Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have equipment and public liability insurance which is being marked as a disallowable expense in Quick Books Self Employed.

Another user has had the same problem and was advised to set his home working time to under 24 hours. This does fix the insurance problem but then makes the home office allowance disallowable instead. Obviously these are both claimable expenses, does anybody know how to fix this please.

On another subject, can anyone tell me how I actually contact Quick Books Self Employed for help please? There doesn't seem to be any obvious way to do this from the help button on my home page, I just get directed to the community pages and previous answers. Can't see a way to open a ticket.

Thanks.

Solved! Go to Solution.

Hello Davep64

Thanks for your reply. It is something that is often mentioned and it is the case that categories are key as to where things post especially when there are things like hours worked from home involved. So in this case if you use the 'Accountancy, Legal and other Professional Fees' category it will post as you want it to.

Yes it will be helpful for anyone with this issue to refer to your Community post:)

Thank you

Emma

Thanks for posting and reaching out to us here in the Community, @davep64.

Tracking of expenses can vary as each business is unique. Some are allowable for tax purposes, others aren’t.

Allowable expenses include the cost of goods sold or stock used (the amount paid for stock if you use cash basis), wages, rent, lighting, postage, phone calls and motor costs such as fuel and insurance or aflat rate amount and any adjustment expenses that arise on a change from cash basis to traditional accounting basis this year.

They don’t include your own salary, wages or drawings, National Insurance contributions, the cost of entertaining, the cost of buying a vehicle or other equipment (unless you use cash basis, where allowable expenses include payments for equipment and vehicles other than cars), depreciation, and losses on assets

If you used traditional accounting basis, you can claim capital allowances on the cost of the equipment or machinery used in the business in boxes 49 to 59. Some expenses are only partly allowable. For example, you can only claim the business part of the costs of using your own car or using a room in your home as your office. If you use cash basis, you can only claim up to £500 of any payments of interest and other costs for cash borrowing.

I encourage seeking help from your accountant. He/she can guide you which option to take based on your recording practice and business needs.

For additional reference, you can check these links:

Meanwhile, there are two options in contacting our QuickBooks Self-Employed Support: Email or Chat. Either way, you can refer to this link for the steps: QBSE Support.

Let me know how it goes or if you have follow-up questions. I'm always here to provide assistance. Have a good one.

Hi,

Thanks for your reply. Unfortunately it seems to fail to address the problem I'm having. I realise that some items are allowable for tax purposes, some partially allowable and some are not allowable.

The problem I'm having is that have two allowable expenses that I can't enter into Quick Books. One is an insurance policy for equipment and public liability, the other is an allowance for using a room in my home as an office. I know these are both allowable because my accountant has entered them into my accounts for the last 10 years.

For some reason Quick Books won't let me put one of these into my accounts without cancelling out the other, please see my first post again for details.

Also, the instructions you have given me to contact QBSE support seem to be incorrect. When I use the support page link that you have supplied, there is no option to "Ask a question (or tell us what's wrong)".

I can go to the "Other Questions" section, but that only appears to allow me to post a question on the community boards. Same thing if I use the help button on my QBSE home page. I would like to start a ticket and get some direct support, is there some way can I do this? You mention email and chat support, I don't see any options for these.

Hi there, @davep64,

The program is compliant to the SA103F deduction categories that you can claim as allowable expenses. Also, the data you entered on your Tax Profile determines whether or not an expense is allowable. Please see this article for more information: About SA103F Categories.

If you use cash basis accounting, you can claim your equipment and public liability insurance as allowable expenses that you would normally use for less than 2 years. For traditional accounting, you can claim these as capital allowances. For more details, you can read through the HMRC website.

Since you work from home as your office, the system uses the simplified expense method to calculate this deduction. Entering more than 25 hours on the Tax Profile sets your Rent/Utilities/Insurance expenses as disallowable. Though you've already set the hours to 24, you'll need to leave the Do you work from home? box blank (see the screenshot below). By doing so, you can claim the actual costs and make this as allowable. For more details about this process, you can go through this article: Work From Home Deduction.

In line with this, I'd still recommend consulting your accountant. This is to make sure the categories are correct.

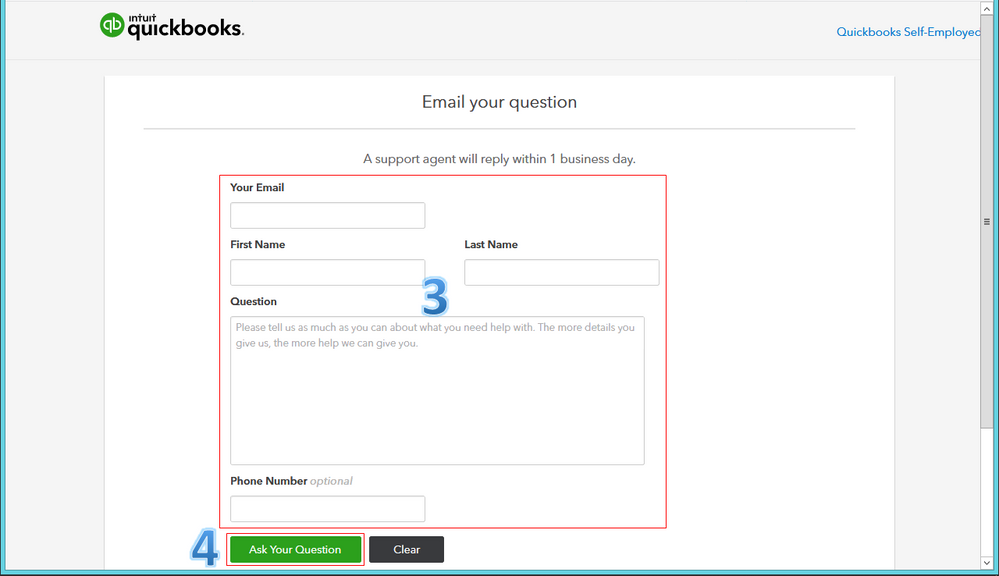

On the other hand, you can perform the steps below on how to contact our support team directly. From there, one of our specialists will reply within one business day. Let me guide you how.

In case you want further guidance in working out your taxable profits, you can use this HS222 Self Assessment Helpsheet.

This will point you in the right direction, @davep64.

I'm here anytime you have other concerns. Have an awesome day.

Sorry, but I don't think you are reading my questions properly.

I sometimes work from home but my main business is conducted away from my home. I use my home office for about 40 hours per month, the rest of the time I'm working in other locations.

I'm using cash accounting and want to claim my equipment and public liability insurance as an allowable expense. If I use the simplified expense method for use of home as office and set it to the required amount, i.e. around 40 hours, the insurance is then classified as unallowable. Why?

I don't want to set the hours worked at home as zero and do the calculations myself, I'm perfectly happy with the simplified method, but I do need to enter the insurance costs as well. This is insurance that mainly applies when I work away from home, it's not a home insurance policy and therefore should not be affected by the number of hours I'm working from home. I've read the article on "Work from home deductions" and understand it, I want to use the simplified method.

Your message does not explain why I can't do this. I'm getting a bit frustrated with this as I've asked the same question three times now and I'm not getting a sensible answer. Why can't I enter both expenses?

Hello, @davep64.

Determining whether or not an expense is allowable depends on the information you've on entered on your Tax Profile. Also, there are types of expenses aren't business allowable depending on your business operation, entity, and local regulation. Let me share additional information on the system handles your expense transactions.

If you entered more than 25 hours in your Tax Profile setting, the system will set your Rent/Utilities/Insurance expenses as disallowable. If you want to claim actual costs, you can leave the Business use of home office box blank and keep categorising your bank transactions. You can check this article for more detailed information: SA103F Categories.

Alternately, I'd suggest consulting with your accountant for you to be guided properly on the best route to take in categorizing your income and expenses.

Also, I have here these articles for additional insights:

You can always visit us here in the Community if you have other questions. I'm always here to help.

Thank you for your reply.

This seems to be a categorisation problem. I've been trying to enter this into 'Rent/Utilities/Insurance' and, as far as I can work out, your system is assuming that my equipment and public liability insurance is home insurance, and is being taken into account when I put in home office hours.

I've looked at the categories in the SA103F link you sent me and have now entered the insurance into the 'Accountancy, Legal and other Professional Fees' category. I can now enter both expenses.

This must be a fairly common problem, so I hope this solves it for someone else!

Hello Davep64

Thanks for your reply. It is something that is often mentioned and it is the case that categories are key as to where things post especially when there are things like hours worked from home involved. So in this case if you use the 'Accountancy, Legal and other Professional Fees' category it will post as you want it to.

Yes it will be helpful for anyone with this issue to refer to your Community post:)

Thank you

Emma

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.