Contact Us to talk with a live agent.

Keep in touch if you need any more assistance with this, or there's something else I can do for you. I've got your back. Have a good day.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Has the way QB Advanced deals with small employers NI allowance been fixed? My NI is still showing as an Expense, via the payroll journal.

hi

Here's a screenshot of the two default accounts. Should they be going to something else ? Seems to me that the ALLOWANCE should also be going these accounts to offset.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Has the way QB Advanced deals with small employers NI allowance been fixed? My NI is still showing as an Expense, via the payroll journal.

Hello 1935 1451 4278 549,

Thanks for coming back to us,

The screenshot has not come through to us in order to have a visual of the issue.

Are you able to resend the screenshots to us please.

Thanks

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Has the way QB Advanced deals with small employers NI allowance been fixed? My NI is still showing as an Expense, via the payroll journal.

does it work now?

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Has the way QB Advanced deals with small employers NI allowance been fixed? My NI is still showing as an Expense, via the payroll journal.

Yes that worked thanks, so these are the default accounts QuickBooks has for the payroll and are correct

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Has the way QB Advanced deals with small employers NI allowance been fixed? My NI is still showing as an Expense, via the payroll journal.

Having establisehd that, can we return to the problem and that is how QB deals with the HMRC NI allowance? thank you.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Has the way QB Advanced deals with small employers NI allowance been fixed? My NI is still showing as an Expense, via the payroll journal.

Thanks for coming back to the Community, 1935 1451 4278 549.

Yes, that’s how QB deals with the HMRC allowance. As mentioned by my colleague, the accounts associated with your payroll are correct. You may want to check on @ShiellaGraceA answer about the posting categories for the employer and employee portion.

You can bookmark this guide for future reference. It contains links to tasks you can perform using the payroll service: QuickBooks Online Advanced Payroll Hub.

Keep in touch if you have any other concerns or clarifications about QBO. I’m here ready to answer them for you. Have a good one.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Has the way QB Advanced deals with small employers NI allowance been fixed? My NI is still showing as an Expense, via the payroll journal.

thanks for reply. Yes, I could do a journal but you fail to explain why we, having to pay more as a result of forced migration to the more expensive Advanced (we have 3 part time employees and that's it, it's not complicated), have to do more work as a result. Standard QB did not require any manual accounting of the allowance, so why cannot the presumably more advanced Advanced version do the same? I"m not being thick, I can see there are others in the community who do not accept this either.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Has the way QB Advanced deals with small employers NI allowance been fixed? My NI is still showing as an Expense, via the payroll journal.

Hi 1935 1451 4278 549 At the present time, as previously stated, to account for the Employment Allowance (EA) you'll have to create two additional lines for the amount of the EA on the journal, the first line would be crediting the Payroll Taxes expenses account and the other would be debiting the Payroll liabilities account/Employer National insurance. We appreciate that this is additional work and time consuming and that the standard payroll accounts for the allowance automatically. Our engineers are aware of the issue and hopefully they will update the product accordingly near future.

0 Cheers

Recommendations

Featured

Ready to get started with QuickBooks Online? This walkthrough guides you

th...