Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have a business credit card which is paid in full at the end of each month. Can I enter the individual purchases made on the credit card, as bills, ie Enter Bills, then pay them all, ie Pay Bills, with the payment from the bank at the end of the month? As everything would be entered and categorised on each bill entry, the details would all be there and it would be simple to use the whole bank payment to pay all the CC bills. The payment from the bank would be exactly what the bills amount to. Can you see any problem with doing this? I would find it a lot easier to understand and carry out.

Solved! Go to Solution.

Thanks for getting back to us, @Oscar10.

I also appreciate you for sharing additional details with us. I’ve replicated here on my end the credit card charges shows in my supplier accounts after entering a Credit Card Charges.

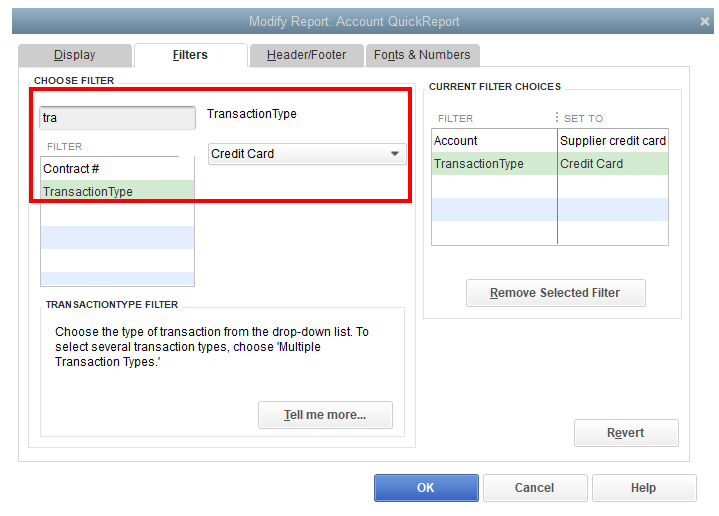

To isolate this issue, let’s run a QuickReport to your supplier’s account to view the credit card charges transactions. Let me show you how.

Once done, you can now locate your supplier credit card charges. For more insight about the process, check out this article for reference: Customise reports in QuickBooks Desktop.

When everything looks good, you can now reconcile your account whenever you’re ready. For the step by step process, utilise this article for guidance: Learn the reconcile workflow in QuickBooks.

In case you have a follow-up question about managing your accounts, feel free to tag me in your reply. I’m only a post away from you. Have a great day ahead and keep well.

Hi Oscar10!

I also like the idea of entering CC purchases one by one because you can categorize them appropriately and you're reflecting what happened in the reality. However, you'll want to change your process because it's taking the CC account out of the equation hence the bills are directly paid by your bank account. I got a simpler process for you.

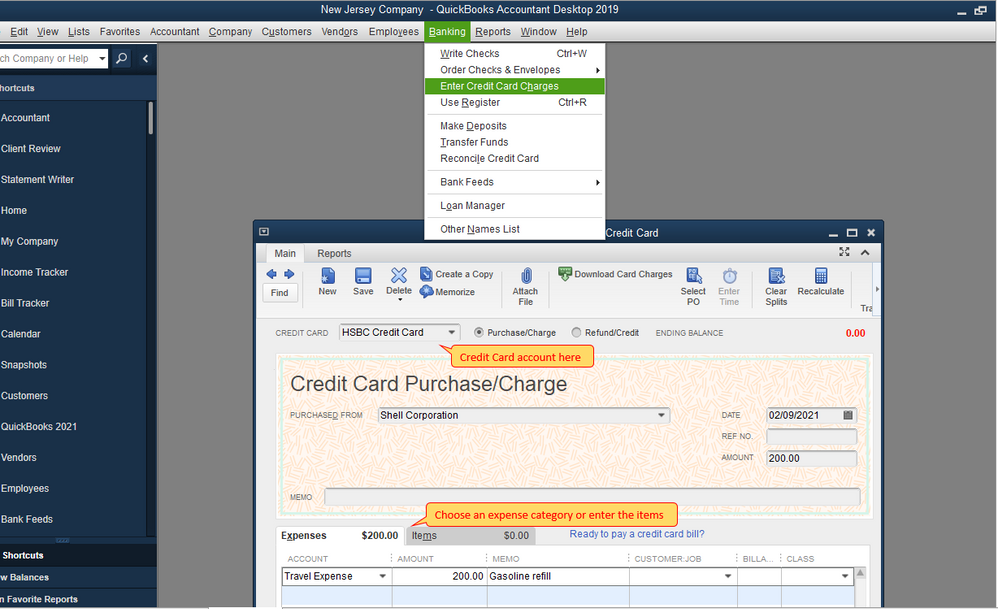

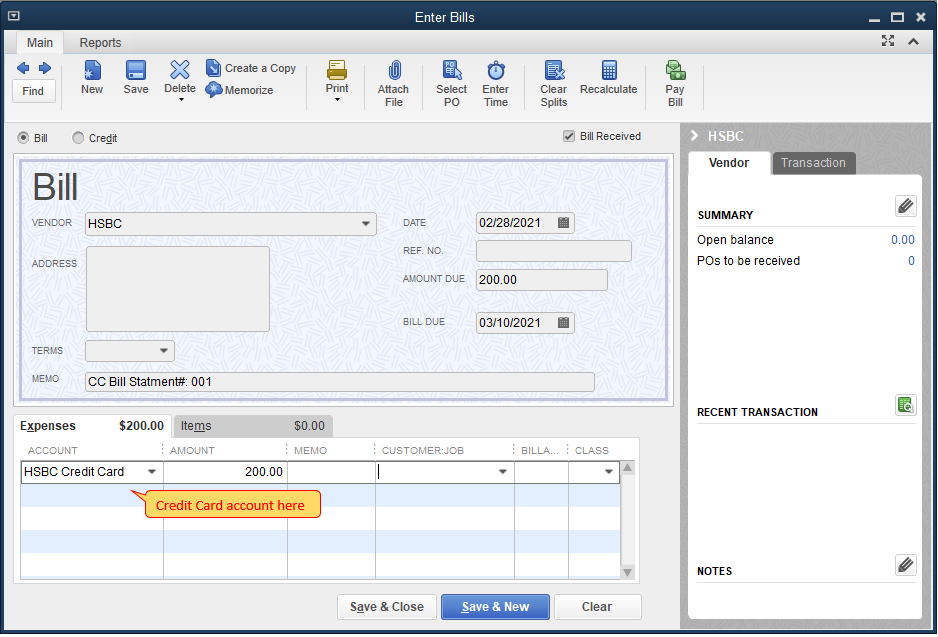

Step 1: Enter the credit card purchases against the credit card account, and you can still categorize them.

The entered purchases will accumulate a credit card balance in your Chart of Accounts, which is what happened in real life.

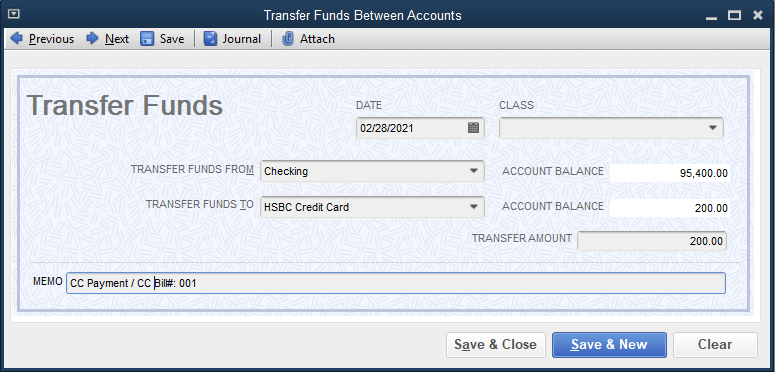

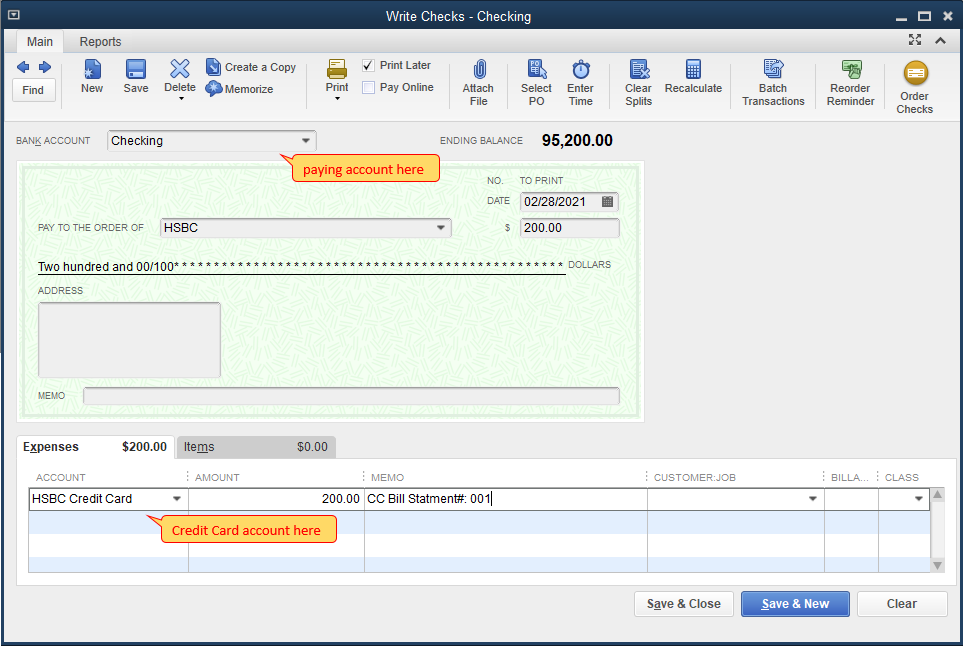

Step 2: Pay the credit card at the end of the month. You have 3 options for this.

After entering the transactions, you can reconcile your credit card account.

That will do it. If you need more help with your credit card transactions, please let me know.

Thank you, that's very helpful. I will try this out, but first I have to see how to start off. I have historical credit card statements from Barclaycard, details were never entered anywhere, just the payment from the bank entered monthly, and the broad outline as stated on the CC Summary was used to allocate block amounts to Expense Accounts, so there are no specific details of vendors and individual transactions etc. There are too many of them to go back and record them properly now, hopefully this can be done in the future.

Our financial year began 1st April 2020, ends 31st March 2021. Due to Covid-19 there are not many transactions this year so I thought this would be a good opportunity to make the correct entries from 1st April 2020 onwards, and then I will become familiar with the procedure to go back and tackle the old statements at a later time.

However, there is a balance owing on the Credit card at 31st March 2020 of £1,500. This was paid from the bank account as usual by direct debit in April. How do I enter / treat this balance and payment? The transactions this is comprised of would of course have occurred in March but I want to start the new records from 1st April.

Hello Oscar10,

Welcome to the Community page,

So you can't miss transactions out, do them in order otherwise you could be assigning credits to the wrong places.

So they have told you already what you need to know, make the bills with the payments from the card, then transfer the funds from the bank to the card to pay it off. If there is a balance you would need to transfer the funds from the bank to the card to pay it off. You will need to start with the oldest and work forwards rather than going backward.

I thank you for your time, but this is not answering my question. I cannot start with the oldest because the oldest is several years ago and I can't go back over all of that at this stage, there is no time to do that, it will take a long time. I need to start from 1st April 2020 so I am not continuing to be in backlog and building up an even greater task !

I am happy to enter as outlined by JessT, that advice was very helpful, but I just don't know what the correct entries would be to enter the balance of £1500 owing on the CC at the 31st March, and then the payment in April. The transactions on the March statement will not be analysed properly, they will just be block entered onto the various Expense accounts as I've previously explained. But the outstanding balance will still be there at 31st March, until paid in April. There must be a logical way of entering this. Your help would be appreciated.

Can anyone help with this?

Thanks for getting back to us, and providing more details with your concern, @Oscar10.

You can follow the process that JessT outlined, so you can categorise the transactions and apply them appropriately. Also, I'd suggest contacting your accountant on what entries you should enter to balance off the £1500 amount.

Furthermore, you can also contact our Customer Support Team. They can pull up your account securely and help you enter those transactions.

Here's how to reach them:

Once done, you can now reconcile your credit card account. For more details, check this article: Reconcile an account in QuickBooks Desktop. It also contains some links on how to fix issues upon reconciling.

Let me know how this goes and leave a reply below if you have any other questions. I'm always around to help. Have a good one.

Hi JessT

When entering a bill in the normal way, this is on the Suppliers bill account and you can see everything you have bought from that supplier, his bills, and then the payments made to him from the bank account.

BUT when the bill is entered on the "Enter Credit Card Charges" window, that bill does not seem to appear on the Suppliers Account, therefore there cannot be a full history of what is bought from that supplier, on his record.

Is there any way round this, or does it mean if the payment is made by Credit Card, it will never be on the supplier account and there is no way of having a full picture in one place for that supplier?

Thanks for getting back to us, @Oscar10.

I also appreciate you for sharing additional details with us. I’ve replicated here on my end the credit card charges shows in my supplier accounts after entering a Credit Card Charges.

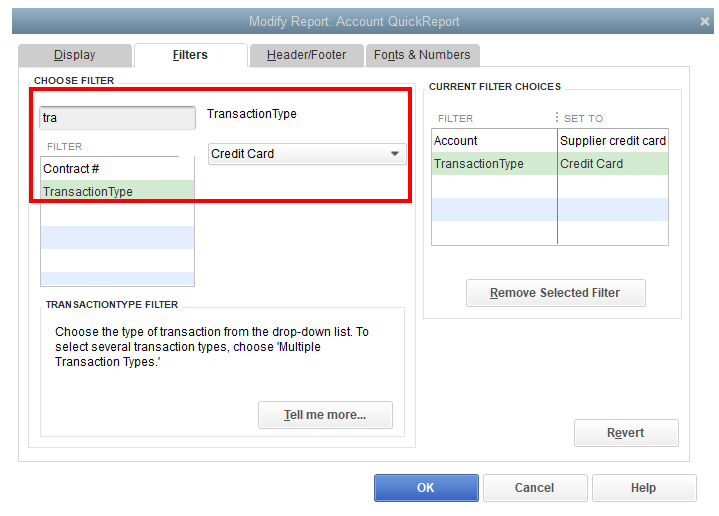

To isolate this issue, let’s run a QuickReport to your supplier’s account to view the credit card charges transactions. Let me show you how.

Once done, you can now locate your supplier credit card charges. For more insight about the process, check out this article for reference: Customise reports in QuickBooks Desktop.

When everything looks good, you can now reconcile your account whenever you’re ready. For the step by step process, utilise this article for guidance: Learn the reconcile workflow in QuickBooks.

In case you have a follow-up question about managing your accounts, feel free to tag me in your reply. I’m only a post away from you. Have a great day ahead and keep well.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.