Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I am struggling with understanding what is going on with invoices, AR, credit memos, and issuing customers a refund. I just want to refund a customer the money they paid after I deposited in the bank account.

I have an invoice for $550. Customer paid, and I deposited the funds in the bank. Customer is now due a full refund. So what I did was create a credit memo, then apply that to the invoice, then issue a check to pay back the customer her $550. I thought that would be it.

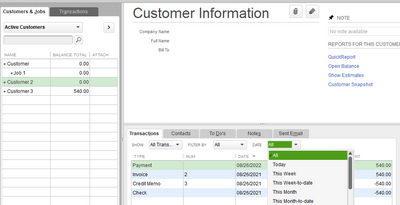

But yet at the end of all this, the customer has a balance of zero owed, the revenue is zeroed out, the bank account is balanced like nothing happened, all of which is correct. But yet the AR shows a balance of $550, still considering something is due. Must I do a general journal transaction to zero out that $550? How do I make the AR go back to zero? Seems this part would be handled automatically when I click on the "use credit to give refund" within the credit memo. The AR balance is showing up in my statement of cash flows. For what it is worth, I attached a picture of the quick report for AR.

Solved! Go to Solution.

Hi there, @QuietEnjoyment.

Yes, you're right. You can issue a refund or check to the customers to refund their payment, but this will not cancel or delete the invoice. Thus, you need to delete or void it following these steps:

In case, you want to close out an unpaid invoice, you can also write them off using bad debt. Here's the link: Write off bad debt in QuickBooks Desktop

For additional insights, you can read this article: Record a credit memo or refund in QuickBooks Desktop.

In case you need help with other customer tasks, click this link to go to our general customer's topic with articles.

Feel free to respond if you need anything else. I'll be here to help. Take care.

Thank you for explaining your concern in such great detail, @QuietEnjoyment.

Based on your screenshot, there's no payment received against the invoice. Hence, it's showing that there's an open Accounts Receivable balance. Since you've mentioned that the customer has a zero amount owed, you may have entered a future invoice payment date.

Let's double-check it using the following instructions:

Once done, pull up the report again and review the Accounts Receivable account. As a reference, check out this article: Record an invoice payment.

Additionally, you have different options in handling customer credits. You can retain it as an available credit, give a refund or apply it to an invoice.

Visit me again should you need more help in getting your Accounts Receivable straightened out. I'm always here to help. Have a great day.

I appreciate the reply. I've check the dates of this all and it's not in the future.

Giving a customer a refund with a credit memo doesn't void the invoice, is that right? Best practice for a situation in which the customer is granted a refund would be to create a credit memo and send them a check...but for the sake of AR, to void the invoice. QB doesn't remind the user to do that, but seems that in most cases, that's what we'd want to do. Is that right?

Hi there, @QuietEnjoyment.

Yes, you're right. You can issue a refund or check to the customers to refund their payment, but this will not cancel or delete the invoice. Thus, you need to delete or void it following these steps:

In case, you want to close out an unpaid invoice, you can also write them off using bad debt. Here's the link: Write off bad debt in QuickBooks Desktop

For additional insights, you can read this article: Record a credit memo or refund in QuickBooks Desktop.

In case you need help with other customer tasks, click this link to go to our general customer's topic with articles.

Feel free to respond if you need anything else. I'll be here to help. Take care.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.