Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

What category and sub category do I place an employee who doesn’t meet the earning threshold for auto enrolment?

I'm here to help categorise an employee who doesn't meet the earning threshold, Hberry.

Staff will fall into one of two categories:

You can categorise the employee under Type 2. If you're unable to decide whether to auto-enroll the employee or not, I suggest contacting your agency or HMRC.

For other employees who meet the threshold, here are the articles to help manage them in QuickBooks:

Let me know if there are other things you need by commenting below. I'm always right here to help you with QuickBooks.

I understand that, however it’s the “which one applies to *****?” Either active workplace pension, inactive workplace pension, auto enrolment postponed or none of the above. I am not sure which to tick for someone who doesn’t meet the auto enrolment earnings.

Thanks for coming back to the Community, Hberry.

Is the employee an entitled worker who still wants to be added to the workplace pension despite earning below the threshold?

Are they due to hit the threshold in the next few months?

Are they looking to opt out for the moment and opt in at a later date?

We just need a little more information to direct you to the best option. You may also want to confirm this with your pension provider.

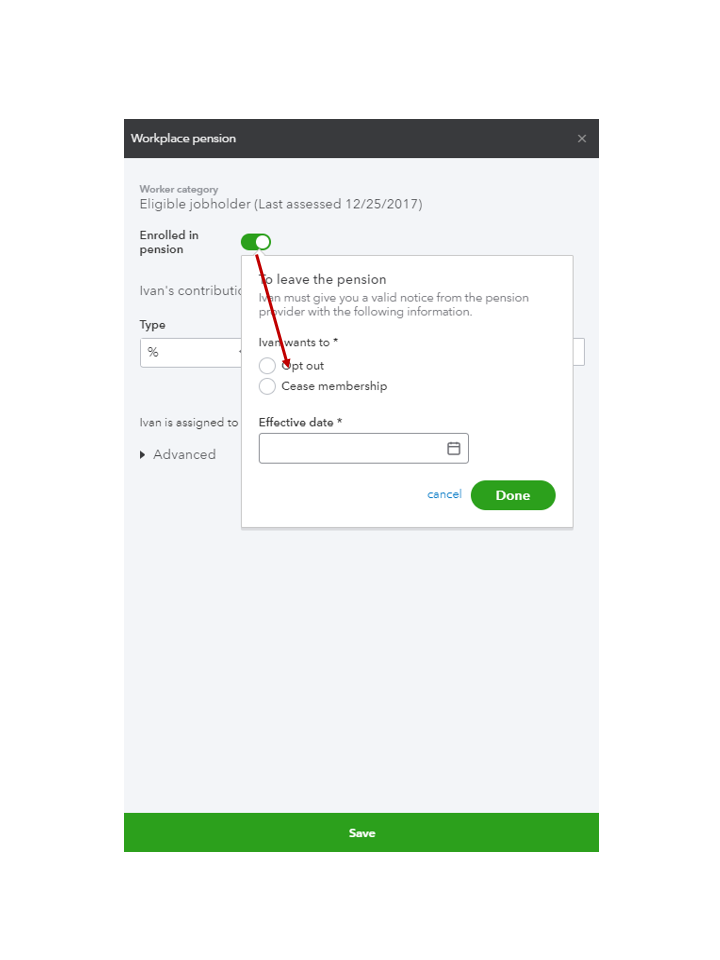

If they want to opt out, go to the Workplace pension settings and choose the Opt out option.

Let me help and guide you through the process. Here’s how:

Let me share this article to learn more about workplace pensions. It includes instructions on how to set up the payroll item, set the start date, etc: Workplace pensions in QuickBooks Online Standard Payroll.

To guide you on how to perform any payroll tasks efficiently, click here to access our self-help articles. The topics consist of taxes, forms, payroll reports, and other payroll-related processes. From there, you'll also see the articles for QBO Advanced Payroll.

Keep in touch if you have any other concerns or questions. I’ll get back to make sure you’re taken care of. Have a great week ahead.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.