I've got the steps so you can enter a VAT-only bill in QuickBooks Online (QBO), Wayne. I'm delighted to walk through every procedure.

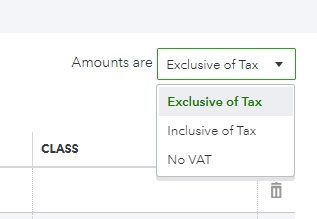

To handle this accordingly, we can utilize the Category details section of the Bill page to generate a bill for the VAT charge. Then, make it Exclusive of Tax from the Amounts are field.

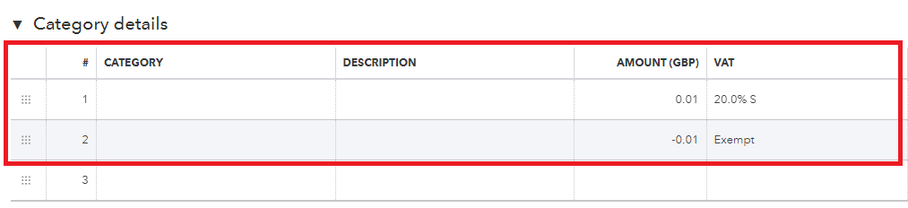

After that, select 20.0% S and Exempt (0%) on the first and second line's VAT columns. Subsequently, input an amount for both lines. One should be positive, and the other should be negative to offset the value.

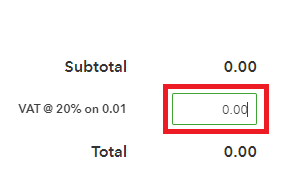

Following that, enter the VAT amount under the Subtotal field. Please refer to these steps for complete guidance:

I've also included these resources, which will be handy in calculating and submitting VAT to HMRC and reviewing the complete list of VAT codes:

Making sure all your concerns are taken care of is my priority. If you have follow-up questions about generating a bill intended for VAT charges or need assistance with other transactions, hit the Reply button. I'm one click away.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.