I appreciate your proactiveness in addressing this matter, Ben. Ensuring that your EPS is submitted to HMRC is essential for compliance. I know this is your goal, as it helps confirm you're reporting your PAYE liabilities accurately.

I see that you've already been in touch with our support team. However, given your situation, it would be best to contact them again to check on your case. Our payroll experts will gather any additional information needed and offer you straightforward advice on the next steps to take toward a solution.

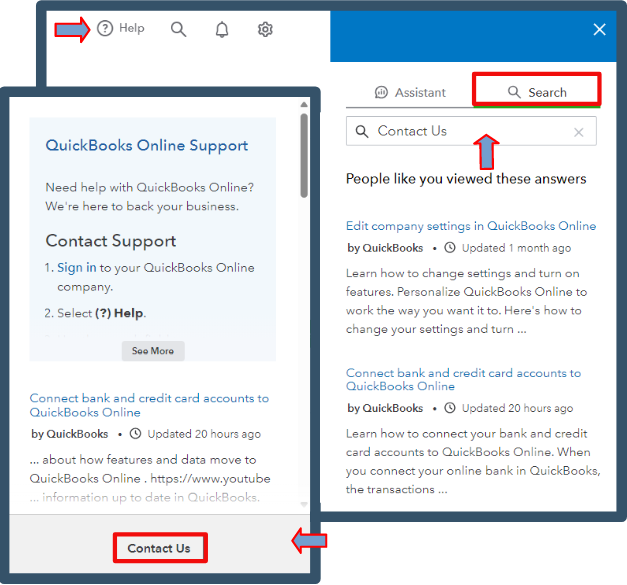

Here's how to contact our live support team:

- Head to the Help icon, then the Search tab.

- Enter Contact US in the search box.

- Click Contact Us.

- Pick the Chat or Callback option.

For successful communication, please refer to this article to learn about our supporting hours: Get help with QuickBooks products and services.

In the meantime, you can consider submitting your EPS via HMRC Basic PAYE tools as a workaround.

Moreover, you can create and customise your Payroll reports to streamline your payroll management process and obtain specific information you need in the future.

Contacting our live payroll experts is the best way to follow up on your case and ensure the success of your EPS submission. I appreciate your efforts and patience as we work to resolve this matter, Ben.