Hello, Arabella.

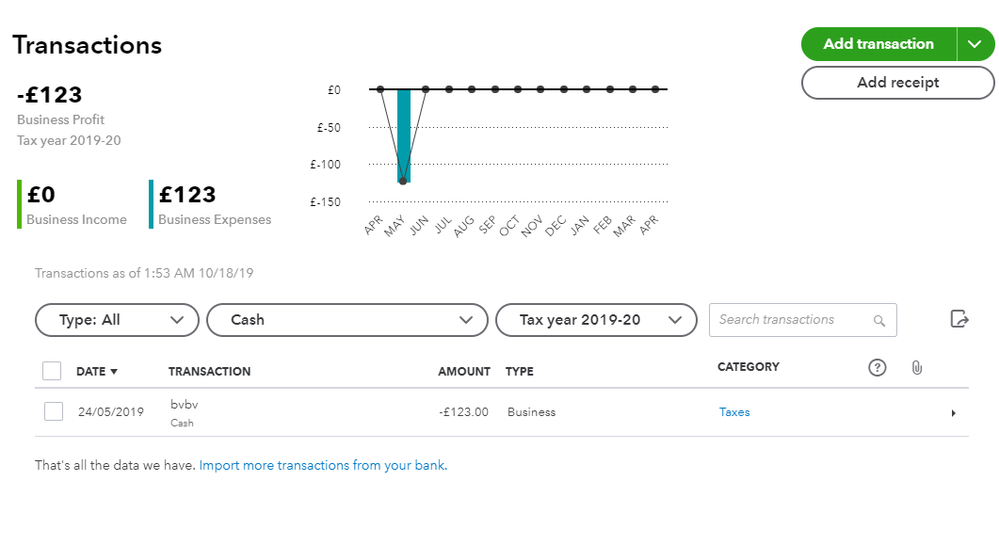

For recording purposes, if these payments are for taxes, you can choose the Taxes as for the categorisation. However, these are VAT payments, then you can choose VAT Paid for the category.

To know more about expense categories in QuickBooks, check out these articles:

For account-related issues, feel free to reach out to our QuickBooks Self-Employed Support.

Should you have additional tax concerns, please let me know. I'll be around to help.