Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Welcome aboard to the Online Community, dbiltd.

To properly track the employee’s furlough, I recommend you get in touch with the HMRC. They can provide detailed information on the amount to enter on the paycheque.

Once you have the details available, create a pay category for furlough. The steps differ depending on the payroll service. Click on the link for the one you’re currently using.

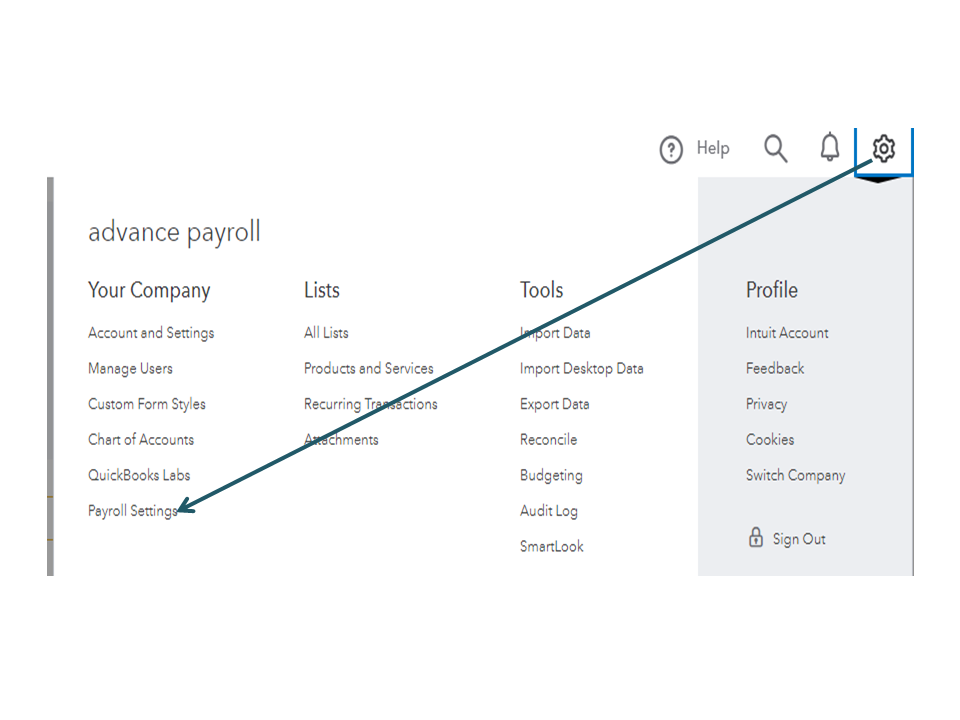

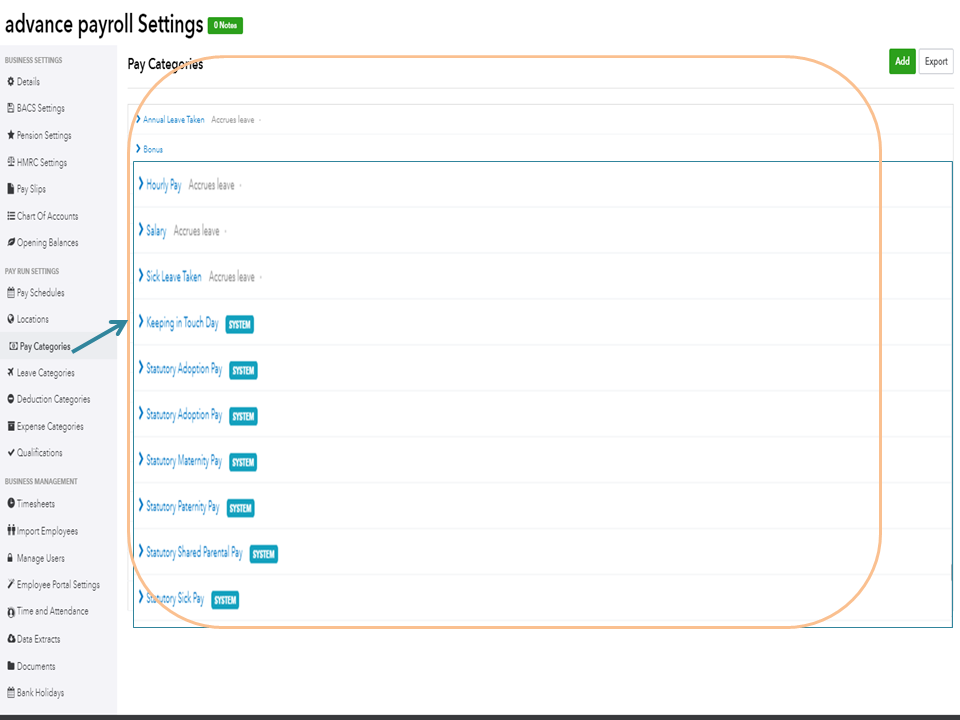

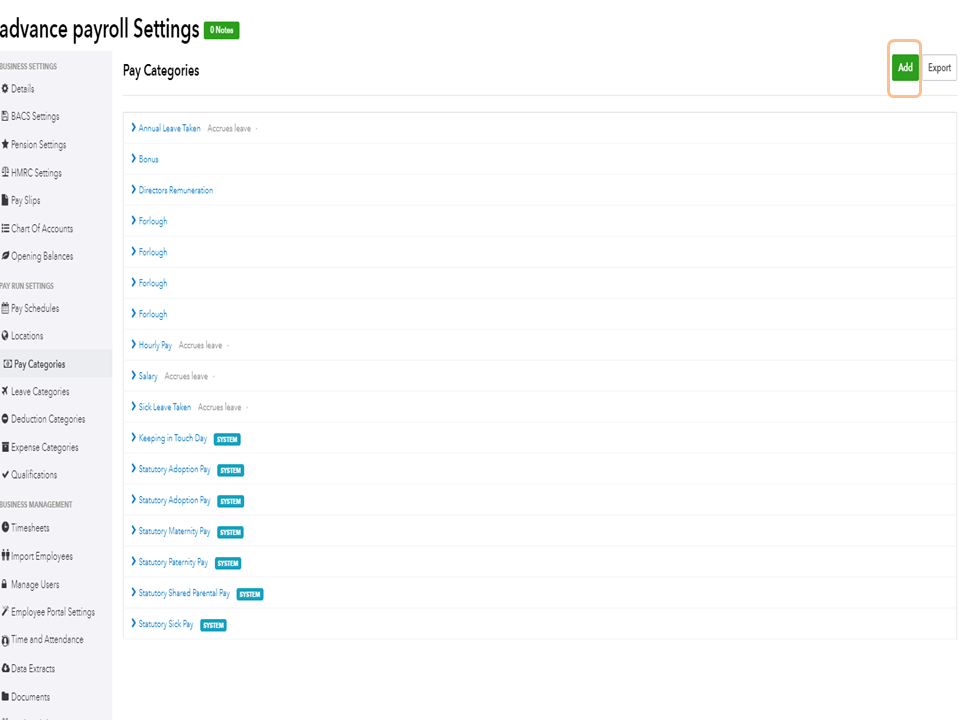

For QuickBooks Online Advance Payroll, check out the steps below:

For additional information, see the Creating & managing pay categories in QuickBooks Online Advanced Payroll article. It provides an overview of how to manage payroll items and steps to ad done.

Let me know in the comment box if you have any other concerns. I’m always here to assist further. Have a good one.

Please could you tell me what to do with an employee earning more than the £2500.00 per month cap?

Do i enter their normal wages and make deductions or do i enter £2500.00 the make a deduction for 20%?

Good day, Serena76.

I'd like to make sure you are routed to the right support that can help you handle payroll for employees who are earning more than £2500.00.

This concern requires help HMRC. I'd recommend reaching out to the them, so they'll be able to provide the best course of action in this situation.

You can check out this link as this will route you to HMRC page: https://www.gov.uk/government/organisations/hm-revenue-customs.

Feel free to visit us again if you have other concerns. I'd be more than happy to help. Take care and have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.