Hi, info2172.

In QuickBooks Self-Employed (QBSE), you're tracking income and expenses for tax purposes.

As a self-employed sole trader, you don't pay yourself a traditional salary with deductions like a regular employee. Instead, you take money out of your business for personal use, which is known as an Owner's withdrawal.

It is a key distinction, as these payments are not considered a business expense and do not affect your business's profit and loss statement. You will pay income tax on your business's overall profit at the end of the year, not on the individual amounts you've paid yourself.

The simplest way to record and track this is to move the money from your business bank account to your personal bank account. It will appear as a transaction in your QBSE account if your bank accounts are linked.

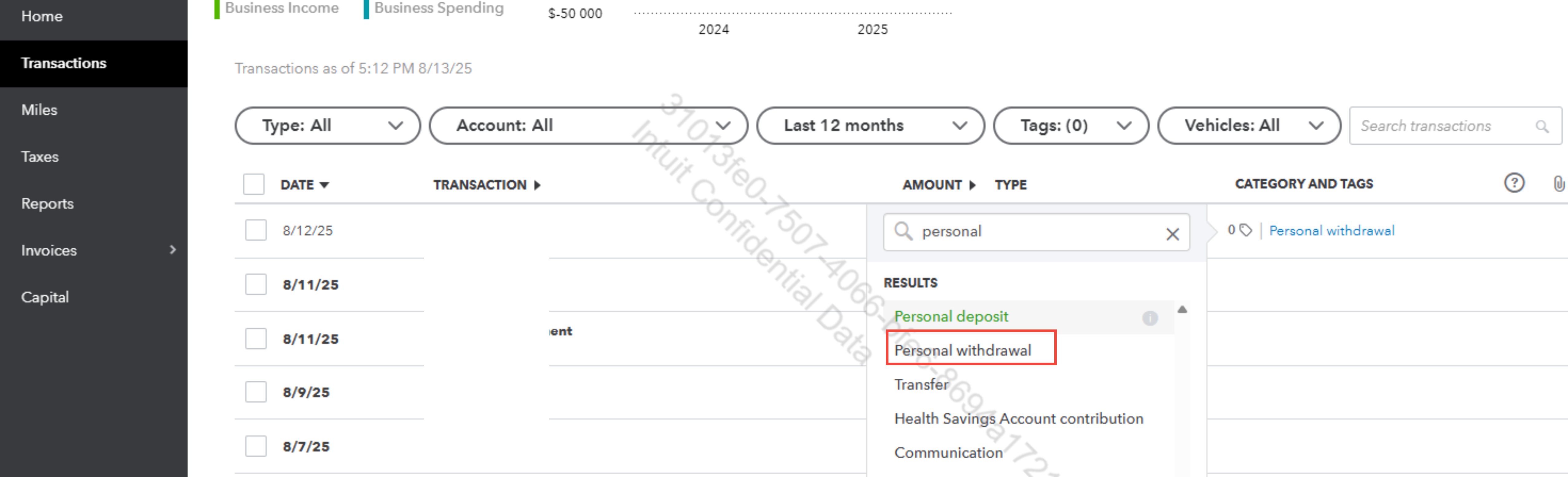

In your QuickBooks transactions list, find the outgoing payment. When you are categorizing the transaction, select the option to classify it as Owner's Withdrawal" or "Personal Withdrawal" to track it accurately.

You can refer to this article for more details on the categories: Categorise money transfers in QuickBooks Self-Employed.

By following this process, QuickBooks Self-Employed will correctly handle the transaction for tax purposes. It will keep it separate from your business expenses, ensuring it doesn't reduce your business's profit.

If you have more questions or concerns, please feel welcome to reply below. We'd be glad to assist.