Thanks for reaching out to the Community about your concern, carronbridgeinn-.

The employee’s pay will not deduct the income tax if the tax information and allowance are not properly set up. To resolve the issue, make sure to get the P45 form from your worker, as this is used to calculate taxes and contributions when you run payroll.

If this is a new employee and does not have a P45, let them fill out the HMRC's starter checklist. Then, visit the agency's website to get the tax code: GOV.UK.

Once you have the information handy, input the correct employee’s tax data. Follow the instructions in the following guide: Edit employees in QuickBooks Online Standard Payroll (UK).

However, if this is not a new worker, open the Payroll Settings and worker’s profile. This is to ensure the employee is configured to deduct the allowances.

Here’s how:

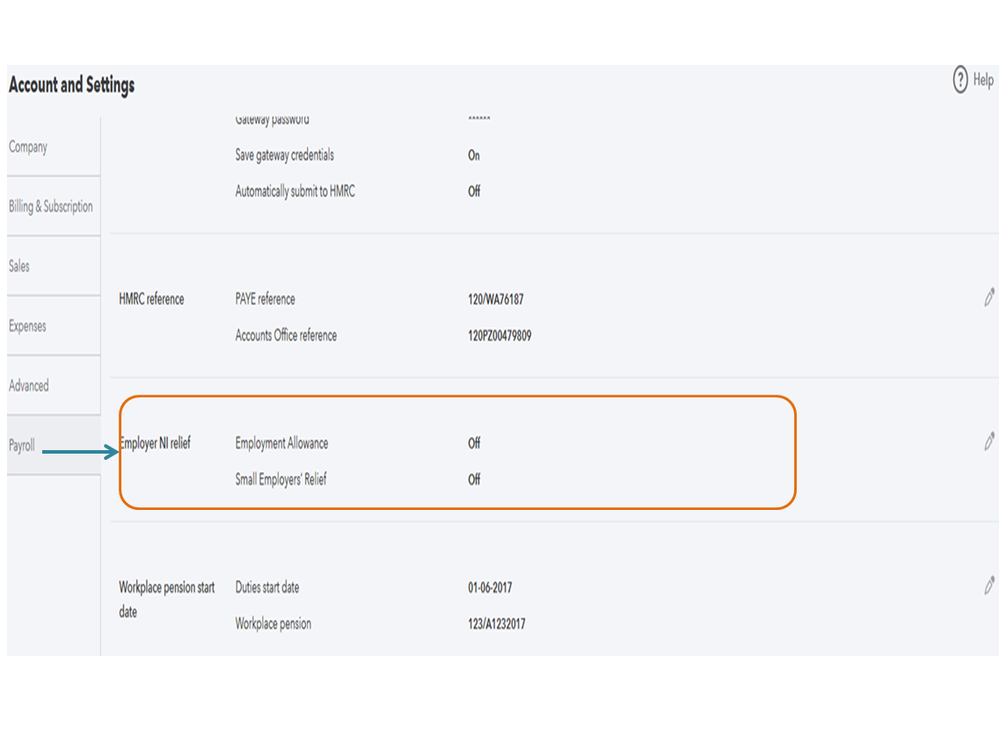

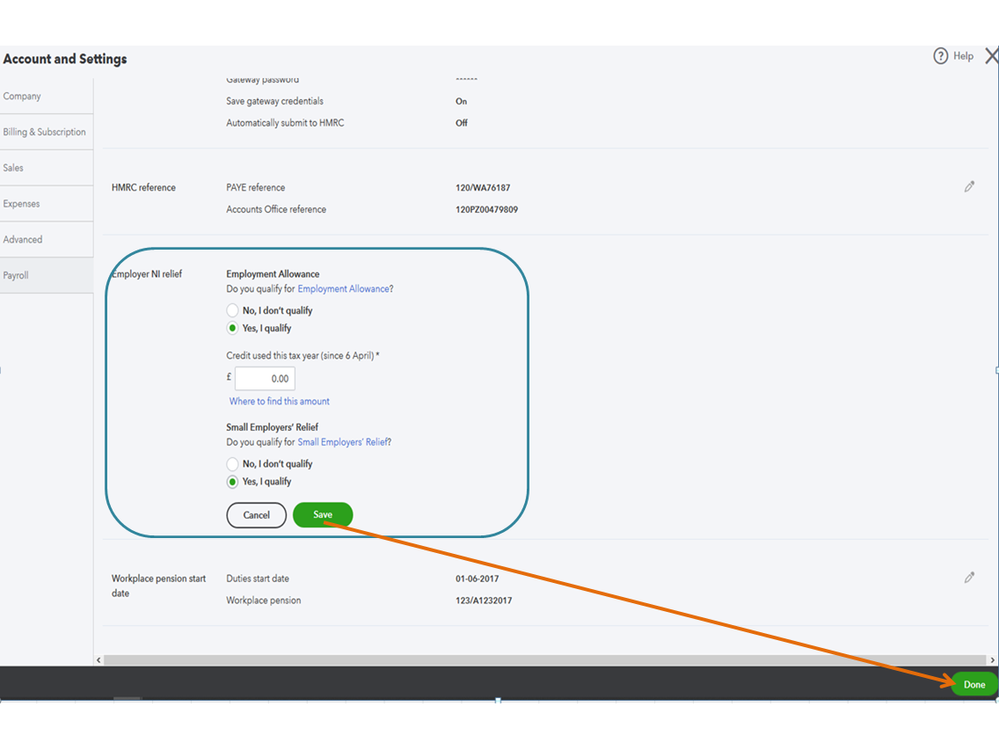

- Go to the Gear icon and choose Account and Settings under Your Company.

- Tap the Payroll menu on the left panel to access the Employer NI relief section.

- Make sure the Employment Allowance option and is turned on.

- If not, click the Pencil icon and mark the radio button for Yes, I qualify and fill in the remaining fields.

- Hit Save and Done.

To view the employee’s profile:

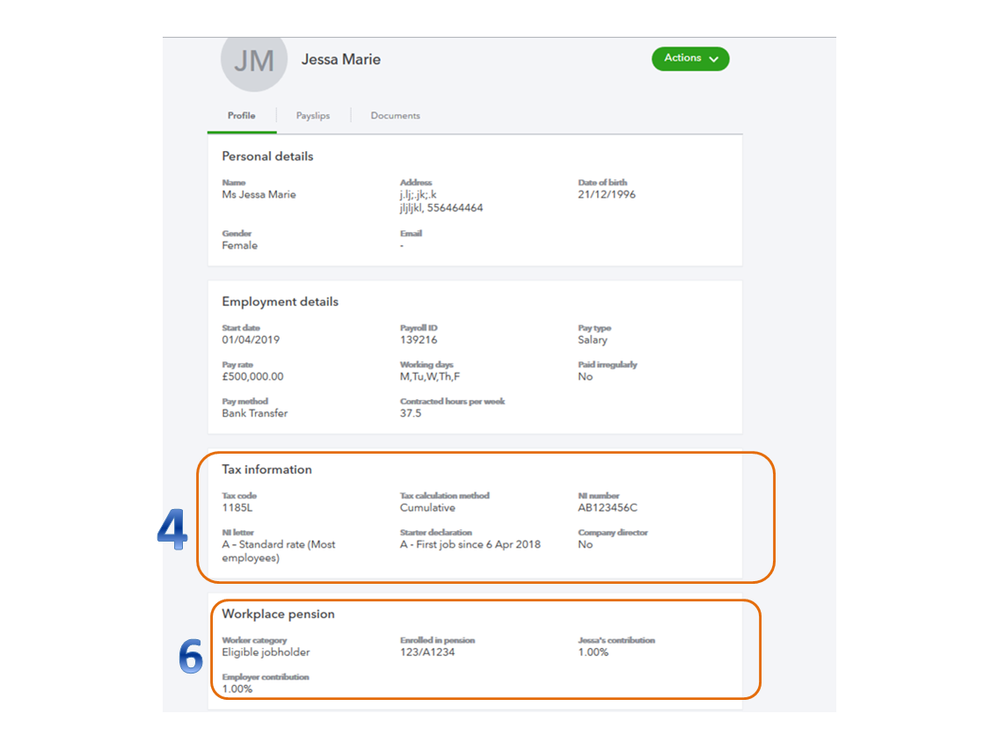

- Tap the Payroll menu on the left panel and select Employees.

- Click on the worker’s name to view more details.

- Go to the Profile tab and navigate to the Tax information section.

- From there, make sure the Tax code, Tax calculation method, NI number, NI letter, and Start declaration sections contains the correct data.

- If it’s incorrect, enter the right information for taxes to calculate.

- If the employee is enrolled in a workplace pension, make sure the Workplace pension section is set up correctly.

Since the income tax is not deducted from his weekly salary, make the changes in the next payroll. The FPS for the next pay run will reflect the updates. If you’ll delete this one payment, you’ll have to remove all of his salary in the payroll system. This guide contains detailed information on what will happen when you cancel a pay run: Deleting a pay run in QuickBooks Online Standard Payroll.

For future reference, I’m adding links that contain a breakdown of articles of the processes you can perform using the payroll service:

If there’s anything else I can help you with, click the Reply button and post a comment. I’ll get back to assist further. Have a good one.